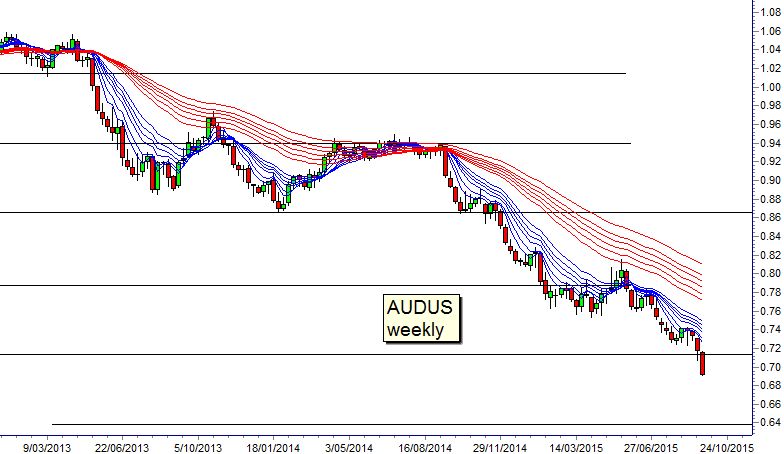

The Aussie did its best to seize the narrow shelf of support near $0.78 but once that failed it has been a quick plunge into the abyss. This is a good news for those who have traded short but it entails the question - how much longer they should stay short?

Daryl Guppy, a trader and author of "Trend Trading: The 36 Strategies of the Chinese for Financial Traders", provides this chart and his own explanations in order to clear up the situation.

The chart has two dominant features.

1) The first is

the prolonged, steady downtrend that is well defined using a Guppy

Multiple Moving Average (GMMA) indicator. The drop below $0.93 in

September 2014 was an accelerated continuation of the downtrend. The

long-term GMMA group of averages quickly expanded showing sustained, durable selling pressure.

No subsequent rally has been able to spur any compression in the long-term GMMA and this confirms the 'bearishness".

2) The second feature is the way the Australian dollar trades in trading bands around $0.08 wide. These bands are used to set the downside targets in the trend.

During the prolonged downtrend the Aussie has moved between broad trading bands. These bands have matched historical support and resistance levels. The fall below $0.94 had a historical support level at $0.865. This support was broken in November 2014 and the Aussie quickly fell to $0.79.

The same trading band measurement is used to establish

the target below support near $0.79. This gives a downside target of

$0.715, which has now been reached and exceeded. The last time this

level was achieved the Australian gauge was trading at 3500. That's a 37

percent fall from recent levels near 5580.

2008, the depth of the market collapse, when the ASX 200 was at 3300, was the last time the Aussie was at $0.64 - 34% below current levels and 40% below the market peak at 5580.

This currency plunge also indicates a short trade in the Australian index.

Once the target is achieved, it's followed by a period of consolidation. Guppy uses the ANTSSYS method to trade both the sustained falls below the support levels and the shorter-term consolidation volatility.

Glenn Stevens, Governor of the RBA, is pressing the Aussie down to $0.67 but the chart support is at $0.64. The idea that a weak dollar equals an economy in deep distress does not seem to worry the central bank, which has wound back a decade of miscalculated GDP growth figures to well under 3 percent, the analyst says.

In his opinion, the strength of the local currency reflects the poor health of the Australian economy. Both the AUD crosses and the ASX provide

secular shorting opportunities.

If the economy continues to weaken, will the Greece scenario wait for Australia too? Here is another story you can be interested in...