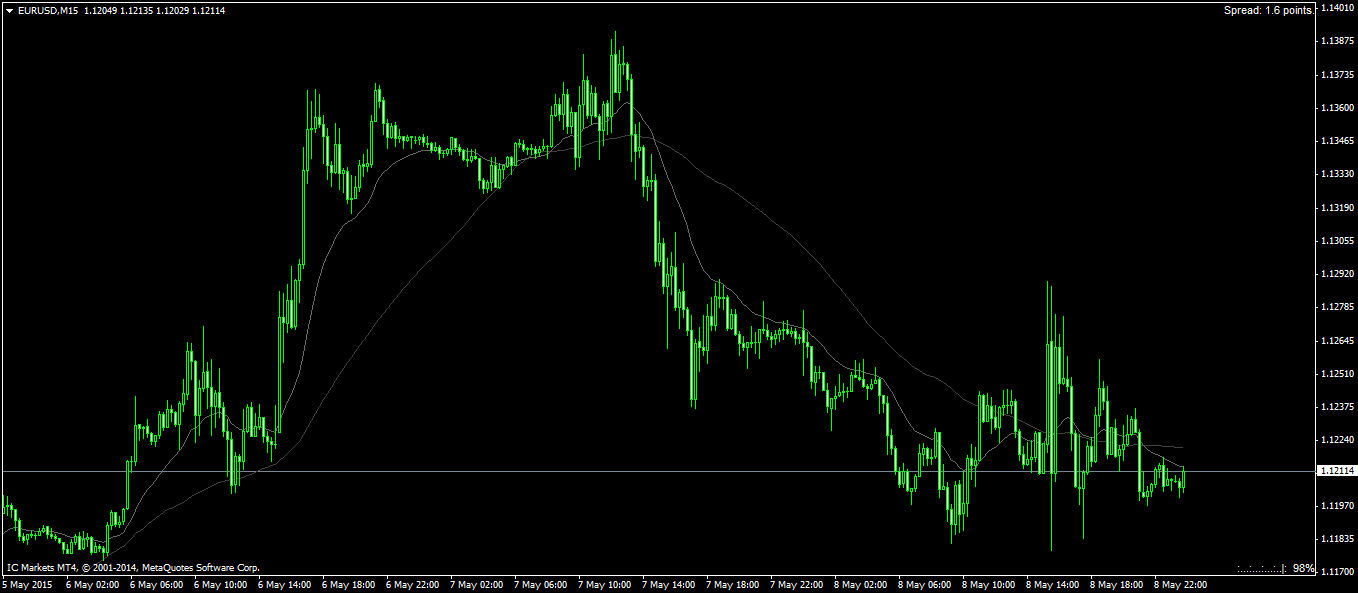

If you traded yesterday’s non-farm payroll release and Canadian job data change, you probably found it a bit chaotic. I would say a bit more chaotic than usual as we saw this whiplash action instead of a huge spike in one direction.

The U.S. unemployment rate fell to 5.4%. The non-farm payrolls came out at 223k versus the 224k expected. The Baker Hughs US rig count once again to 894 compared to the 905 previous. The payrolls were close enough to expectations to deter any serious doubt in the economy strength, but the figures still aren’t strong enough for an immediate rate hike. Currently, the projected rate hike is set for September. Keep in mind that a sell-off may occur similar to the upwards spike in the Australian Dollar during the RBA rate cut. In other words, many traders are anticipating the rate hike and have been buying into the U.S Dollar. After the rate hike announcement, there may be a sell-off from the purchase.

This week’s Commitment of Trader report showed some turnaround points. Silver experienced the largest net long from small speculators. Slight scale back in the USD net long position while the Euro and Pound both remains net short. The Yen, on the other hand, remains almost neutral at the end of this week.

Stay tuned for the chart setups into next week’s trades.