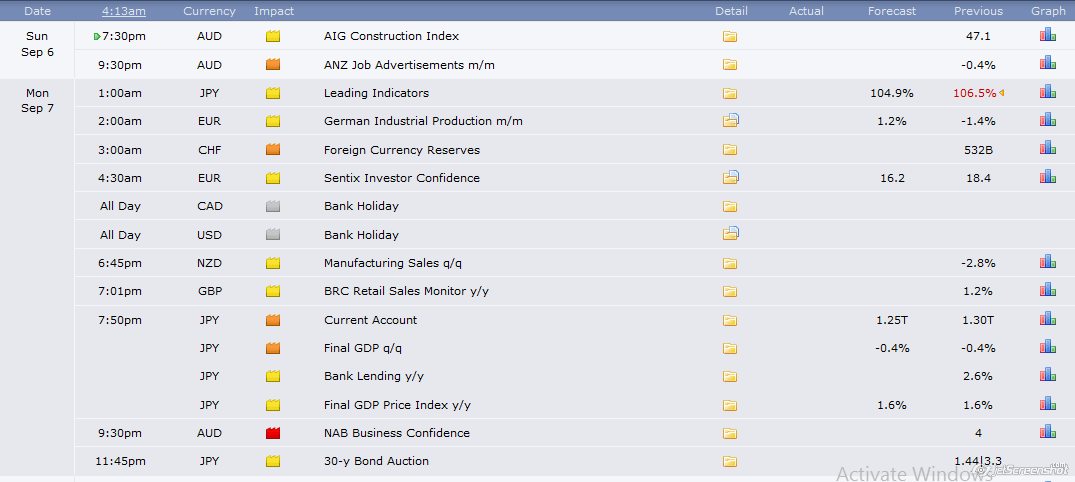

September started with more unpredictability and more instability. Rate choices in Canada; New Zealand and the UK, Employment information in Australia and US shopper supposition all emerge. These are the headliners on our date-book during the current week. Go along with us as we investigate these budgetary highlights.

The U.S. economy delivered 173,000 occupations in August, missing the mark regarding gauges however with positive updates and peppy pay development. The discharge came at a critical timing of the rate-trek level headed discussion and the blended report raised instability, yet we think the Fed could even now bring on a "dovish climb". In the euro-zone, things are a long way from calm, with Draghi demonstrating his will to act, measuring vigorously on the euro. Item monetary standards couldn't appreciate the Chinese occasion and were hit hard. Things are going to get chaotic once more. We should begin,

Overhauls:

The U.S. economy delivered 173,000 occupations in August, missing the mark regarding gauges however with positive updates and peppy pay development. The discharge came at a critical timing of the rate-trek level headed discussion and the blended report raised instability, yet we think the Fed could even now bring on a "dovish climb". In the euro-zone, things are a long way from calm, with Draghi demonstrating his will to act, measuring vigorously on the euro. Item monetary standards couldn't appreciate the Chinese occasion and were hit hard. Things are going to get chaotic once more. We should begin,

Overhauls:

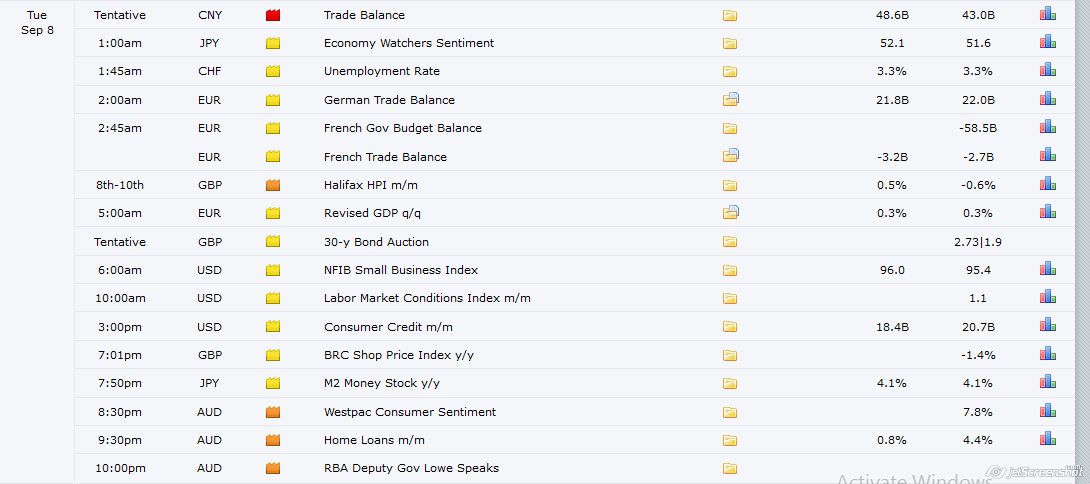

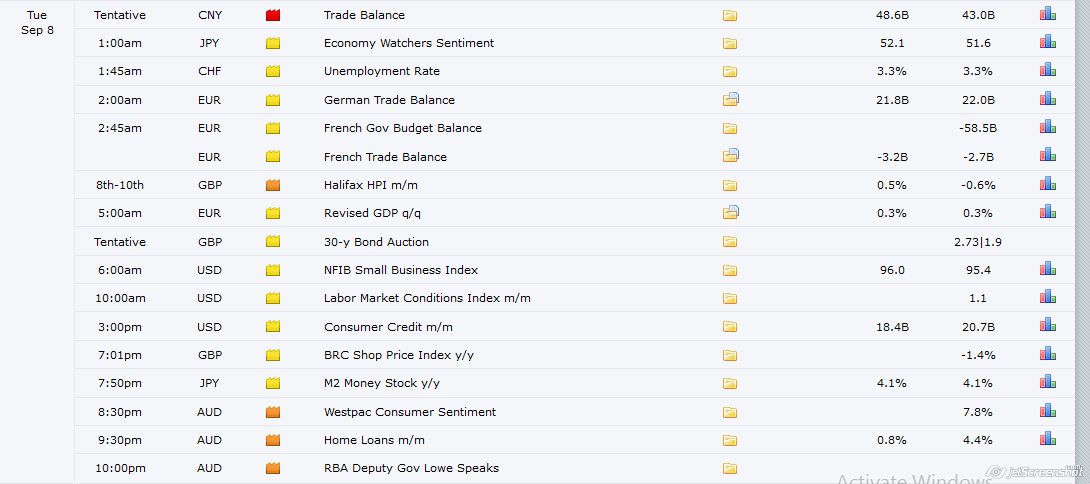

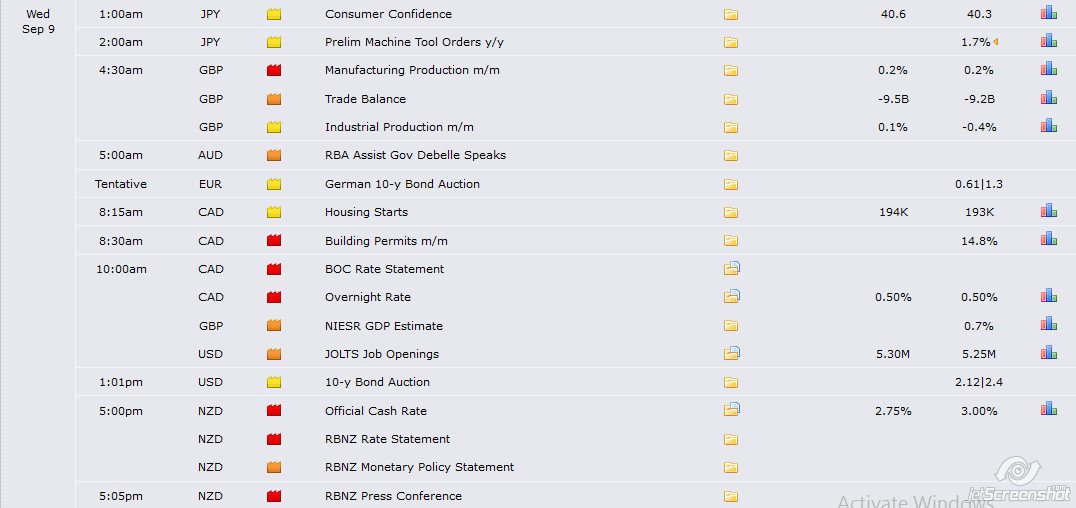

- Canadian rate choice: Wednesday, 14:00. Canada's national bank chose to bring down its benchmark premium rate to 0.5% in July. This was the second cut for the current year, planned to support the economy. The BOC decreased its development gauge in 2015 from its April projection in the wake of demonstrating a gentle compression the first a large portion of the year. Nonetheless, the Central Bank figures a bounce back in the second a large portion of 2015, expecting 1.9% development this year. Examiners expect the BOC will keep up rates this time.

- US JOLTS Job Openings: Wednesday, 14:00. Employment opportunity are peered toward by the Fed as they give a more extensive sign about the occupation business sector, regardless of the possibility that this figure is deferred. In June, the figure remained on 5.25 million, and an ascent to 5.33 million is on the cards for July.

- New Zealand rate choice: Wednesday, 21:00. New Zealand's national bank cut its benchmark premium rate by 25 premise focuses to 3.0% in July, in any expectation of raising swelling and boosting financial movement. The rate cut was in accordance with business conjecture. The Central Bank development standpoint disintegrated subsequent to the last approach meeting in June. Be that as it may, the neighborhood cash has diminished detectably from that point forward, helping makers with weaker ware fare costs. Experts expect further cuts in September and in October as the log jam in China begins to influence New Zealand's economy. Business analysts gauge another rate slice to 2.75% this month.

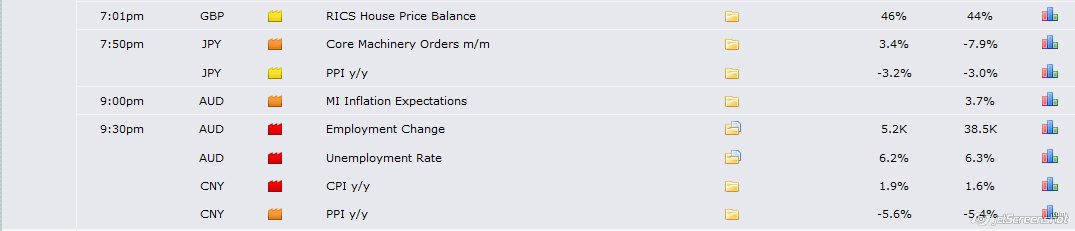

- Australian vocation information: Thursday, 1:30. The unemployment rate in Australia edged up 0.2% in July coming to 6.3%, in spite of work making of 38,500 positions in July. Examiners expected a littler expansion of 10,200 employments and unemployment rate of 6.1%. The purpose for the sharp ascent in unemployment was an increment in the interest rate, coming to 65.1%. The ascent in the quantity of employment seekers may add to occupations development in the coming months, which is something to be thankful for the Australian economy. Investigators expect a vocation addition of 5,200 positions and a decrease in the unemployment rate to 6.2%.

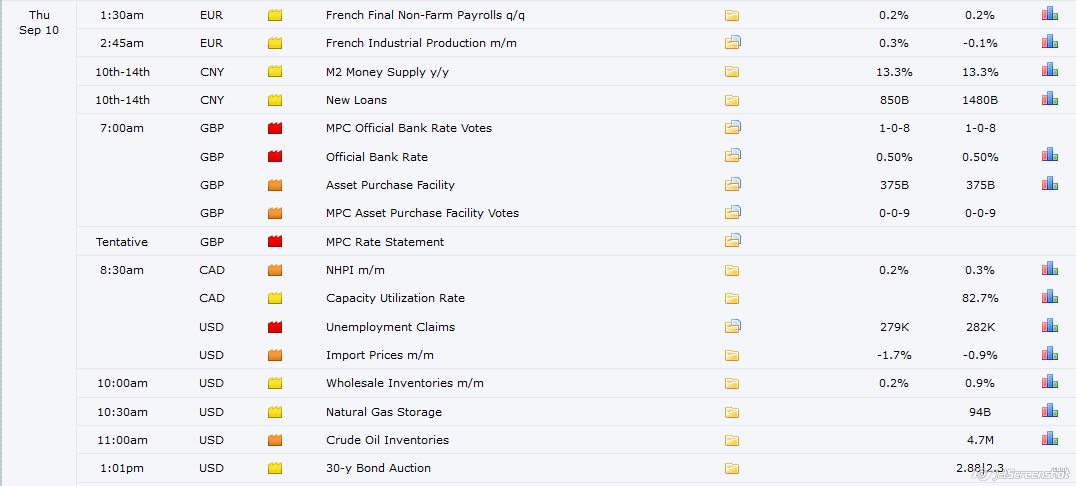

- UK rate choice: Thursday, 11:00. The Bank of England kept up premium rates at 0.5% in August in spite of one voting part calling to raise rates. Absence of inflationary weights deferred the Central Bank's choice to raise rates. Nonetheless, Bank representative Mark Carney said an ascent is "moving nearer", yet can't "be anticipated ahead of time". The giving way securities exchange in China and the discussions over Greece's obligations painted a troubling standpoint of worldwide development, adding to the Bank's choice to defer the rate climb. By the by, the Bank anticipates that swelling will come back to focus one year from now, rising 0.25% in the initial four months and may twofold from 0.5% to 1% before the end of 2016. Investigators see not change in Carney's fiscal strategy this time.

- US Unemployment Claims: Thursday, 12:30. The quantity of Americans documenting new applications for unemployment advantages rose a week ago by 12,000 to 282,000, surpassing conjectures of 273,000. On the other hand, the quantity of utilizations remain generally low in time of a worldwide log jam. The four-week normal expanded 3,250 to 275,500. That normal has fallen 9.2% in the course of recent months. The blend of solid employment development and low levels of uses proposes that the US economy will keep on extending in the coming months. Financial experts conjecture the quantity of new claim will achieve 279,000 this week.

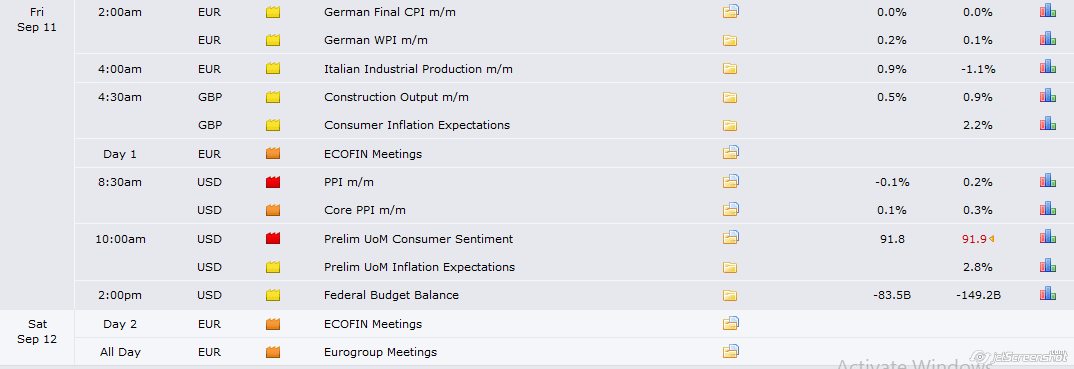

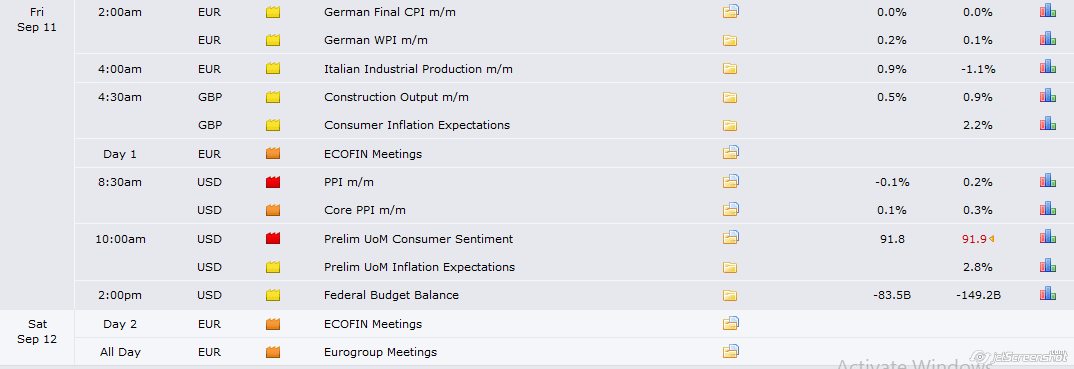

- US PPI: Friday, 12:30. U.S. maker costs in the US expanded for a third straight month in July, rising 0.2% after a 0.4% increase in July. On the other hand, expansion weights stayed curbed against the background of lower oil costs and an in number dollar. In the 12 months through July, the PPI declined 0.8% after 0.7% drop in June. It was the 6th straight 12-month diminish in the record. Maker costs are relied upon to decrease by 0.1% in August.

- US UoM Consumer Sentiment: Friday, 14:00. U.S. buyer certainty debilitated for a moment month in August, as family units were more cynical the rate climb result. The University of Michigan's preparatory record of feeling contracted to 92.9 from 93.1 in July. Financial analysts expected a perusing of 93.5. The worldwide monetary turmoil brought on by China has yet to influence future conclusion reports. Americans conjecture a swelling rate of 2.8% in the following 12 months, the same as in July, the report indicated. Throughout the following five to 10 years, they foreseen a 2.7%, down from 2.8%. U.S. purchaser slant is required to plunge further to 91.6.

That’s it for the major events this week.https://www.mql5.com/en/signals/111434#!tab=history