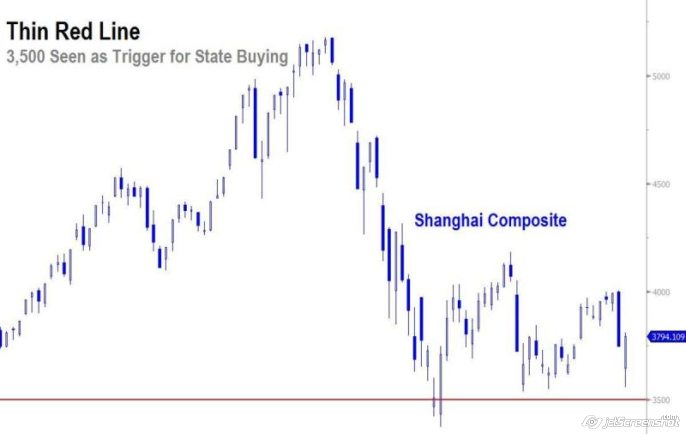

China's Newest Make-or-Break Level for Stocks Is Shanghai 3,500

In a Chinese securities exchange fixated on round numbers, 3,500 has developed as the most recent represent the deciding moment level for dealers attempting to gage the resilience of state backing.

Indications of government purchasing have showed up at that cost on the Shanghai Composite Index no less than four times in the course of recent weeks. The most recent sample went ahead Wednesday, when the gage posted an intraday rally of 6.6 percent subsequent to tumbling to as low as 3,558.38.

Theory around the administration's aims has raised following Friday, after China's securities controller flagged powers will pare back an extraordinary crusade to prop up offer costs as unpredictability falls. While strategy producers have a long history of shielding key levels on the Shanghai Composite, their part in supporting the business has tackled considerably more noteworthy significance as China's wealthiest brokers join a mass migration of remote speculators in the wake of a $4 trillion accident.

"Everyone's eyes are centered around whether the administration will shore up the 3,500 level," said Nelson Yan, boss speculation officer at the Hong Kong unit of Changjiang Securities Co. "Any inaction could trigger another round of offering."

The legislature has equipped a state organization with more than $400 billion to reinforce offer costs and advised state-possessed organizations to purchase stocks. It's trying to prop up the business sector after a drop of more than 30 percent in the Shanghai Composite debilitated to undermine trust in President Xi Jinping's capacity to deal with the economy.

Offer Buybacks

The benchmark gage fell as much as 8.2 percent to 3,421.53 on July 8, preceding paring misfortunes to close over 3,500. The next day, the gage surged 10 percent off its intraday low of 3,373.54. On July 28, the measure bounced back more than 6 percent in the wake of touching 3,537.56.

Confirmation of government backing at firmly watched levels in China's securities exchange stretch back to in any event June 2005, when the Shanghai Composite quickly fell underneath 1,000. The controller reacted by asking stores to balance out the business sector and permitting organizations to purchase back their shares.

Inability to shield such levels dangers quickening misfortunes. Examiners at Macquarie Group Ltd. furthermore, Guosen Securities Co. guessed toward the end of June that powers would mediate to keep the file over 4,000. After the gage shut underneath that level on July 2, shares tumbled a further 10 percent throughout the following four days.

The Shanghai Composite drooped 3.4 percent at its most reduced close in two weeks on Thursday.

Indeed, even as the state purchases, financial specialists with the most in question are liquidating out in the midst of indications of an extending monetary misery.

Dimmer Prospects

The quantity of dealers with more than 10 million yuan ($1.6 million) of shares in their records shrank by 28 percent in July, while those with between 1 million yuan and 10 million yuan declined by 22 percent, as indicated by information ordered by China Securities Depository and Clearing Corp. Global financial specialists have sold $7 billion of Shanghai shares through a trade join with Hong Kong since July 3.

"More financial specialists may be taking the chance of state purchasing to dump their possessions, as development prospects for China are looking dimmer," said Bernard Aw, a Singapore-based strategist at IG Asia Pte Ltd.

A weaker yuan is additionally decreasing the appeal of Chinese resources. The money dove the most in 21 years a week ago after the national bank out of the blue degraded it.

China Securities Finance Corp., the state office tasked with supporting offer costs, will stay in money markets for a considerable length of time to come, the China Securities Regulatory Commission said, in spite of the fact that the organization will no more add to property unless there's bizarre unpredictability and systemic danger. The store exchanged a few shares to Central Huijin Investment Ltd., a unit of the country's sovereign riches subsidize, the CSRC said.

'Shrewd Traders'

Regardless of the fact that state-upheld purchasers hold the line at 3,500, the Shanghai Composite may battle to surpass 4,500 - an objective Chinese financiers refered to when they revealed a business sector bolster reserve on July 4. The gage dove 11 percent in three days after it shut down at 4,123.93 on July 23.

Clear levels of state backing are "awesome for wary merchants," said Michael Every, head of money related markets research at Rabobank Group in Hong Kong. "Purchase in transit up as government offers higher - then offer at the level they have hailed as an objective. Flush and rehash. The administration conveys the can."

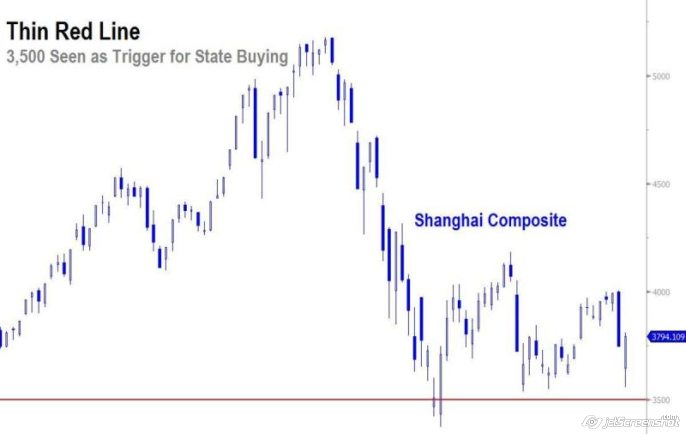

In a Chinese securities exchange fixated on round numbers, 3,500 has developed as the most recent represent the deciding moment level for dealers attempting to gage the resilience of state backing.

Indications of government purchasing have showed up at that cost on the Shanghai Composite Index no less than four times in the course of recent weeks. The most recent sample went ahead Wednesday, when the gage posted an intraday rally of 6.6 percent subsequent to tumbling to as low as 3,558.38.

Theory around the administration's aims has raised following Friday, after China's securities controller flagged powers will pare back an extraordinary crusade to prop up offer costs as unpredictability falls. While strategy producers have a long history of shielding key levels on the Shanghai Composite, their part in supporting the business has tackled considerably more noteworthy significance as China's wealthiest brokers join a mass migration of remote speculators in the wake of a $4 trillion accident.

"Everyone's eyes are centered around whether the administration will shore up the 3,500 level," said Nelson Yan, boss speculation officer at the Hong Kong unit of Changjiang Securities Co. "Any inaction could trigger another round of offering."

The legislature has equipped a state organization with more than $400 billion to reinforce offer costs and advised state-possessed organizations to purchase stocks. It's trying to prop up the business sector after a drop of more than 30 percent in the Shanghai Composite debilitated to undermine trust in President Xi Jinping's capacity to deal with the economy.

Offer Buybacks

The benchmark gage fell as much as 8.2 percent to 3,421.53 on July 8, preceding paring misfortunes to close over 3,500. The next day, the gage surged 10 percent off its intraday low of 3,373.54. On July 28, the measure bounced back more than 6 percent in the wake of touching 3,537.56.

Confirmation of government backing at firmly watched levels in China's securities exchange stretch back to in any event June 2005, when the Shanghai Composite quickly fell underneath 1,000. The controller reacted by asking stores to balance out the business sector and permitting organizations to purchase back their shares.

Inability to shield such levels dangers quickening misfortunes. Examiners at Macquarie Group Ltd. furthermore, Guosen Securities Co. guessed toward the end of June that powers would mediate to keep the file over 4,000. After the gage shut underneath that level on July 2, shares tumbled a further 10 percent throughout the following four days.

The Shanghai Composite drooped 3.4 percent at its most reduced close in two weeks on Thursday.

Indeed, even as the state purchases, financial specialists with the most in question are liquidating out in the midst of indications of an extending monetary misery.

Dimmer Prospects

The quantity of dealers with more than 10 million yuan ($1.6 million) of shares in their records shrank by 28 percent in July, while those with between 1 million yuan and 10 million yuan declined by 22 percent, as indicated by information ordered by China Securities Depository and Clearing Corp. Global financial specialists have sold $7 billion of Shanghai shares through a trade join with Hong Kong since July 3.

"More financial specialists may be taking the chance of state purchasing to dump their possessions, as development prospects for China are looking dimmer," said Bernard Aw, a Singapore-based strategist at IG Asia Pte Ltd.

A weaker yuan is additionally decreasing the appeal of Chinese resources. The money dove the most in 21 years a week ago after the national bank out of the blue degraded it.

China Securities Finance Corp., the state office tasked with supporting offer costs, will stay in money markets for a considerable length of time to come, the China Securities Regulatory Commission said, in spite of the fact that the organization will no more add to property unless there's bizarre unpredictability and systemic danger. The store exchanged a few shares to Central Huijin Investment Ltd., a unit of the country's sovereign riches subsidize, the CSRC said.

'Shrewd Traders'

Regardless of the fact that state-upheld purchasers hold the line at 3,500, the Shanghai Composite may battle to surpass 4,500 - an objective Chinese financiers refered to when they revealed a business sector bolster reserve on July 4. The gage dove 11 percent in three days after it shut down at 4,123.93 on July 23.

Clear levels of state backing are "awesome for wary merchants," said Michael Every, head of money related markets research at Rabobank Group in Hong Kong. "Purchase in transit up as government offers higher - then offer at the level they have hailed as an objective. Flush and rehash. The administration conveys the can."