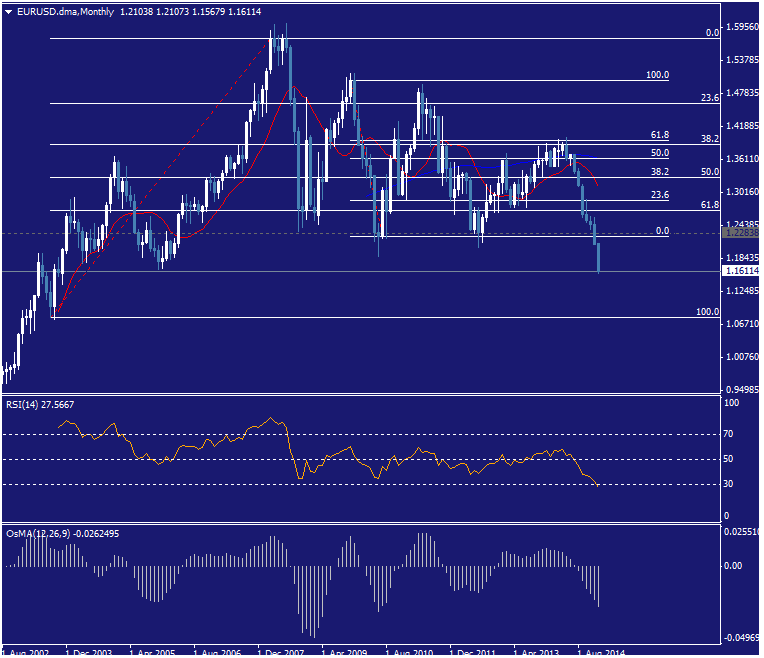

The Euro may be carving out a bottom against the US Dollar as positive RSI divergence warns of ebbing downside momentum.

Even the RSI 14 MA is also piercing the 30 line which marks the entrance towards the bearish zone on a Monthly Chart.

Near-term resistance is at 1.1870, the January 12 high, with a break above that on a daily closing high exposing support-turned-resistance marked by the July 2012 low at 1.2041.

We expect any on-coming EURUSD strength to be corrective, in line with our long-term outlook. With that in mind, we will treat upside momentum as an opportunity to enter short at a more attractive level and remain on the sidelines in the interim.

The Swiss National Bank's decision to remove the EURCHF Sf 1.2000 floor is a monumental development for FX markets.Sparing no few words, nothing more needs to be said than the fact that this is a complete surprise for most (if not all) market participants.

With the SNB's balance sheet having exploded to 100% of the country's annual GDP, the cost of maintaining the floor was too costly for the SNB. The first signs that the SNB was struggling with the floor came on December 18, when the SNB first introduced negative interest rates as a way to deter speculators from betting on further Franc appreciation.At the time we said that the move was in all likelihood preemptive action to front run a massive balance sheet expansion by the ECB; this may be the surest sign yet that the ECB is on the verge of unveiling some massive QE program at its meeting next week.For more details & learning FX Get Connected - Skype - rohit.fidelis

The International Monetary Fund's head, Christine Lagarde, called the move "a bit of a surprise".

She said she was also surprised that the governor of the Swiss National Bank had not contacted her, and said she hoped he had communicated the plan to his fellow central bank governors. Following the SNB move the euro went from buying 1.20 francs to buying just 0.8052, but it later recovered to buy 1.04. Swiss shares closed down 9% and stock markets around Europe fell with investors buying "safe haven" assets such as gold and German bonds.

![How to Build Your EA Trading Portfolio in 2026: From Free Module to Funded Account [Step-by-Step] How to Build Your EA Trading Portfolio in 2026: From Free Module to Funded Account [Step-by-Step]](https://c.mql5.com/6/994/splash-preview-767579.png)