Goldman: Neither Greece, nor Fed rate hike enough to threaten junk-rated bonds

Such factors as Greek turmoil, approaching Fed rate liftoff or potential closing of U.S. capital markets are not sufficient to threaten junk-rated companies, according to analysts at Goldman Sachs.

The atmosphere of near-zero interest rates which has remained in place since the collapse of Lehman Brothers has allowed junk-rated corporate borrowers to tap the market repeatedly, selling more bonds at a cheaper financing cost and pushing out their borrowings, says Bloomberg.

This

means that even if external shocks were to endanger access to

capital markets, firms with relatively weaker balance sheets have

a buffer, analysts Bridget Bartlett and Spencer

Rogers said in their recent report.

75

percent, or $606 billion, of the high-yield bonds sold over the past

three years have been used to refinance at cheaper levels, leaving

companies in much better shape when it comes to their debt profiles.

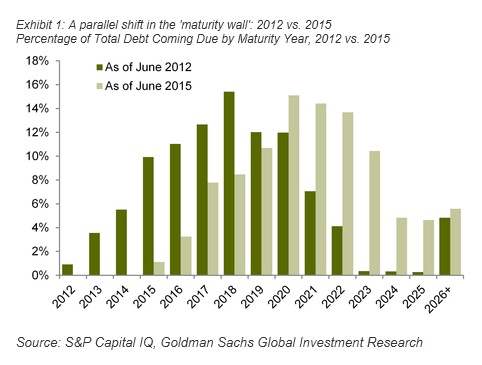

The trend is shown in the chart below:

It indicates a change in the "maturity wall,"

or the indebtedness that companies will have to pay back or refinance

in the coming years.

As Goldman gauged, the five-year maturity wall has been extended by three years, i.e. back in 2012, 63 percent of high-yield debt was scheduled to come due in the five years from 2016 to 2020. Currently, 64 percent of debt outstanding is set to start maturing three years later, from 2019 to 2023, Goldman said.

Basically, the maturity wall has been extended further, even though the absolute amount of high-yield debt outstanding climbed as record-low borrowing costs and investors hungry for yields encouraged companies to tap the market repeatedly.

"On a notional basis, the near-term

debt burden today has doubled over the past three years from $8.5bn due

in ≤ 1y in 2012 to $16.3bn coming due in ≤ 1y today.

However, this expansion is symptomatic of the substantial growth of the high-yield market overall, which has risen sharply from $0.92trn in 2012 to $1.45trn today."

However, the Goldman

analysts came to a conclusion that all the refinancing means that high-yield firms are in good conditions to forecast any harmful weather conditions, except one: barring a recession scenario,

this should help mitigate default risk in the high yield market, they say.