'We place a 25% chance of a hike, and 75% for no hike' - Citi

Citigroup made a forecast for Fed hike for today in technical and fundamental ways:

-

"Citi’s baseline is for a 25bps hike, but there

remains considerable scope for surprise, as well as hifting

communication to play a role. Ultimately we think the decision boils

down to how the FOMC sees market conditions, and whether the recent

volatility could lead the FOMC to temporarily postpone hiking."

-

"In our view we place a 25% chance of a hike, and 75% for no hike. Still, the risk/reward favors a more hawkish outcome. We

think the next most likely possibility would be for the committee to

signal the October meeting as live, a hawkish outcome for the bond

market."

From technical points of view

If September hike - Buy USD/CAD

"Initial reaction is clearly USD positive through the rates channel.

Distance on USD rally depends on how market extrapolates the tightening

path (after SEP/Yellen signals). We like USDCAD higher under a Fed hike,

signaling a more hawkish reaction function, supporting the yield

differential and dampening the external demand impulse to Canada."

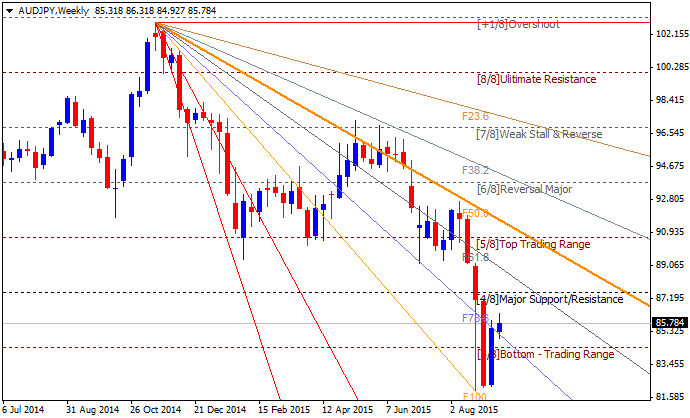

If September skipped - Buy AUD/JPY

"If September is skipped, the reaction in FX is going to depend on the

motivation. If it was market volatility, EM uncertainty and the USD,

then October is more likely to be in play. Instead, if its inflation and

a view the NAIRU is considerably lower, 2015 could be off the table."