Yet that is precisely where about six oil sands administrators from Suncor Energy Inc. to Brion Energy Corp. end up with costs for Canadian oil now drifting around $30 a barrel. While surrounding them anticipates have been delayed or crossed out, their speculations were judged too far along when the oil amusement all of a sudden moved from offense to guard.

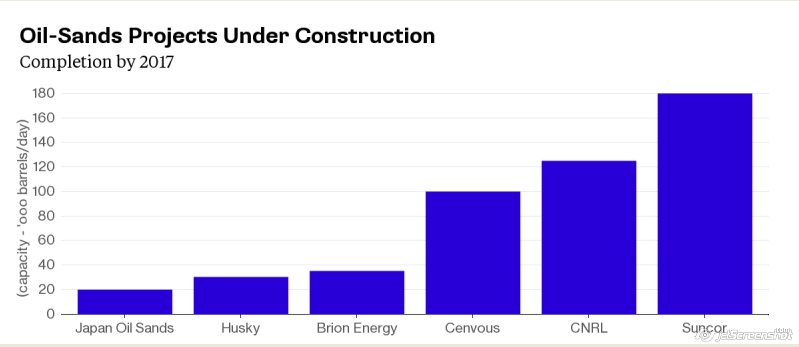

These tasks will include at any rate another 500,000 barrels a day - around a 25 percent expansion from Alberta - to an oversupplied North American market by 2017. For organizations stuck burning through billions in a downturn, the time needed to win back their speculations will protract extensively, said Rafi Tahmazian, senior portfolio chief at Canoe Financial LP.

"Yet, the ramifications of backing off an undertaking are more regrettable," said Tahmazian, who aides supervise about C$1 billion ($758 million) in vitality reserves at the Calgary venture firm.

A general dependable guideline says new plants oblige a West Texas Intermediate cost of $80 a barrel to make back the initial investment. Western Canada Select, a mix of overwhelming Alberta unrefined, is at present offering at a rebate of about $14 a barrel to the WTI benchmark, which fell 1.5 percent Friday to settle at $46.05 on the New York Mercantile Exchange.

WTI Differentials

This differential for Alberta's oil, taking into account such variables as quality and pipeline limit, has gone from $7 to $20 this year and surpassed $40 a barrel in late 2012 and some piece of 2013.

Cenovus Energy Inc., a Calgary-based maker that uses steam innovation to soften bitumen and pump it to the surface, has put off two new tasks until the oil value recuperates. Be that as it may, it's squeezing ahead with developments began before the downturn that will include 100,000 barrels of limit by one year from now.

"We don't need fleeting estimating to manage our interest in long-life, exceptional yield oil sands ventures," Cenovus Chief Executive Officer Brian Ferguson told examiners in July, when WTI was exchanging close $50.

Oil organizations arrangement for value varieties amid the lives of long haul ventures. Cenovus "anxiety tried" its extension down to a cost of $50 a barrel, a level that will permit it to keep paying a lessened profit and store some further development, Ferguson said in July.

$50 Oil

Indeed, even $50 may seem idealistic now, with WTI quickly sinking underneath $40 in August and a few investigators, including those at Citigroup Inc., guaging costs in the low $30s. Income for Cenovus can vacillate by a huge number of dollars with evolving costs, yet the organization still goes for a 15 percent return over the life of its tasks, said representative Sonja Franklin.

There are some silver linings for those as yet extending. The Canadian dollar, which has fallen in pair with oil, helps the primary concern, as do diminished expenses for gifted tradesmen and materials.

Canadian Natural Resources Ltd., Husky Energy and Japan Oil Sands are among those committing valuable funding to finish tasks propelled in more promising times.

Fetched cognizant Suncor Energy Inc. is likewise continuing with one of the biggest bitumen mines in the oil sands at its C$13 billion Fort Hills site. Once finished in 2017, Suncor President Steve Williams hopes to stick to little tuck-in tasks. "I don't see the following mine being constructed rapidly," he said in a June meeting.

Narrowing Returns

Quantifiable profit for the life of the Fort Hills bitumen mine will likely be under 9 percent contrasted and the first focus of 13 percent, said Sam Labell, an investigator at Veritas Investment Research Corp. in Toronto.

Returns on capital contributed by Canada's biggest oil-sands makers came to 20 percent at a few focuses in the course of recent years, as per information arranged by Bloomberg. That figure is currently more like zero or negative for organizations, for example, Athabasca Oil Co. what's more, Cenovus.

Administrators can all the more effortlessly suspend ventures in the "front-end" building stage, after which it turns out to be more agonizing in light of the fact that the cash as of now in the ground delivers zero arrival, said Labell. On the off chance that an organization has the capital accessible, it will tend to press ahead despite the fact that falling costs are eating into benefits, he said.

"There's a ton of anxiety to want the business," he said.

Generally Affected

Northern Alberta's oil-sands organizations have been the absolute most influenced district on the planet since the worldwide retreat on venture started a year ago, as per different investigators. By and large, around 800,000 barrels a day of oil sands activities have been postponed or scratched off, as indicated by Wood Mackenzie Ltd., an examination advisor.

After the last drawn out value downturn in 1986, no new real oil sands plants were begun well into the following decade. The activities got in midstream today might again be the last ones manufactured for years to come, specialists say.

"The financial aspects have changed and there's no guarantee things will return to the way they were," said Bob Schulz, an educator at the University of Calgary's Haskayne School of Business. Once the present round of activities is done, the arranging sheets are unfilled, he said.https://www.mql5.com/en/signals/111434#!tab=history