Perhaps Computers Weren't to Blame for August's Stock Selloff After All

5 September 2015, 20:26

0

146

Hazard equality—the "all-climate" speculation procedure spearheaded by Ray Dalio's Bridgewater Associates—has been getting a wide range of consideration lately, of the wrong kind.

The technique, in which subsidizes tend to naturally modify arrangement of securities, stocks, and different resources in light of higher business unpredictability, has been reprimanded by some for shifting so as to fuel the late selloff property into money.

Bloomberg News reported that Bridgewater's All Weather Fund itself is said to have lost 4.2 percent in August. In the interim, JPMorgan investigator Marko Kolanovic, who has been vocal about the offering weights created by such quantitative stores, said on Thursday that uplifted unpredictability implies that hazard equality players would most likely need to dispose of another $100 billion in stocks in the following one to three weeks.

This is what they said ("beta" is generally characterized as a position's unpredictability contrasted and the general business):

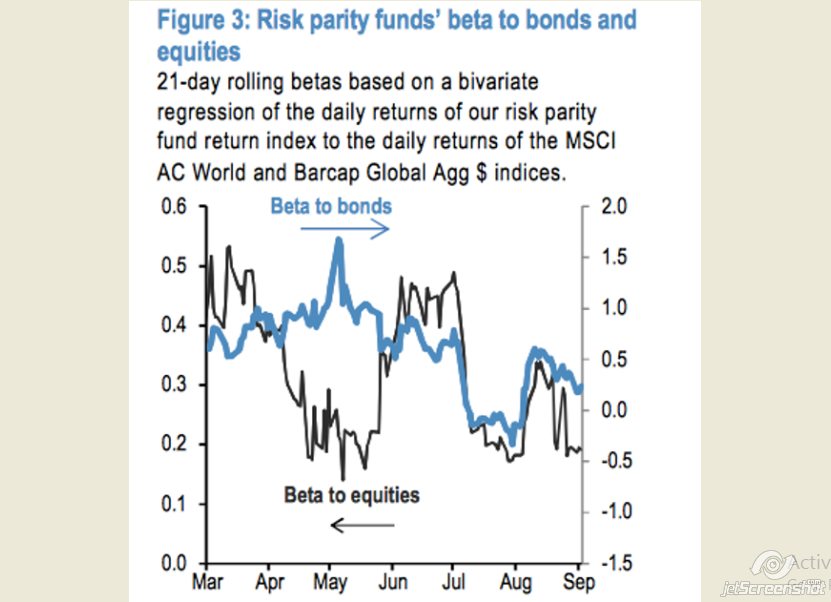

... This terrible execution by danger equality stores amid August does not so much make them the principle guilty parties of the late market amendment. In the first place, the value beta change amid the August revision demonstrated in Figure 3 is fairly little (it moved from 0.3 to 0.2) contrasted with its authentic variety. Second, hazard equality stores don't normally apply high influence to their value speculations. They rather apply high influence to their bond interests keeping in mind the end goal to differentiate their value possessions, since bonds have about 33% of the unpredictability of values.

This system makes hazard equality supports more defenseless against ascends in bond instability and in connection between bonds and values, instead of ascends in value unpredictability. What's more, this most likely clarifies the somewhat quieted rebalancing in danger equality trust positions inferred by Figure 3. Amid August, neither security instability nor the connection between securities and values saw any material increment to actuate hazard equality trusts to change their exposures in a more declared manner.

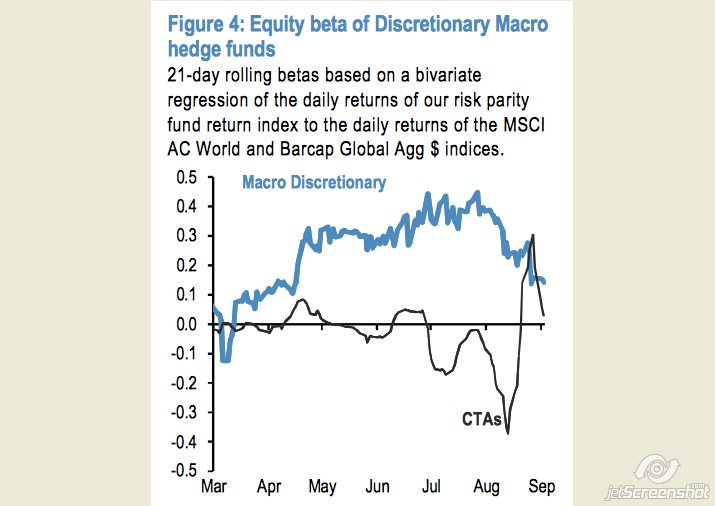

At the end of the day, had hazard equality stores been essentially shedding stocks amid a month ago's turmoil, one may have expected that value beta figure to fall substantially more. By differentiation, the JPMorgan experts point out, the stock beta of those out-dated optional cash directors declined a far more prominent degree.

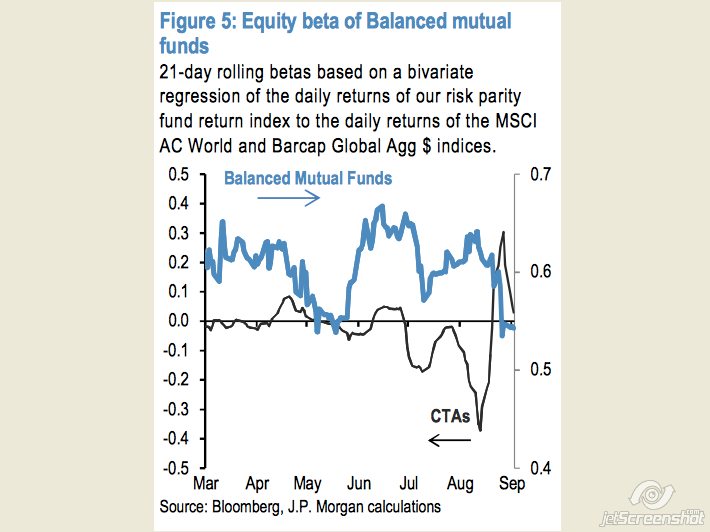

Both figures show quick de-gambling with the value betas of both - 0.4 Discretionary Macro flexible investments and Balanced Mutual Funds declining unexpectedly in August. Truth be told, the value beta decays seen in August by both Discretionary Macro flexible investments and Balanced Mutual Funds were a 1.5x and 2.0x chronicled standard deviation contrasted and only 0.6x for danger equality reserves, individually.

The technique, in which subsidizes tend to naturally modify arrangement of securities, stocks, and different resources in light of higher business unpredictability, has been reprimanded by some for shifting so as to fuel the late selloff property into money.

Bloomberg News reported that Bridgewater's All Weather Fund itself is said to have lost 4.2 percent in August. In the interim, JPMorgan investigator Marko Kolanovic, who has been vocal about the offering weights created by such quantitative stores, said on Thursday that uplifted unpredictability implies that hazard equality players would most likely need to dispose of another $100 billion in stocks in the following one to three weeks.

This is what they said ("beta" is generally characterized as a position's unpredictability contrasted and the general business):

... This terrible execution by danger equality stores amid August does not so much make them the principle guilty parties of the late market amendment. In the first place, the value beta change amid the August revision demonstrated in Figure 3 is fairly little (it moved from 0.3 to 0.2) contrasted with its authentic variety. Second, hazard equality stores don't normally apply high influence to their value speculations. They rather apply high influence to their bond interests keeping in mind the end goal to differentiate their value possessions, since bonds have about 33% of the unpredictability of values.

This system makes hazard equality supports more defenseless against ascends in bond instability and in connection between bonds and values, instead of ascends in value unpredictability. What's more, this most likely clarifies the somewhat quieted rebalancing in danger equality trust positions inferred by Figure 3. Amid August, neither security instability nor the connection between securities and values saw any material increment to actuate hazard equality trusts to change their exposures in a more declared manner.

At the end of the day, had hazard equality stores been essentially shedding stocks amid a month ago's turmoil, one may have expected that value beta figure to fall substantially more. By differentiation, the JPMorgan experts point out, the stock beta of those out-dated optional cash directors declined a far more prominent degree.

Both figures show quick de-gambling with the value betas of both - 0.4 Discretionary Macro flexible investments and Balanced Mutual Funds declining unexpectedly in August. Truth be told, the value beta decays seen in August by both Discretionary Macro flexible investments and Balanced Mutual Funds were a 1.5x and 2.0x chronicled standard deviation contrasted and only 0.6x for danger equality reserves, individually.

Something to contemplate over the long week https://www.mql5.com/en/signals/111434#!tab=history