U.S. economy looks much more grounded after upward amendment to GDP report.

27 August 2015, 18:52

0

215

The U.S. economy looks a great deal more vivacious in the second quarter than beforehand suspected, as a report discharged Thursday indicated organizations got off the sidelines and spent some cash.

The speeding up in business venture, on the off chance that it's supported, could add to the economy's energy in the months ahead. The information show why the Federal Reserve is considering trekking interest rates at its next meeting in September.

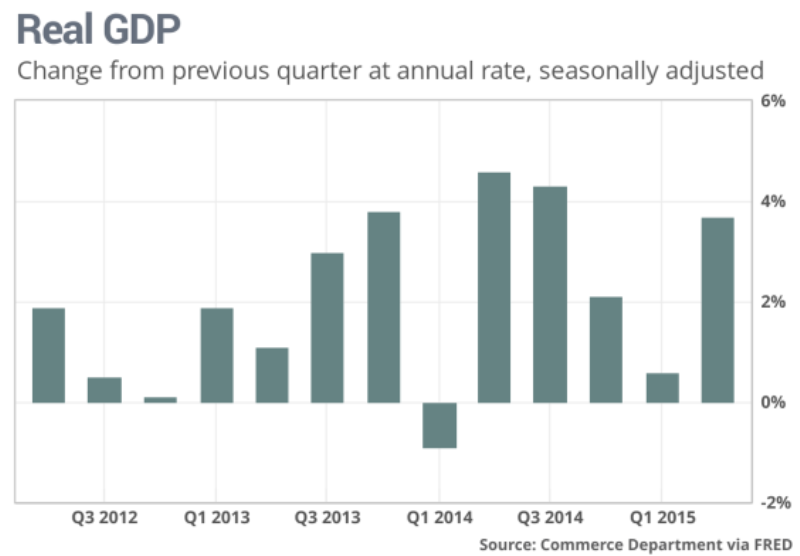

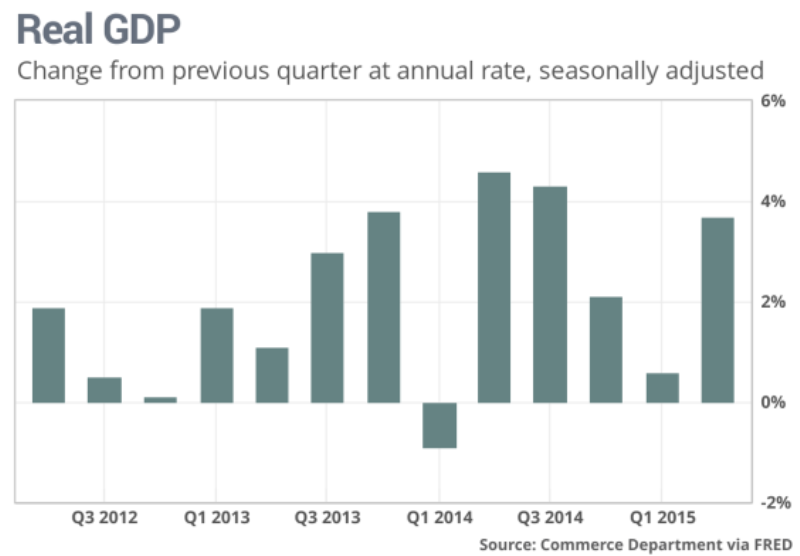

The U.S. economy developed at a quicker 3.7% yearly pace in the second quarter, up from the beginning appraisal of development at a 2.3% clasp, the Commerce Department said Thursday.

Financial analysts surveyed by Market Watch figure total national output would be overhauled up to 3.3%, however business speculation was more grounded than anticipated. The administration evaluated a month ago that total national output extended at an occasionally balanced 2.3% clasp from April to June.

U.S. stocks, which have rotated over the worries about China's economy, hopped on Thursday.

Buyer spending, the principle driver of U.S. monetary movement, drove the route of course. Costs were reconsidered up to 3.1% from 2.9% in the second quarter after a lukewarm 1.8% addition in the initial three months of the year.

Furthermore, recently overhauled figures from the Commerce Department demonstrate that organizations contributed at a much speedier rate.

Organizations expanded venture by 3.2% expansion of a drop of 0.6%, with spending on structures, for example, office structures ascending by 3.1% rather than a drop of 1.6%.

One reason organizations may have contributed more: Corporate benefits hopped an expected 2.4% in the second quarter in the wake of declining by 5.8% in the first quarter.

Furthermore, they helped spending on hardware by 10.7%, as opposed to 7%..

It's not clear this pace can be supported. Case in point, state and neighborhood government spending was helped to 4.3% from 2.0%, the quickest pace subsequent to 2001. Financial analysts don't think this will last.

Furthermore, the estimation of inventories, which adds to GDP, expanded by $121.1 billion in the second quarter rather than a formerly assessed $110.0 billion. This is relied upon to subtract from development in the third and final quarter.

In any case, genuine last deals to private residential buyers, a measure of movement without inventories, saw a more grounded upward pick up than numerous financial experts expected, from 2.5% to 3.3%.

Financial experts surveyed by Market Watch estimate the U.S. will develop at a 2.8% pace in the July-September quarter. However, that was before the current week's money related business sector instability.

Swelling as measured by the PCE value file ascended at a 2.2% yearly rate.

William Dudley, the president of the New York Fed, said Wednesday that late financial information has been really positive. He showed that he had been in any event near support a rate trek at the Fed's Sept. 16-17 meeting.

Then again, late money related business turmoil has confused the U.S. national bank's arrangements. Dudley told correspondents the lofty business decays had made a rate build "less convincing."

It might be months before financial analysts will know whether the current week's stock auction is a monetarily essential stun.

"The way to the fiscal approach position in the close term won't be past development or expansion execution, however the standpoint for both," said Millan Mulraine, vice president financial expert at TD Securities.

"What's more, given the late monetary business sector unpredictability and the waiting nervousness about worldwide development, the standpoint for both is currently more dubious and tilted to the drawback, particularly for swelling. This will give the affection to the Fed to take a go on bringing rates up in September," he included.https://www.mql5.com/en/signals/111434#!tab=history

The speeding up in business venture, on the off chance that it's supported, could add to the economy's energy in the months ahead. The information show why the Federal Reserve is considering trekking interest rates at its next meeting in September.

The U.S. economy developed at a quicker 3.7% yearly pace in the second quarter, up from the beginning appraisal of development at a 2.3% clasp, the Commerce Department said Thursday.

Financial analysts surveyed by Market Watch figure total national output would be overhauled up to 3.3%, however business speculation was more grounded than anticipated. The administration evaluated a month ago that total national output extended at an occasionally balanced 2.3% clasp from April to June.

U.S. stocks, which have rotated over the worries about China's economy, hopped on Thursday.

Buyer spending, the principle driver of U.S. monetary movement, drove the route of course. Costs were reconsidered up to 3.1% from 2.9% in the second quarter after a lukewarm 1.8% addition in the initial three months of the year.

Furthermore, recently overhauled figures from the Commerce Department demonstrate that organizations contributed at a much speedier rate.

Organizations expanded venture by 3.2% expansion of a drop of 0.6%, with spending on structures, for example, office structures ascending by 3.1% rather than a drop of 1.6%.

One reason organizations may have contributed more: Corporate benefits hopped an expected 2.4% in the second quarter in the wake of declining by 5.8% in the first quarter.

Furthermore, they helped spending on hardware by 10.7%, as opposed to 7%..

It's not clear this pace can be supported. Case in point, state and neighborhood government spending was helped to 4.3% from 2.0%, the quickest pace subsequent to 2001. Financial analysts don't think this will last.

Furthermore, the estimation of inventories, which adds to GDP, expanded by $121.1 billion in the second quarter rather than a formerly assessed $110.0 billion. This is relied upon to subtract from development in the third and final quarter.

In any case, genuine last deals to private residential buyers, a measure of movement without inventories, saw a more grounded upward pick up than numerous financial experts expected, from 2.5% to 3.3%.

Financial experts surveyed by Market Watch estimate the U.S. will develop at a 2.8% pace in the July-September quarter. However, that was before the current week's money related business sector instability.

Swelling as measured by the PCE value file ascended at a 2.2% yearly rate.

William Dudley, the president of the New York Fed, said Wednesday that late financial information has been really positive. He showed that he had been in any event near support a rate trek at the Fed's Sept. 16-17 meeting.

Then again, late money related business turmoil has confused the U.S. national bank's arrangements. Dudley told correspondents the lofty business decays had made a rate build "less convincing."

It might be months before financial analysts will know whether the current week's stock auction is a monetarily essential stun.

"The way to the fiscal approach position in the close term won't be past development or expansion execution, however the standpoint for both," said Millan Mulraine, vice president financial expert at TD Securities.

"What's more, given the late monetary business sector unpredictability and the waiting nervousness about worldwide development, the standpoint for both is currently more dubious and tilted to the drawback, particularly for swelling. This will give the affection to the Fed to take a go on bringing rates up in September," he included.https://www.mql5.com/en/signals/111434#!tab=history