Euro Plunges With S&P 500 Futures on Greece; China Set for Bear

Stocks dropped around the world, while Treasuries and German bunds surged on growing concern that Greece will leave the euro region. Credit risk jumped the most since September 2008, and Chinese shares entered a bear market.

The Stoxx Europe 600 Index slid 2.5 percent by 6:57 a.m. in New York and Standard & Poor’s 500 Index futures fell 1.1 percent. A U.S. exchange-traded fund tracking Greek equities slid 15 and the yield on the country’s 10-year bonds jumped the most on record. Rates similar-maturity bunds and Treasuries both fell 15 basis points. The euro dropped 0.4 percent $1.1124 and the cost of insuring investment-grade corporate debt surged the most since the collapse of Lehman Brothers Holdings Inc. The Shanghai Composite Index extended declines from its peak on June 12 to more than 20 percent.

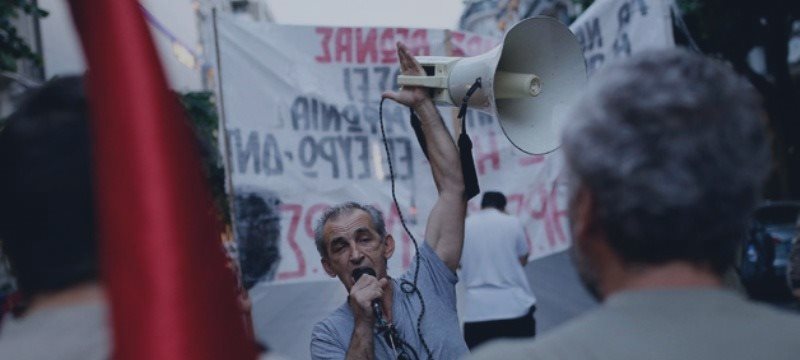

Greece imposed capital controls early Monday, shuttered financial markets and closed banks until at least July 6, the day after Greeks will vote in a referendum on proposals needed to restore bailout aid. Prime Minister Alexis Tsipras called for the vote before the June 30 expiry of the current bailout and a $1.7 billion payment due to the International Monetary Fund. Swiss National Bank President Thomas Jordan said demand for the franc prompted it to intervene in the market.

Capital controls and the referendum “are both symptomatic of the fact that negotiations have broken down,” said Michael Ingram, a London-based market strategist at BGC Partners. Absent a complete capitulation from creditors, “Greece will default on the IMF tomorrow and emergency liquidity assistance should be withdrawn on Wednesday,” he said.

Grexit Odds

There’s an 85 percent chance Greece will leave as it faces a “massive economic contraction,” said Mohamed El-Erian, the former chief executive at Pacific Investment Management Co. Citigroup Inc., which coined the term “Grexit” in February 2012, now predicts the country will stay in euro area following the referendum.

Morgan Stanley increased the probability of departure by the end of 2016 to 60 percent from 45 percent. Royal Bank of Scotland Group Plc on Monday doubled the odds to 40 percent. Opinion polls show a majority of the Greek population supports retaining the single currency.

All but 10 of the shares trading in the Stoxx 600 fell, with banks and automakers leading declines. Trading volumes were 82 percent greater than the 30-day average, according to data compiled by Bloomberg.

The European Commission offered Greek voters a 10-point plan for bailout requirements on Sunday, urging Greece to stay in the euro area.

The Athens Stock Exchange was closed on Monday. The Lyxor ETF FTSE Athex 20 fell 16 in Germany. Depositary receipts of National Bank of Greece SA sank 37 percent in early New York trading while bottler Coca-Cola HBC AG dropped 2.5 percent in London.

Bonds Slide

The yield on 10-year Greek bonds surged 379 basis points to 14.64 percent, the highest since December 2012. In March 2012 the yield reached 44.21 percent.

Portugal, Italy and Spain led declines in the other markets in western Europe, with benchmark equity gauges sliding at least 3.5 percent. The yield on Portugal’s 10-year bond jumped 25 basis points to 2.97 percent, while Spanish and Italian rates increased at least 17 basis points.

The Markit iTraxx Europe Index, which tracks credit-default swaps for investment-grade companies, jumped as much as 13.5 basis points to 80 basis points, the highest since March 2014. Contracts insuring financial companies’ senior debt jumped as much as 21 basis points to 98 basis points.

The euro declined against most of its major peers, with the biggest drop -- of 1.4 percent -- coming against the yen. Implied one-month volatility for euro-dollar trading rose as much 3.54 percentage points to 15.32 percent, the most since the 2008 global financial crisis, before dropping back to 13.78 percent. The measure reached as high as 18.42 percent in September 2011.

Terror Attack

TUI AG sank 6.5 percent. Thomson Airways Ltd. and First Choice Holidays Plc, owned by TUI, said over the weekend that some of its customers were victims of a terror attack in Tunisia.

S&P 500 E-mini futures expiring in September dropped after the index posted its ninth straight week with a move of less than 1 percent, the longest streak since 1993.

The MSCI Emerging Markets Index fell 1.9 percent, the most since Dec. 1. A Bloomberg gauge of 20 currencies slid 0.6 percent, the most in a month, with Turkey’s lira and Russia’s ruble losing more than 1 percent against the dollar. Hungary’s forint slid 1 percent versus the euro.

China Rout

The Shanghai Composite Index tumbled 3.3 percent, leaving it down 22 percent from its peak, as signs of an exodus by leveraged investors overshadowed the central bank’s effort to revive confidence with an interest-rate cut. Hong Kong’s Hang Seng China Enterprises Index of mainland shares slid 3 percent, extending declines from a high on May 26 to 14 percent.

Shares in Shanghai swung between a loss of 7.6 percent and a gain of 2.5 percent in Monday trading, with the point move being the largest since 1992. China’s securities regulator may halt initial public offerings in a bid to stem the rout, according to people familiar with the matter.

West Texas Intermediate crude slipped 2.1 percent to $58.39 a barrel, declining for a fourth day, and Brent oil lost 2.3 percent to $61.79 per barrel.

Nickel slid as much as 3.5 percent in London to the lowest since May 2009, leading declines in most base metals, as Greece’s debt crisis undermined confidence in the global growth outlook and overshadowed China’s move to stimulate its economy.

(The magnitude of euro expected volatility was corrected in an earlier version of this story.)

seemore signals https://www.mql5.com/en/signals/111434