Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, NZDUSD and GOLD

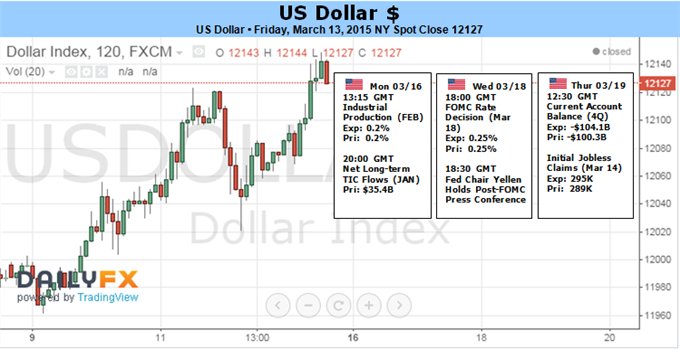

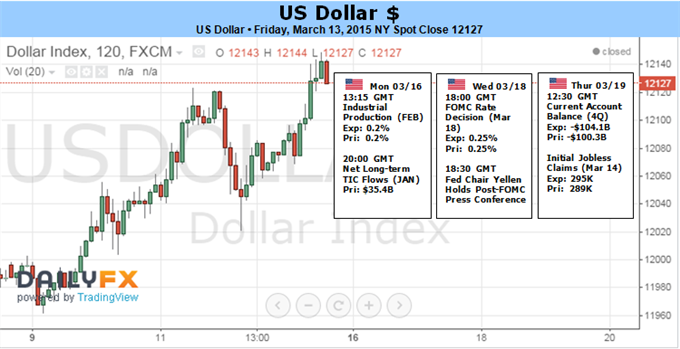

US Dollar - "For FX traders, the focus of the upcoming event risk is easily on the rates-Dollar connection. Yet, investors in any asset should take note of this event for its influence speculative appetite. A ‘yield chase’ has developed out of years of excessive monetary policy coupled with a moderate recovery. And, while the Fed’s own contribution to the system can notionally be replaced by the growing stimulus in Europe and Asia, risk aversion can still spread by the Fed’s shift. Given the dependency on low cost capital (chased with leverage) and the easy of contagion transmission across the global financial system (remember the Great Financial Crisis began in US housing), sentiment is on the edge of an inflated balloon. It also happens that the Dollar represents liquidity in a fire sale market."

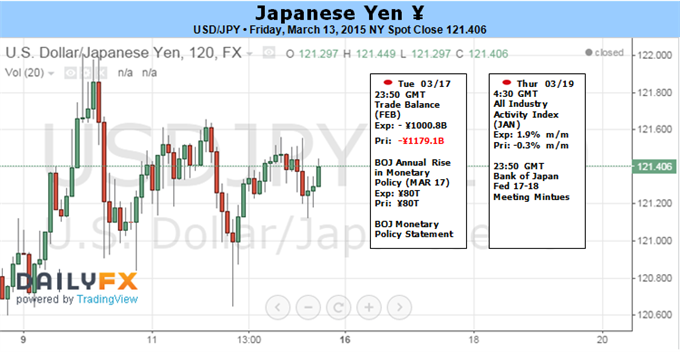

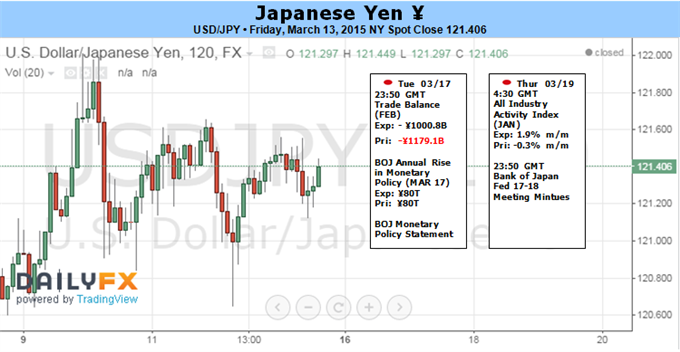

USDJPY - "The long-term outlook for USD/JPY remains bullish as the FOMC remains well on its way to remove the zero-interest rate policy (ZIRP), but the fresh development coming out of the central bank is likely to heavily impact near-term volatility in as market participants continue to speculate on the timing and the pace of the Fed’s normalization cycle."

GBPUSD - "Short-term forecasts for the Sterling seem especially uncertain ahed of the release of Bank of England MPC Meeting Minutes and a highly-anticipated US Federal Open Market Committee meeting. FX options traders have sent 1-week and 1-month GBPUSD volatility prices/expectations to their highest since the Scottish Referendum. And with uncertainly surrounding upcoming UK Government Elections, traders may prove especially skittish on any surprises."

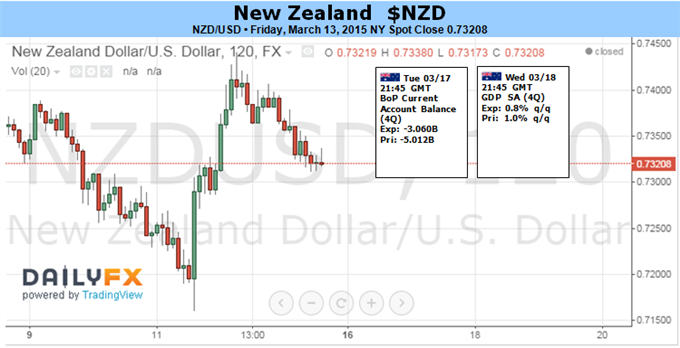

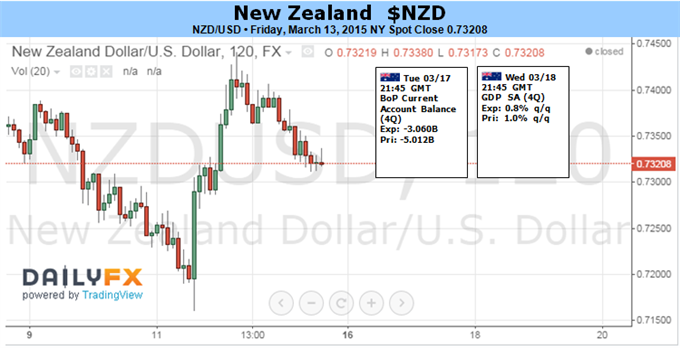

NZDUSD - "A significant correlation between NZDUSD and the S&P 500 (0.52 on 20-day percent change studies) hints the currency is sensitive to broad-based sentiment trends. That will come into play as the Federal Reserve delivers the outcome of the FOMC policy meeting, this time accompanying the statement with an updated set of economic forecasts and a press conference from Chair Janet Yellen. Fed tightening fears have proven to be a potent catalyst for risk aversion since the beginning of the month. That means a hawkish tone is likely to sink the Kiwi, while a dovish one may offer the currency a lift."

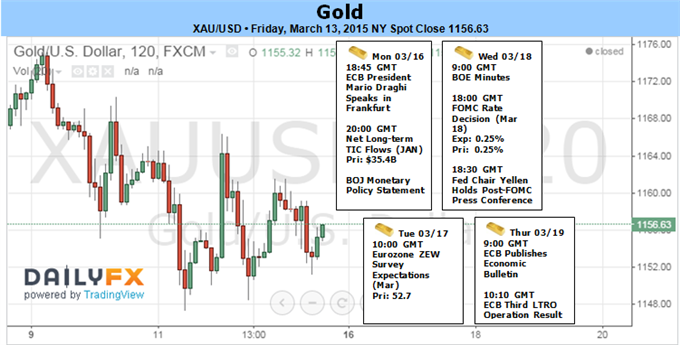

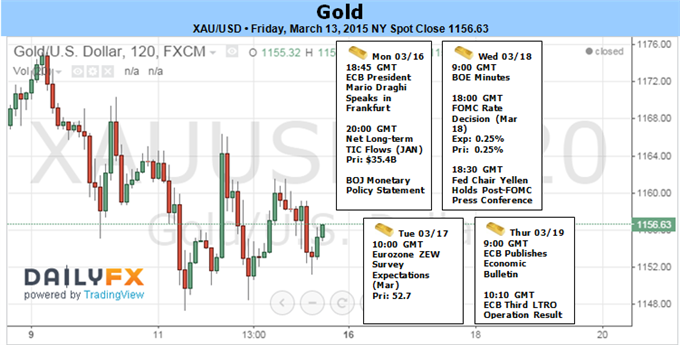

GOLD - "A break below this threshold risks sharper losses

for bullion with subsequent support objectives seen at 1125/30, 1099

& the 2010 low at 1044. Interim resistance stands at 1172/73 and

this level will serve as our near-term bearish invalidation level with a

breach above targeting trendline resistance off the January highs which

converges on a basic 23.6% retracement of the yearly range at 1185

heading into mid-next week. Bottom line: its downtrend at support- with

major even risk next week likely to offer a catalyst for price action on

either a recovery back into the yearly trendline, or a continuation of

the broader primary downtrend."