"The best financial advice I´ve ever received or given." The most successful investors share their wisdom with us. Part 1

Good advice can make careers and change lives for the best. The Wall Street Journal asked well-known economists, managers and investors to share with the readers the best financial advice they ever got or gave.

Robert Shiller,

Nobel laureate in economics (2013) and professor at Yale University

The best advice I ever got was the buy signal from my dissertation adviser at MIT and later co-author, Franco Modigliani, very close to the bottom of the market in the early 1980s.

I put virtually my portfolio 100% into value stocks then, even though the conventional academic wisdom was then that one should be more diversified. I didn't start taking it out substantially until sometime around the turn of the century, around 1999, though I don't remember exactly. I read very carefully his paper with [Richard] Cohn published in the Financial Analysts Journal in 1979, "Inflation, Rational Valuation and the Market." It concluded that the stock market was 50% undervalued.

Actually, that was an understatement—from 1982 to 2000 the S&P 500 total-return index went up something like 20-fold. This investment advice created another miracle for me, for it inspired me to write my article "Do Stock Prices Move Too Much to Be Justified by Subsequent Changes in Dividends?" published in the [American Economic Review] in 1981 and mentioned prominently in the Scientific Background paper for the Nobel Prize.

So Franco's advice not only got me phenomenal returns, it also helped me win the Nobel Prize. You can't get better investment advice than that.

William Sharpe, Nobel laureate in economics (1990) and emeritus finance professor at Stanford University

Best advice I've gotten (from Armen Alchian, my mentor at the University of California, Los Angeles, when I was a graduate student): When thinking about markets, assume that prices are set by the interactions of buyers and sellers, each trying to maximize their own welfare. The best advice I've given: In securities markets, don't expect a free lunch; diversify broadly and keep your costs low.

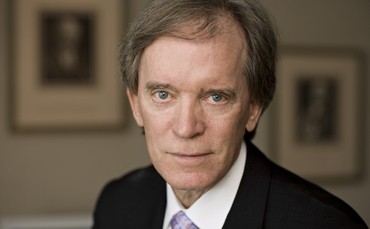

Bill Gross, co-chief investment officer of Pimco

An investor's inner time clock is crucial to getting in and getting out of markets. If the normal cock-a-doodle-doo of the rooster is at 6 a.m., there will be some investors who wake up at just past midnight—far too early for timing a market bottom or top. And some who wake up at 10 or 11 a.m. like a college student—far too late. Learn to recognize when your clock generally goes off, and work on getting it to ring at 6 a.m.

Jed Rakoff, U.S. District Judge, Southern District of New York

When I turned 43, I confided in one of my mentors, Judah Gribetz (former counsel to New York Gov. Hugh Carey), that I was thinking of pursuing a federal judgeship. He asked me: "How much have you put away for your (three) daughters' college education?" I admitted it was not much.

He said, "A judge can't be truly independent if he's always worrying about finances. Don't apply until you've saved enough to put all your kids through college for four years. And don't forget that college costs these days increase at twice the (predicted) inflation rate!"

It took me another nine years to save up to meet this goal, but when I then applied to be a federal judge, I knew I wouldn't have to worry about anything but doing the job. It was the best investment advice I ever received.

Maurice "Hank" Greenberg, chairman of Starr Insurance Holdings and former chairman of American International Group

Advice you have in one era is not advice you can employ endlessly. I would nonetheless give the advice to others: Invest in what you are doing, show your own confidence in what you are doing. But keep in mind there are much broader issues that must be considered today than would have been in the past, issues of regulation and the politics where you are doing business, and the impact that could have on your company, or any company.