Wednesday marked wider losses for gold which was steady near five-year lows. However, the chart below suggests the yellow metal is not the biggest loser across the commodities sector.

Gold futures for August delivery dropped $10.60, or 0.96%, to trade at $1,092.90 a troy ounce, while silver futures for September delivery dipped 11.7 cents, or 0.79% to trade at $14.66 an ounce.

Copper followed the metals sector hitting an intraday trough of $2.427 a pound, a level not seen since July 8, before trading at $2.433 during European morning hours, down 4.1 cents, or 1.68%.

Expectations the Federal Reserve will raise

rates later in the year, potentially leading to more strength for the greenback, is the main factor to blame for the tumbling commodities. Most of them are priced in dollars, making them

more expensive to users of other currencies as the buck gets stronger.

The dollar index - measuring the dollar strength versus its major rivals - is currently at 97.36.

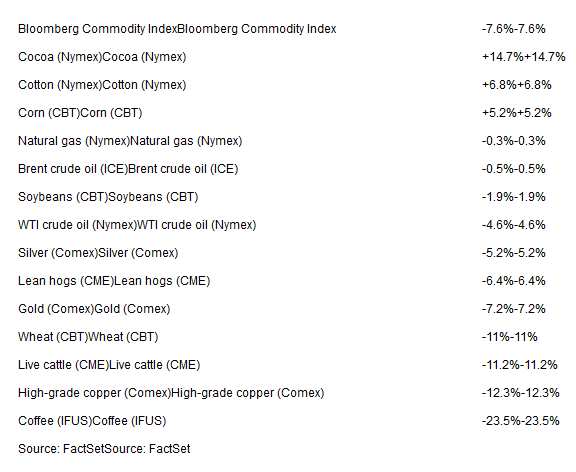

Here’s a table looking at the performance since the end of last year through Tuesday afternoon of some of the most traded and closely watched commodities compared with the Bloomberg Commodity Index.

As you see, although gold have been widely impacted, it is not the unluckiest loser. By a wide margin, that distinction goes to coffee futures, which have shed 23.5%.

Coffee is suffering the pain of a weaker real - Brazilian currency, favorable harvest conditions in that country, and hopes for a recovery in inventories. Coffee had rallied into the autumn of 2014 on crop worries tied in part to a drought in Brazil.

In the meantime, cocoa futures have outperformed.

Prices of cocoa dropped in the early 2015 but eventually rebounded on concerns over the influence of a severe Harmattan wind on harvests

in Ivory Coast, the world’s largest producer, and Ghana, which is the second one according to analysts at Capital Economics.

That rally gave way as fears

eased, but fresh worries over drought and low fertilizer use in

Ghana eventually pushed futures higher, analysts note.