FX weekly Review Hybrid Grid Strategy Wk01 / Sun. 04-Jan-2015

First of all a happy new year for everyone and a good trading year in 2015. In this article I will provide my view on the EUR/NZD. This is the pair that I am currently interested in for trading with the Hybrid Grid strategy and I will analyse in this article. I am also interested in the EUR/USD and this pair was analyzed in the article Forex Ranking and Rating Wk53

- All trades are based on specific rules according to the FxTaTrader Hybrid Grid strategy.

- For the performance and closed positions click here.

This article will provide:

- The weekly currency chart for the analyzed pair.

- The weekly(decision) TA chart for the analyzed pair.

- A Technical analysis for the analyzed pair of the Daily, Weekly and Monthly chart.

- Possible positions for the coming week and positions taken.

According to the TA Charts, the "Currency score" and the "Ranking & Rating list", all the pairs in the Top 10 of the "Ranking & Rating list" are good to trade except for NZD/CAD. These are 2 average performing currencies with a currency score difference of only 3. See the Currency score article of this weekend Forex Weekly Currency Score Wk 01 for more information. There are some rules for taking positions according to the FxTaTrader Hybrid Grid Strategy. The strategy can open multiple positions of a currency pair but each currency may only be present once in the same direction in the pairs chosen for trading. It means that not all the possible positions of this coming week can be opened. For more information see FxTaTrader Hybrid Grid Strategy.

_______________________________________________________

Possible positions for coming week

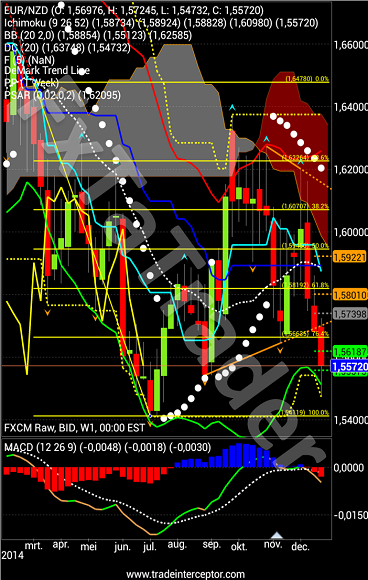

EUR/NZDThis pair will be analyzed in detail. The situation compared to the last weeks has improved and the pair is interesting for the Hybrid Grid strategy. The pair broke through the lows of the previous weeks and is clearly in a downtrend in the Daily, Weekly and Monthly charts. It also has space to go down compared to the EUR/USD. There is a bottom on 10 July 2014 at 1,5409 where the price can go towards and which can clearly be seen in the TA Weekly chart included in this article. There are more bottoms in the monthly chart around 1,500 where the price can go towards. The EUR/USD on the other hand just went through an important previous bottom but this happened briefly and on low liquidity so more confirmation is needed that price will continue to go down. The EUR/NZD is also showing a nice pull back at the moment and the first position can be placed around the previous bottom 1.5644 which has become a resistance level in the chart and the second and possibly third position can be placed between that level and more near the current price.

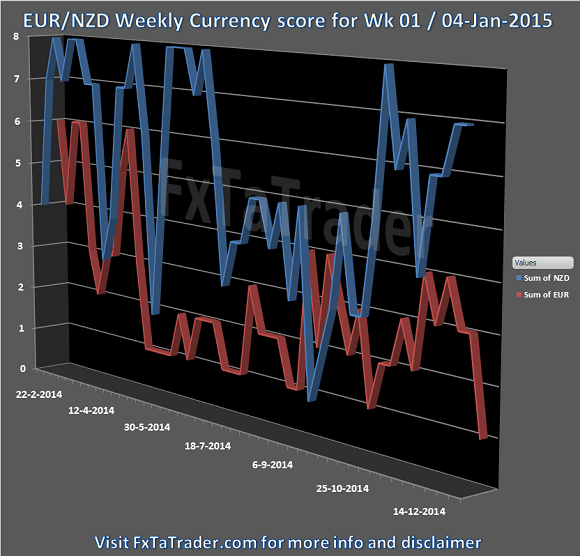

- As can be seen in the Currency Score chart in my previous article of this weekend Forex Weekly Currency Score Wk 01, the EUR is having a score of 1 and the NZD a score of 7. With a Currency score difference of 6 and the NZD having a classification of an average performing currency while the EUR is a weaker currency it is an interesting pair in the coming week for going short.

- The position in the Ranking and Rating list in the last weeks also shows that the pair is attractive for taking short positions. In the current list of this weekend Forex Ranking & Rating Wk 01 the pair has a rank of 2. This list is used as additional information besides the Currency score and the Technical analysis charts.

- Besides the general information mentioned the outlook in the TA charts also makes it an attractive opportunity.

Rank: 2

Rating: - - -

Weekly Currency score: Down

Based on the currency score the pair looked interesting in the last 3 months. The NZD is an average performing currency from a longer term view and currently having a currency score of 7. The EUR is a weaker currency from a longer term view and currently having a score of 1. Based solely on this information the pair does look interesting for going short in the coming week.

_______________________________________________________

Monthly chart: Down

- On the monthly(context) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and regaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

- Since the monthly chart is used to get the context how that pair is developing for the long term the indicators are looking fine because they are showing strength in the current downtrend.

- On the weekly(decision) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions. The MA's crossed just last week and it happened below the cloud.

- The MACD is in negative area gaining strength.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions. In the week of 5 September 2014 the PSAR gave a false signal during 1 week and it reversed again so this is not relevant.

Daily chart: Down

- On the daily(timing) chart the indicators are looking strong for going short.

- The Ichimoku is meeting all the conditions.

- The MACD is in negative area and looking strong.

- The Parabolic SAR is short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

Total outlook: Down

EUR/NZD Weekly chart

_______________________________________________________

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you would like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article. Good luck in the coming week and don't forget to check my weekly Forex "Ranking and Rating list" and the "Currency Score".

_______________________________________________________

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.