The referendum on whether the Greece government should accept Troika’s bailout presented at 25th June, will be held this Sunday. The polls show that the ‘Yes’ and ‘No’ are tied, and so speculation about the result will last until the very end. This undecision is of course being reflected on the markets.

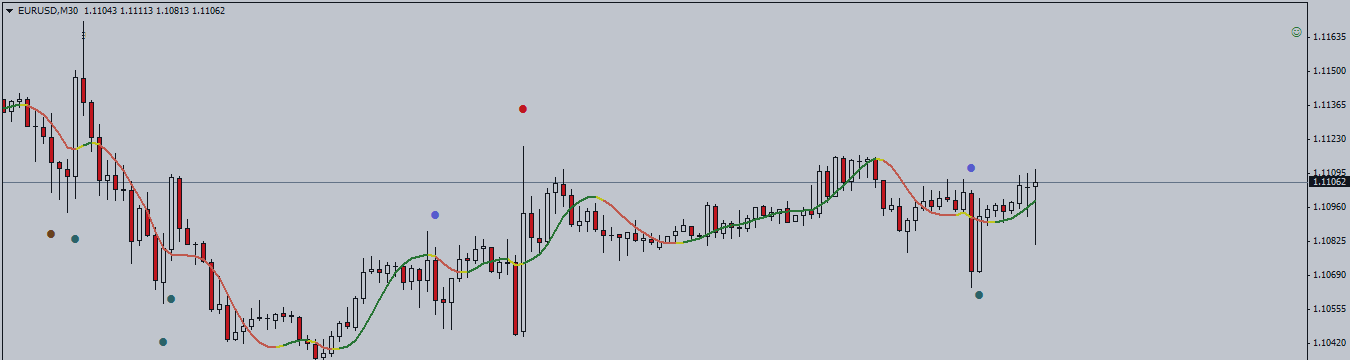

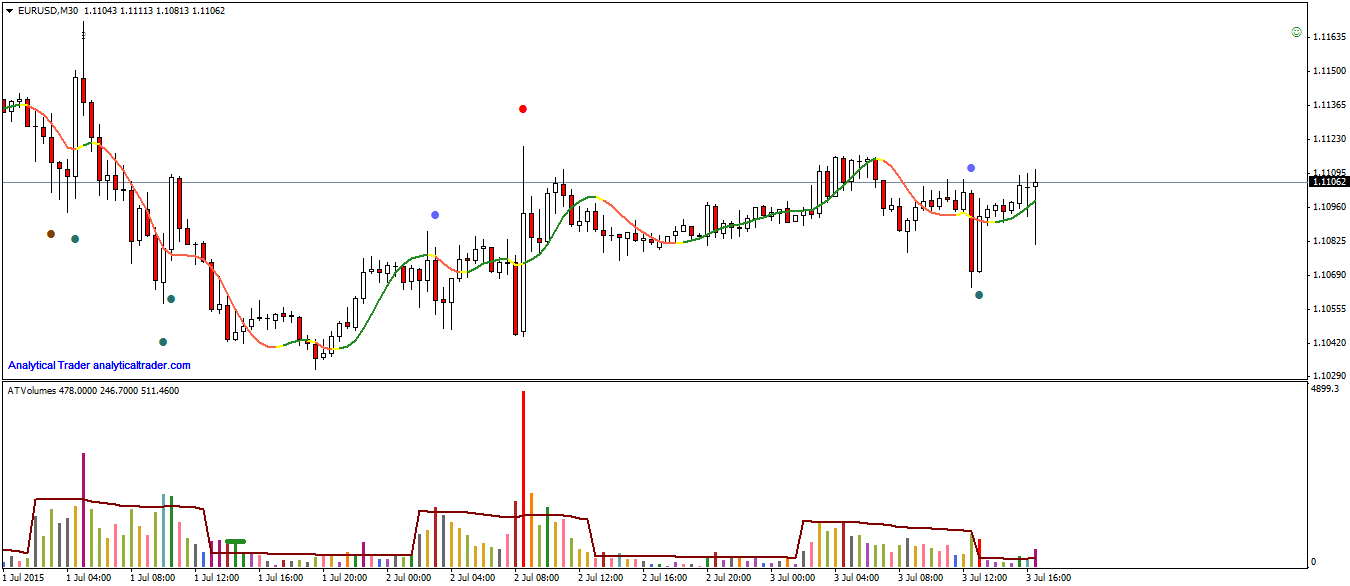

In the Euro pairs, we can see there was significant supply at 2nd July (today was US Independence day, which means most of the positioning for the referendum was actually made on Thursday), marked by the red dot and very high (red) volume. Similar signs can be seen in other Euro pairs, such as EUR/CHF and EUR/GBP. This was to be expected, as investors are disposing of their Euros to reduce their exposure to the expected volatility.

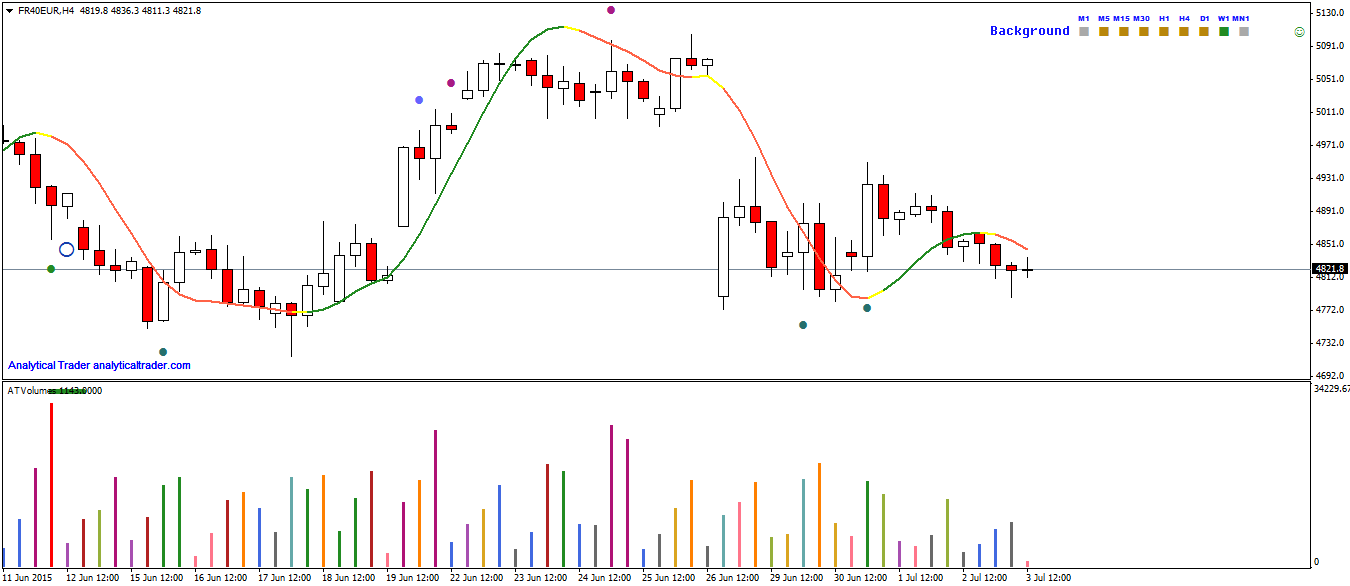

In stocks, there was buying in the last few days, and no selling pressure when prices were coming down. These are most probably traders closing/reducing their short positions from the beginning of the correction (CAC40).

In normal conditions, institutional traders more or less know how to value on what they’re investing in, otherwise they’d be bankrupt given time, and their trading can then be seen on the volumes and prices action. But in this case, since nobody has a way of knowing the results of the referendum beforehand, the safe approach for an investor to take is to reduce or close completely any open position on Euro pairs or stocks.

Analytical VSA Trader