The Fed's Countdown Markets Watch for Interest Rate Liftoff, and Worry.

13 September 2015, 19:09

0

137

At some point or another, the U.S. Central bank will draw back on the best money related boost in its history. For quite a long time, it's been sitting tight for confirmation that the recuperation is sufficiently solid to permit it to start pulling up the interest rate it pushed to close to zero after the 2008 money related emergency. Financial specialists are sitting tight anxiously for pieces of information to the date of what numerous are calling liftoff. Bolstered authorities like to concentrate on what they call standardization, the moderate crawl upward that they imagine coming after the first increment in rates. Yet, it's not simply the timing that is unverifiable: Getting things back to ordinary will likewise oblige the Fed to utilize untested new devices that a few financial specialists trepidation could bring about turmoil in the business sectors. Previous Fed Chairman Alan Greenspan's expectation? "There is no possible situation in which it will be simple."

The Situation

Sustained Chair Janet Yellen has said that if the economy continues enhancing, a rate build would be fitting in 2015, an assessment she rehashed before Congress in July. Minutes of the Fed's July 28-29 meeting demonstrate that most arrangement producers reasoned that conditions for raising rates surprisingly since June 2006 hadn't been come to, however they "were drawing closer that point." But in late August, after the steepest losing streak in U.S. stocks in four years, New York Fed President William Dudley said the case for bringing rates up in September — the generally expected date — was "less convincing." Former U.S. Treasury Secretary Lawrence Summers, writing in the Financial Times that week, said bringing rates up sooner rather than later "would be a genuine mistake." In June, the International Monetary Fund had additionally encouraged the Fed to hold up until 2016, a perspective reverberated by the World Bank. Encouraged authorities have attempted to move the discourse from liftoff to the more drawn out direction of steady increments. Yellen said it could take "quite a long while" to get to a typical level — Fed authorities see 3.75 percent as a rate they hope to reach — and that the bank will hold the flexibility to "accelerate, moderate down, respite or even turn around course." But an extensive variety of financial specialists and authorities have communicated stresses over how the security business will respond. In May 2015, Yellen recognized that security yields "could see a sharp hop" when rates go up. As though in affirmation, her comments drove U.S. stocks and bonds down quickly. The scene helped numerous to remember the business dive in 2013 that took after an indication by Yellen's forerunner about going down the bank's gigantic bond-purchasing project. It's recognized as the "decrease fit."

The Background

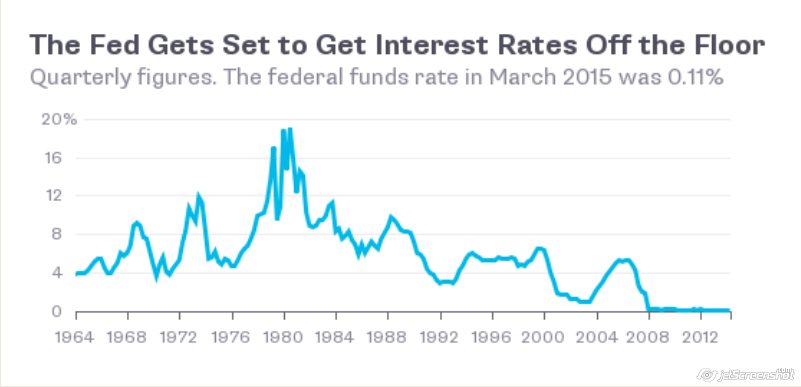

The Fed sets money related approach by conforming the premium rate that huge banks pay one another for overnight credits, the fed stores rate. Changes in that rate swell through the economy, influencing vocation, yield and the cost of merchandise and administrations. Pretty much as the Fed needed to concoct whimsical instruments, for example, its security purchasing system to animate the economy, it's been trying new apparatuses for raising the fed trusts rate and in this manner tightening boost down. Its fundamental center is the tremendous heap of money banks have stopped at the Fed subsequent to the 2008 accident. To get the fed stores rate up, the Fed will build the interest it pays on those purported abundance saves. That higher rate will give banks a danger free distinct option for exchanges like making advances or purchasing securities that acquire less, accordingly driving the interbank rates up toward the Fed's level. The Fed will likewise utilize another type of overnight getting, known as opposite repo, that will be accessible to currency business sector finances and other substantial non-bank speculators too. In an opposite repo, the Fed will offer to get securities overnight at a rate sufficiently high to dishearten giving at rates underneath the objective reach.

The Argument

The IMF cautioned that an untimely rate increment could interfere with recuperation. The World Bank stresses that fixing will hurt economies in rising and creating nations as the dollar reinforces. Different commentators take note of that the Fed has been reliably overoptimistic, and that rate increments by the European Central Bank in 2011 have been rebuked by some to slow the district's recuperation. On the other side, some Fed local bank presidents have cautioned that further defers may fuel resource air pockets and that holding up to fix builds the danger of expansion. Pundits of the Fed's untested converse repo methodology, for example, previous Federal Deposit Insurance Corp. head Sheila Bair, say it could exacerbate turbulence: Its for all intents and purposes danger free returns could urge huge financial specialists to escape to the wellbeing of the Fed's offerings at the first indication of inconvenience, conceivably undermining different markets. Some in Congress additionally say the arrangement adds up to a development of the administration's budgetary wellbeing net to cover currency business sector stores. Different stresses are fixed to changes in the security showcase that could make it harder for venders to discover a purchaser amid the sort of instability liftoff may trigger. While Fed authorities have recognized that there could be unintended outcomes, leaving rates at zero inconclusively isn't being examined as an option.https://www.mql5.com/en/signals/111434#!tab=history