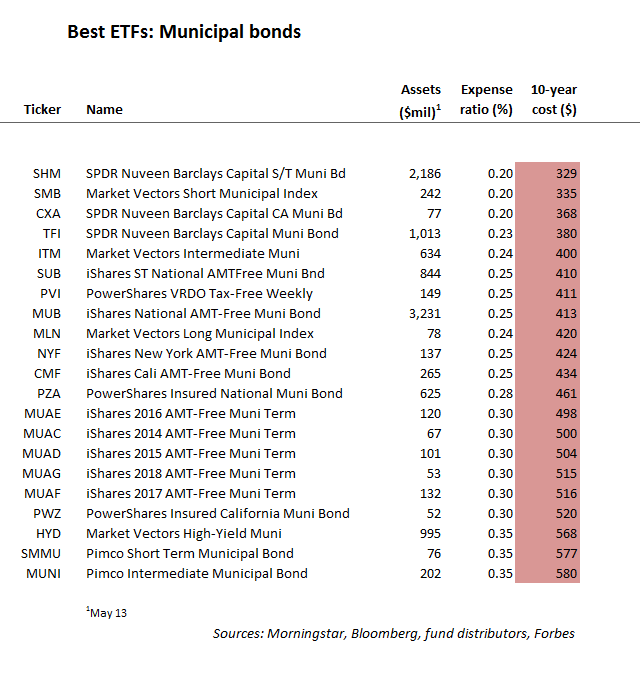

The table below shows you the best buys in exchange-traded funds holding tax-exempt bonds. But “best buy” means only “better than other muni ETFs”; it does not necessarily mean “good buy.” Don’t put in a purchase order for any of these funds unless you have a positive answer to both of these questions:

Do you really want to own municipal bonds?

Are ETFs the best way for you to own them?

The answer to the first question depends on your tax bracket and your

taste for risk. High-quality long-term tax-exempt bonds yield around

2.7%, versus 3% for 20-year bonds from the U.S. Treasury. After federal

income taxes (for any but a very low-bracket investor), the yield

advantage goes to the tax-exempts. But muni bonds are risky.

Detroit went bust, punishing its lenders. Spendthrift California (recently upgraded by Moody’s to AA3) probably won’t. But it might. California is a feudal state, in which the serfs are taxpayers and the lords of the land are state employees. This works only as long as the taxpayers stay put. Some have been escaping to Texas.

The second question, about the optimum vehicle for holding securities, is more easily answered. For most investors, the ETF option is suboptimal. For some reason the price war that has made equity ETFs into terrific buys has not come to the municipal bond arena.

Let’s compare the biggest muni ETF, the iShares AMT-free Muni Bond fund (ticker: MUB), to a big mutual fund alternative, the Vanguard Long-Term Tax-Exempt Fund (ticker for the Admiral share class: VWLUX). You might have to pay a commission to get into or out of the ETF, and you will definitely suffer a loss from the bid/ask spread. Neither cost applies to a no-load mutual fund like Vanguard’s.

There’s a big difference in holding costs. The expense ratio is 0.25% a year for MUB, but only 0.12% for Admiral investors in the Vanguard fund. The Admiral share class is available to people putting in at least $50,000. If you don’t qualify for Admiral but have at least $3,000, you get Vanguard’s Investor share class at 0.2% a year. That’s still an improvement over the ETF.

A vicious circle is in place for tax-exempt ETFs. Vendors can’t cover their costs on tiny ETFs except with fairly stiff expense ratios, and investors won’t flock to the funds unless the costs come down.

Our ten-year cost figures assume a $10,000 investment and reflect bid/ask spreads, the expense ratio and, in rare cases, income from securities lending. For comparison with stock funds they assume the same 5% annual return over the decade, even though any muni fund will almost certainly earn less than that.

One more caution on muni ETFs: The cost figures on all our ETF tables use the inside bid/ask spreads quoted by market makers. For a giant stock or taxable bond ETF the market makers may be willing to move several thousand shares at the quoted price, so this spread is a realistic estimate of the round-trip trading cost for an individual investor. For a muni bond ETF, though, the spread may be good for only a few hundred shares. Try to move $50,000 into or out of a thinly traded ETF and you are likely to get hosed, especially if you place a market order.

Among the muni funds with fairly stiff bid/ask spreads (in the vicinity of 0.2%) are three California portfolios: SPDR Nuveen Barclays Capital California (CXA), PowerShares Insured California (PWZ) and iShares California AMT-Free (CMF).

This file contains the rules and methods for the ETF ratings and a directory of the separate ETF ranking groups.