It's back to the USA on the most proficient method to esteem a stock.

What's more, this is my greatest amazement on the grounds that esteeming a stock and stock examination go together.

You can't esteem a stock 100% successfully unless you've investigated the organization.

On the other hand it could be individuals in the US are more keen on recognizing what stock to purchase and at what value, while individuals in India are more inspired by taking all the while.

In any case, it goes to indicate how one dimensional the manner of thinking of a human can be.

"Simply let me know what to purchase"

"Demonstrate to me best practices to dissect stocks"

"I simply need to realize what this stock is worth"

Goes to demonstrate how troublesome stock picking truly is on the grounds that you first need to discover something that looks sufficient to purchase, know how to examine it to go to a natural quality.

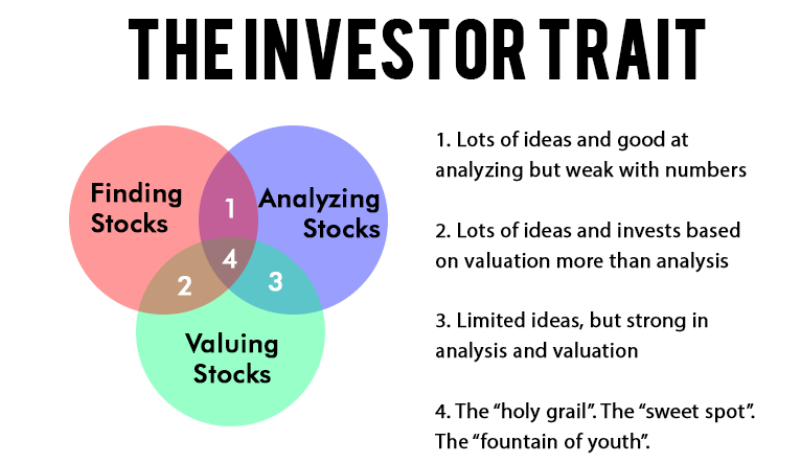

Something like this.

The Investor Trait

I observe zone 1 to be the most exceedingly bad. It's the place all the shallow articles live and you see a huge amount of these uproarious ones all over the place. The ones based recapping what profit turned out to be contrasted with investigator desires on account of rivalry and blah.

Zone 2 is the region where I have a tendency to live more often than not. I have a lot of stock thoughts yet before I get to any breaking down I need to verify that the numbers bode well before I invest the energy to begin perusing reports and dissecting the points of interest.

Zone 3 is far and away superior when rather than taking a shot at such a variety of thoughts, the financial specialists that gathering in this square are exceptionally centered around comprehension a stock totally. The best financial specialists and masters live here.

And after that there's zone 4.

In any game, there's dependably a sweet spot. Whether it's in your golf club, tennis racket or bat, the one spot where everything works in congruity. A place that I need to be. Who doesn't?

In Buffett's prime, he effectively waltzed around zone 4.

He and his band of super financial specialists commanded this domain and on the off chance that you've perused his letters, it's not difficult to see why and thankfully, we have Buffett's knowledge on picking stocks from many years of experience.

What might Buffett do in this business sector?

Well here's an accumulation of Buffett's considerations on how he goes about breaking down and esteeming stocks.

7 Wise Thoughts from Buffett on Finding Stocks

1. I began at page one [of these manuals] and experienced each organization that exchanged, from beginning to end. When I was done I knew something about each organization in the book.

2. I like organizations that I can get it. How about we begin with that. That limits it around 90%. There are a wide range of things I don't see, yet luckily, there is sufficient I do get it. You have this huge wide world out there and each organization is freely claimed. So you have all American business for all intents and purposes accessible to you. So it bodes well to run with things you can get it.

3. To begin with, you require two heaps. You need to isolate organizations you can comprehend and sensibly foresee from those you don't comprehend and can't sensibly anticipate. A case is biting gum versus programming. You likewise need to perceive what you can and can't know. Put all that you can't comprehend or that is hard to anticipate in one heap. That is the as well hard heap. When you know the other heap, then it's essential to peruse a great deal, find out about the commercial ventures, get foundation data, and so forth on the organizations in those heaps. Perused a considerable measure of 10Ks and Qs, and so forth. Perused about the contenders. I would prefer not to know the cost of the stock before my investigation. I need to take the necessary steps and evaluation a quality for the stock and after that contrast that with the present offering cost. In the event that I know the cost ahead of time it may impact my examination. We're inspiring prepared to make a $5 billion venture and this was the procedure I utilized.

4. You need to turn over a considerable measure of rocks to locate those little peculiarities. You need to discover the organizations that are off the guide – way off the guide. You may discover nearby organizations that have nothing the matter with them by any means

5. The vast majority get intrigued by stocks when others is. The time to get intrigued is the point at which nobody else is. You can't purchase what is mainstream and do well.

6. I don't hope to bounce more than 7-foot bars: I glance around for 1-foot bars that I can venture over.

7. If we somehow happened to do it over once more, we'd do it practically the same way. The world hasn't changed that much. We'd perused everything in sight about organizations and businesses we think we'd get it. Furthermore, living up to expectations with far less capital, our speculation universe would be far more extensive than it is as of now.

7 Gems from Buffet on Analyzing Stocks

1. You don't should be a specialist with a specific end goal to accomplish tasteful venture returns. Be that as it may, on the off chance that you aren't, you must perceive your confinements and take after a course sure to work sensibly well. Keep things basic and don't swing for the wall. At the point when guaranteed speedy benefits, react with a snappy "no."

2. There's nothing diverse, in my perspective, about dissecting securities today versus 50 years prior.

3. We support organizations where we truly think we know the answer. In the event that we think the business' aggressive position is unstable, we won't attempt to remunerate with cost. We need to purchase an extraordinary business, characterized as having an exceptional yield on capital for a drawn out stretch of time, where we think administration will treat us right. We like to purchase at 40 pennies on the dollar, yet will pay a considerable measure closer to $1 on the dollar for an incredible business.

4. Munger: Margin of security means getting more esteem than you're paying. There are numerous approaches to get esteem. It's secondary school variable based math; in the event that you can't do this, then don't contribute.

5. In case you're going to purchase a homestead, you'd say, "I purchased it to win $X developing soybeans." It wouldn't be in light of what you saw on TV or what a companion said. It's the same with stocks. Take out a yellow cushion and say, "In case I'm going to purchase GM at $30, it has 600 million shares, so I'm paying $18 billion," and answer the inquiry, why? On the off chance that you can't answer that, you're not subjecting it to business tests.

6. Capital-escalated businesses outside the utility area alarm me more. We get not too bad profits for value. You won't get rich, yet you won't become penniless either. You are in an ideal situation in organizations that are not capital concentrated.

7 Nuggets from Buffett on Valuing Stocks

1. At the point when Charlie and I purchase stocks which we consider as little partitions of organizations our examination is fundamentally the same to that which we use in purchasing whole organizations. We first need to choose whether we can sensibly evaluate a profit range for a long time out, or more. In the event that the answer is yes, we will purchase the stock (or business) on the off chance that it offers at a sensible cost in connection to the base limit of our assessment. On the off chance that, notwithstanding, we do not have the capacity to gauge future income which is normally the case we just proceed onward to different prospects. In the 54 years we have cooperated, we have never inescapable an appealing buy as a result of the full scale or political environment, or the perspectives of other individuals. Actually, these subjects never come up when we decide.

2. In 1986, I bought a 400-section of land ranch, found 50 miles north of Omaha, from the FDIC. It cost me $280,000, extensively not exactly what a fizzled bank had loaned against the ranch a couple of years prior. I don't knew anything about working a ranch. In any case, I have a child who loves cultivating, and I gained from him both what number of bushels of corn and soybeans the homestead would deliver and what the working costs would be. From these assessments, I ascertained the standardized come back from the homestead to then be around 10%. I likewise thought it was likely that profitability would enhance after some time and that product costs would move higher too. Both desires demonstrated out.

3. Natural quality is frightfully imperative however exceptionally fluffy. We attempt to work with organizations where we have genuinely high likelihood of recognizing what the future will hold. On the off chance that you claim a gas pipeline, very little is going to turn out badly. Possibly a contender enters driving you to cut costs, however inborn worth hasn't gone down on the off chance that you officially figured this in. We took a gander at a pipeline as of late that we think will go under weight from different methods for conveying gas [to the territory the pipeline serves]. We take a gander at this uniquely in contrast to another pipeline that has the most minimal expenses [and does not confront dangers from option pipelines]. In the event that you figure inborn esteem legitimately, you consider things like declining costs.

4. Financial specialists making buys in an overheated business sector need to perceive that it might frequently take an augmented period for the estimation of even a remarkable organization to make up for lost time with the value they paid.

5. We utilize the same rebate rate over all securities. We may be more traditionalist in evaluating trade in for spendable dough a few circumstances.

6. Simply on the grounds that premium rates are at 1.5% doesn't mean we like a venture that yields 2-3%. We have least edges in our psyche that are a ton higher than government rates. When we're taking a gander at a business, we're taking a gander at holding it everlastingly, so we don't expect rates will dependably be this low.

7. The proper numerous for a business contrasted with the S&P 500 relies on upon its arrival on value and profit for incremental contributed capital. I wouldn't take a gander at a solitary valuation metric like relative P/E proportion. I don't think cost to-profit, cost to-book or cost to-deals proportions let you know all that much. Individuals need a recipe, yet it isn't so much that simple. To esteem something, you basically need to take its free money streams from now until the hereafter and after that markdown them back to the present utilizing a proper rebate rate. All money is equivalent https://www.mql5.com/en/signals/111434

What's more, this is my greatest amazement on the grounds that esteeming a stock and stock examination go together.

You can't esteem a stock 100% successfully unless you've investigated the organization.

On the other hand it could be individuals in the US are more keen on recognizing what stock to purchase and at what value, while individuals in India are more inspired by taking all the while.

In any case, it goes to indicate how one dimensional the manner of thinking of a human can be.

"Simply let me know what to purchase"

"Demonstrate to me best practices to dissect stocks"

"I simply need to realize what this stock is worth"

Goes to demonstrate how troublesome stock picking truly is on the grounds that you first need to discover something that looks sufficient to purchase, know how to examine it to go to a natural quality.

Something like this.

The Investor Trait

I observe zone 1 to be the most exceedingly bad. It's the place all the shallow articles live and you see a huge amount of these uproarious ones all over the place. The ones based recapping what profit turned out to be contrasted with investigator desires on account of rivalry and blah.

Zone 2 is the region where I have a tendency to live more often than not. I have a lot of stock thoughts yet before I get to any breaking down I need to verify that the numbers bode well before I invest the energy to begin perusing reports and dissecting the points of interest.

Zone 3 is far and away superior when rather than taking a shot at such a variety of thoughts, the financial specialists that gathering in this square are exceptionally centered around comprehension a stock totally. The best financial specialists and masters live here.

And after that there's zone 4.

In any game, there's dependably a sweet spot. Whether it's in your golf club, tennis racket or bat, the one spot where everything works in congruity. A place that I need to be. Who doesn't?

In Buffett's prime, he effectively waltzed around zone 4.

He and his band of super financial specialists commanded this domain and on the off chance that you've perused his letters, it's not difficult to see why and thankfully, we have Buffett's knowledge on picking stocks from many years of experience.

What might Buffett do in this business sector?

Well here's an accumulation of Buffett's considerations on how he goes about breaking down and esteeming stocks.

7 Wise Thoughts from Buffett on Finding Stocks

1. I began at page one [of these manuals] and experienced each organization that exchanged, from beginning to end. When I was done I knew something about each organization in the book.

2. I like organizations that I can get it. How about we begin with that. That limits it around 90%. There are a wide range of things I don't see, yet luckily, there is sufficient I do get it. You have this huge wide world out there and each organization is freely claimed. So you have all American business for all intents and purposes accessible to you. So it bodes well to run with things you can get it.

3. To begin with, you require two heaps. You need to isolate organizations you can comprehend and sensibly foresee from those you don't comprehend and can't sensibly anticipate. A case is biting gum versus programming. You likewise need to perceive what you can and can't know. Put all that you can't comprehend or that is hard to anticipate in one heap. That is the as well hard heap. When you know the other heap, then it's essential to peruse a great deal, find out about the commercial ventures, get foundation data, and so forth on the organizations in those heaps. Perused a considerable measure of 10Ks and Qs, and so forth. Perused about the contenders. I would prefer not to know the cost of the stock before my investigation. I need to take the necessary steps and evaluation a quality for the stock and after that contrast that with the present offering cost. In the event that I know the cost ahead of time it may impact my examination. We're inspiring prepared to make a $5 billion venture and this was the procedure I utilized.

4. You need to turn over a considerable measure of rocks to locate those little peculiarities. You need to discover the organizations that are off the guide – way off the guide. You may discover nearby organizations that have nothing the matter with them by any means

5. The vast majority get intrigued by stocks when others is. The time to get intrigued is the point at which nobody else is. You can't purchase what is mainstream and do well.

6. I don't hope to bounce more than 7-foot bars: I glance around for 1-foot bars that I can venture over.

7. If we somehow happened to do it over once more, we'd do it practically the same way. The world hasn't changed that much. We'd perused everything in sight about organizations and businesses we think we'd get it. Furthermore, living up to expectations with far less capital, our speculation universe would be far more extensive than it is as of now.

7 Gems from Buffet on Analyzing Stocks

1. You don't should be a specialist with a specific end goal to accomplish tasteful venture returns. Be that as it may, on the off chance that you aren't, you must perceive your confinements and take after a course sure to work sensibly well. Keep things basic and don't swing for the wall. At the point when guaranteed speedy benefits, react with a snappy "no."

2. There's nothing diverse, in my perspective, about dissecting securities today versus 50 years prior.

3. We support organizations where we truly think we know the answer. In the event that we think the business' aggressive position is unstable, we won't attempt to remunerate with cost. We need to purchase an extraordinary business, characterized as having an exceptional yield on capital for a drawn out stretch of time, where we think administration will treat us right. We like to purchase at 40 pennies on the dollar, yet will pay a considerable measure closer to $1 on the dollar for an incredible business.

4. Munger: Margin of security means getting more esteem than you're paying. There are numerous approaches to get esteem. It's secondary school variable based math; in the event that you can't do this, then don't contribute.

5. In case you're going to purchase a homestead, you'd say, "I purchased it to win $X developing soybeans." It wouldn't be in light of what you saw on TV or what a companion said. It's the same with stocks. Take out a yellow cushion and say, "In case I'm going to purchase GM at $30, it has 600 million shares, so I'm paying $18 billion," and answer the inquiry, why? On the off chance that you can't answer that, you're not subjecting it to business tests.

6. Capital-escalated businesses outside the utility area alarm me more. We get not too bad profits for value. You won't get rich, yet you won't become penniless either. You are in an ideal situation in organizations that are not capital concentrated.

7. No recipe in money lets you know that the canal is 28 feet wide and 16 feet profound. That's what makes the scholastics insane. They can register standard deviations and betas, yet they can't comprehend canals.Possibly I'm being too hard on the scholastics.

7 Nuggets from Buffett on Valuing Stocks

1. At the point when Charlie and I purchase stocks which we consider as little partitions of organizations our examination is fundamentally the same to that which we use in purchasing whole organizations. We first need to choose whether we can sensibly evaluate a profit range for a long time out, or more. In the event that the answer is yes, we will purchase the stock (or business) on the off chance that it offers at a sensible cost in connection to the base limit of our assessment. On the off chance that, notwithstanding, we do not have the capacity to gauge future income which is normally the case we just proceed onward to different prospects. In the 54 years we have cooperated, we have never inescapable an appealing buy as a result of the full scale or political environment, or the perspectives of other individuals. Actually, these subjects never come up when we decide.

2. In 1986, I bought a 400-section of land ranch, found 50 miles north of Omaha, from the FDIC. It cost me $280,000, extensively not exactly what a fizzled bank had loaned against the ranch a couple of years prior. I don't knew anything about working a ranch. In any case, I have a child who loves cultivating, and I gained from him both what number of bushels of corn and soybeans the homestead would deliver and what the working costs would be. From these assessments, I ascertained the standardized come back from the homestead to then be around 10%. I likewise thought it was likely that profitability would enhance after some time and that product costs would move higher too. Both desires demonstrated out.

3. Natural quality is frightfully imperative however exceptionally fluffy. We attempt to work with organizations where we have genuinely high likelihood of recognizing what the future will hold. On the off chance that you claim a gas pipeline, very little is going to turn out badly. Possibly a contender enters driving you to cut costs, however inborn worth hasn't gone down on the off chance that you officially figured this in. We took a gander at a pipeline as of late that we think will go under weight from different methods for conveying gas [to the territory the pipeline serves]. We take a gander at this uniquely in contrast to another pipeline that has the most minimal expenses [and does not confront dangers from option pipelines]. In the event that you figure inborn esteem legitimately, you consider things like declining costs.

4. Financial specialists making buys in an overheated business sector need to perceive that it might frequently take an augmented period for the estimation of even a remarkable organization to make up for lost time with the value they paid.

5. We utilize the same rebate rate over all securities. We may be more traditionalist in evaluating trade in for spendable dough a few circumstances.

6. Simply on the grounds that premium rates are at 1.5% doesn't mean we like a venture that yields 2-3%. We have least edges in our psyche that are a ton higher than government rates. When we're taking a gander at a business, we're taking a gander at holding it everlastingly, so we don't expect rates will dependably be this low.

7. The proper numerous for a business contrasted with the S&P 500 relies on upon its arrival on value and profit for incremental contributed capital. I wouldn't take a gander at a solitary valuation metric like relative P/E proportion. I don't think cost to-profit, cost to-book or cost to-deals proportions let you know all that much. Individuals need a recipe, yet it isn't so much that simple. To esteem something, you basically need to take its free money streams from now until the hereafter and after that markdown them back to the present utilizing a proper rebate rate. All money is equivalent https://www.mql5.com/en/signals/111434