Trading News Events: U.S. Consumer Price Index - increased pressure on the Fed to normalize monetary policy sooner rather than later

Signs of stronger price growth may keep the Fed on course to raise the benchmark interest rate later this year, but a continuation of the disinflationary environment may encourage the central bank to retain the zero-interest rate policy (ZIRP) beyond 2015 in an effort to encourage a more sustainable recovery.

However, subdued input costs paired with the persistent slack in the

real economy may continue to drag on price growth, and a dismal CPI

print may generate a further near-term advance in EUR/USD as market

participants push back for the Fed liftoff.

How To Trade This Event Risk

Bullish USD Trade: U.S. CPI Rebounds 0.1% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

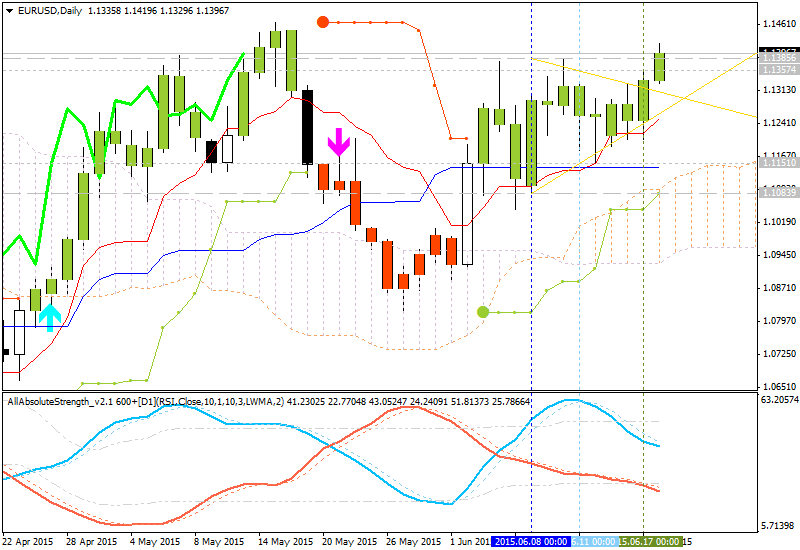

EURUSD Daily

- Despite the more cautious tone coming out of the Federal Reserve, EUR/USD may continue to face range-bound prices over the near-term as it fails to break out of the monthly opening range.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | PipsChange (End of Day post event) |

|---|---|---|---|---|---|

| APR 2015 |

05/22/2015 12:30 GMT |

-0.2% | -0.2% | -144 | -165 |

March 2015 U.S. Consumer Price Index

EURUSD M5: 140 pips price movement by USD - Consumer Price Index news event: