How To Trade - Trading Reversals with Camarilla Pivots for Support & Resistance

Markets are prone to turn at existing points of support and resistance, so the first step is to identify these points on your chart. To simplify the process, for today’s “DT Pivot” strategy, we will be adding camarilla pivots to the chart. These lines are calculated using percentages of the previous day’s trading range which, when added to the graph, creates a clear idea of where price may be supported or reach a barrier of resistance.

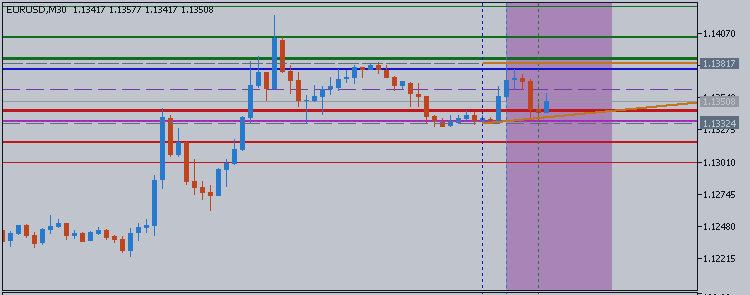

As seen above, Camarilla Pivots label resistance lines R1-R4, and

support lines S1-S4. R4 and S4 are considered extremities in

price—demoting a breakout. Traders looking for short term reversals

should focus on price movements between the S3 and R3 pivots. This is

known as the trading range, and can afford traders short term day

trading possibilities if price stays between these values.

Now that support and resistance have been identified, through the use of

camarilla pivots, traders can begin planning their entry. The key is to

sell the market at resistance. This can be done once price has touched

the R3 pivot and a 30 minute bar closes inside the pivot range.

Conversely, traders should look to buy the market after price touches

the S3 pivot, but only after a 30 minute bar closes inside the pivot

range. Since candle confirmation is used with the “DT Pivot”strategy,

traders can enter into a trade using market orders.

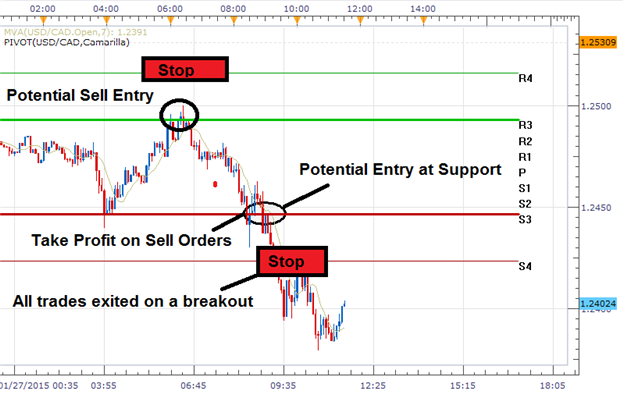

Above we can see several sample entries using this order logic. First,

Entry 1 would be considered after the first highlighted wick passes

through the R3 line of resistance. However, execution would not occur

until the bar closed inside of the range on the 30 minute chart. At this

point traders would look to sell the market in anticipation of a

reversal back to support. For Entry 2 the same rules apply, however

traders will look to buy at support. After price tests the s3 pivot, and

price closes inside of the range, traders will execute a new buy

position. Once a trade is entered it is time to plan the exit strategy.

Traders should always have a plan for managing their position. Eventually the range will come to an end and any existing trades should be exited. When initiating a buy order, stop orders should be placed at the S4 pivot. That way if prices break to a lower low, all buy trades will be closed. Conversely if a trader is selling resistance at the R3 pivot, stops can be placed at the R4 pivot as seen above.