Trading News Events: U.S. Gross Domestic Product (GDP) - First Contraction in Growth Since 1Q 2014

Why Is This Event Important:

Even though the Fed pledges to look past the economic weakness drive by

transitory factors, a larger-than-expected contraction in the growth

rate may spur a further delay in the central bank’s normalization cycle

as it undermines expectations for a stronger recovery.

Nevertheless, increased business outputs paired with the expansion in

private-sector credit may offer a better-than-expected GDP print, and

prospects for a stronger recovery may spur a bullish reaction in the

dollar as the Fed remains on course to remove the zero-interest rate

policy (ZIRP) in 2015.

How To Trade This Event Risk

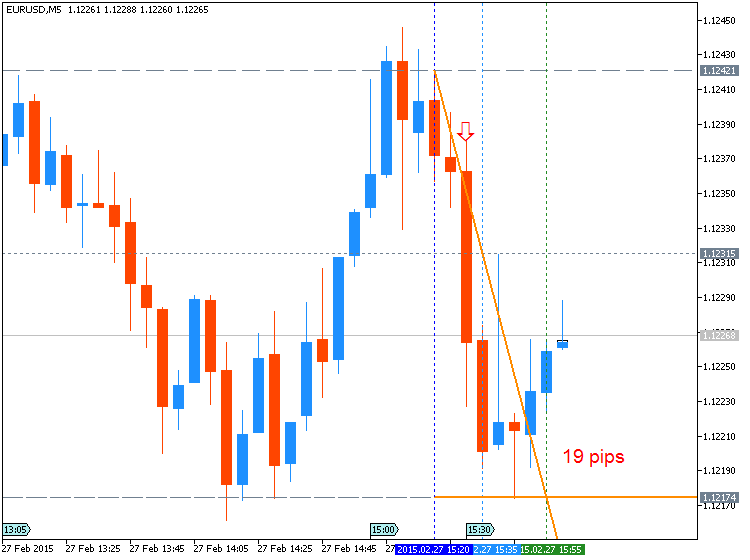

Bearish USD Trade: Growth Rate Contracts 0.9% or Greater

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a short dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in reverse.

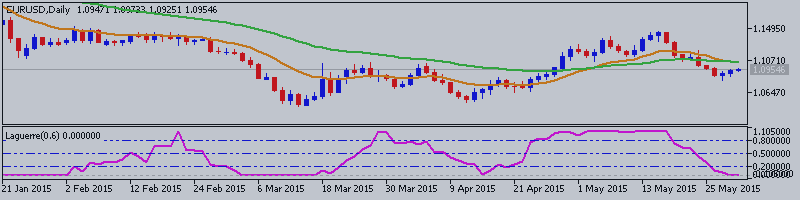

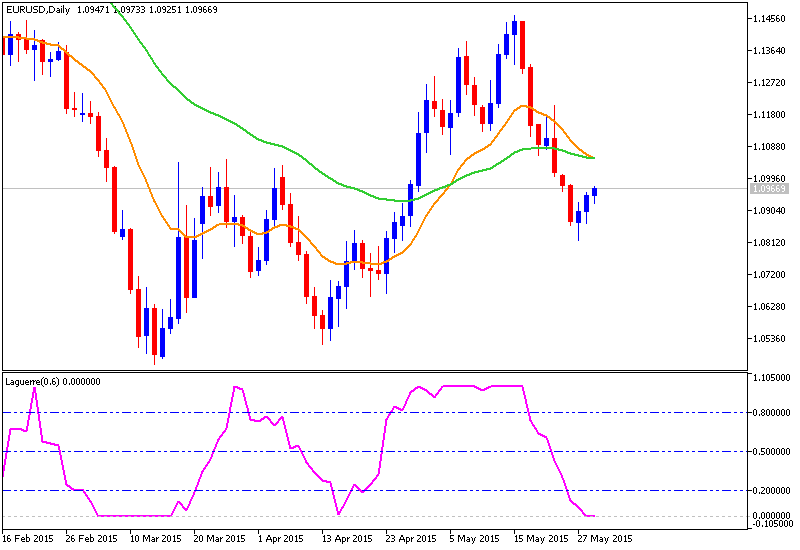

EURUSD Daily

- Failure to preserve the near-term downward trending channel may generate a larger rebound in EUR/USD and spur a consolidation phase in the days ahead.

- Interim Resistance: 1.1180 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0790 (50% expansion) to 1.0800 (23.6% expansion)

4Q 2014 U.S. Gross Domestic Product (GDP)

EURUSD M5: 19 pips price movement by USD - GDP news event: