Stock investors may be pretty unlucky in the month of August, but this one was already logged in record books as the worst in nearly two decades for the Dow Jones Industrial Average.

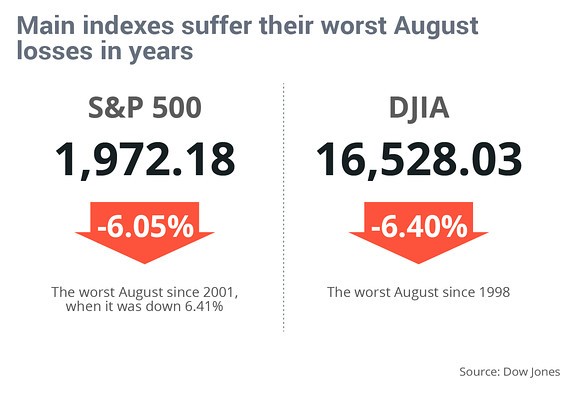

DJIA posted a roughly 6.4% decline in August,

which marked the worst month in more than five years for the market

gauge, which tracks the performance of 30 stocks.

Comparing the month with other Augusts, the blue-chip index logged its worst August since 1998, according to data from Dow Jones.

In general, it was the sixth worst monthly performance for the Dow and the worst since May 2010, when the Dow dropped 7.9%, according to FactSet data.

Meanwhile, the broader U.S. stock benchmark, the S&P 500 recorded a 6.3% fall in August, its worst monthly fall in more than three years. In comparison with other August returns, the S&P 500 marked its worst fall since 2001, when it tumbled 6.41%.

Dow Jones and FactSet data also showed that the Nasdaq’s performance in August - off 6.9% on the month - was similarly sharp, with the tech-heavy index marking its worst performance on the month in 14 years, as well as ringing up its worst monthly return overall in three years.

Concerns about a slowdown in China, plunging oil prices and more anxiety about a possible rate hike by the Federal Reserve are the main culprits for this month's decline.

While autumn (and mostly October) is usually considered to be unlucky for traders, some analysts suggest the bottom has been found.

William Riegel, chief investment officer at TIAA-CREF Asset Management, wrote in a report late Friday that he thinks the market "may have found its footing."

He argues that so many investors sold off stocks and bonds last week in order to lock in cash, and that cash could eventually be used to bargain hunt for stocks once the current market jitters ease.

But that doesn't mean that the correction is over just yet.

Riegel further suggests that there will be likely more volatility ahead, especially with a key jobs report coming out Friday and the Fed set to meet on September 16 and 17 to decide if to increase interest rates. Worries about China haven't completely gone away either.