Societe Generale and other int'l financial institutions were forecasting the price for EURUSD as 1.04/1.05 at year end. But for now - many banks are started to say about bullish or ranging bullish condition for this pair just because of the following: Greek debt crisis go away, Bund yields and PMI

data expected on Friday. Thus, Societe Generale is forecasting for EURUSD to be in ranging bullish condition up to the end of this week and for next weeks for example:

- "Endorsement of the Greek debt deal by Europe's parliaments won't make the Greek debt crisis go away, of course. The next stage, after payment of the money that is due to the ECB on Thursday, will be pressure for a confidence motion in the Greek Parliament and after that, probably, fresh elections."

- "For the Euro area as a while, the focus will likely shift to the PMI data due Friday amid a sense that the region's growth rate is fading somewhat (again)."

- "None of this makes me terribly bullish of the euro, but as long as the slow drift back down in Bund yields is no faster than the move in US Treasury yields and as long as the front end of the US curve remains stubbornly range-bound (2yr swap rate at 94bp this morning), EUR/USD is going to be stuck in this range."

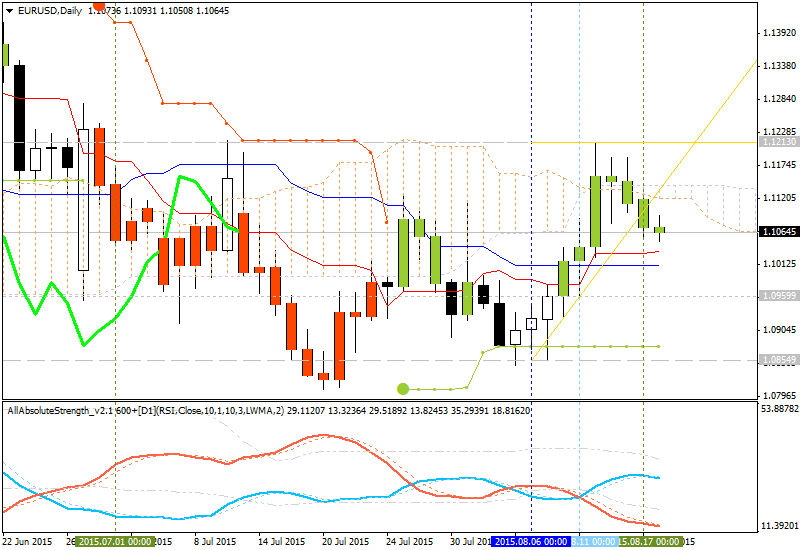

As we see at Ichimoku chart so we may understand that ranging bullish condition is just for H4 timeframe (for intra-day), and daily price is located on the border between the bearish and bullish but ranging (more bearish than bullish). Same situation with Simple Moving Averages chart: H4 price is located to be above 100-SMA/200-SMA, and daily price is located below 200 day SMA and above 100 day SMA for ranging bearish.

Thus, we think that this forecast of Societe Generale may be very questionable concerning technical points of view.