The WSJ: A handful of giant commodity traders such as Trafigura Beheer BV, Glencore and Vitol Group are increasingly

taking a central role in global commodity markets. Those companies do not just bet on prices or arrange shipments. But they are taking on oil companies, miners and major Wall

Street banks by investing billions of dollars into refineries, power

plants, ports and other assets.

"Commodity traders have become more visible and harder to ignore," said Craig Pirrong, a professor of finance with the University of Houston.

The four biggest traders—Vitol, Glencore, PLC, Cargill Inc. and Trafigura—each get annual revenue of more than $100 billion, - a sum putting them in the ranks of household names such as Apple Inc. and Chevron Corp.

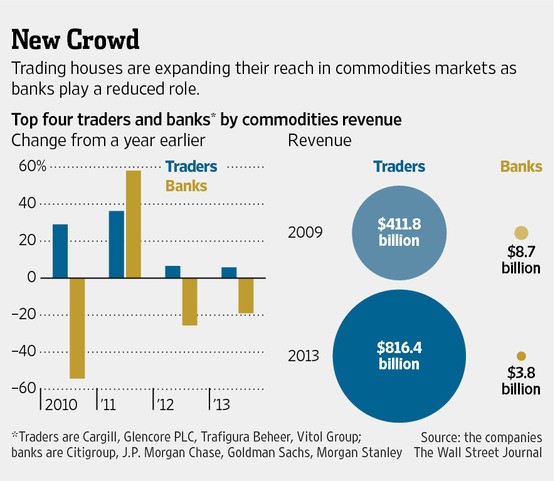

An analysis of company data conducted by

The Wall Street Journal found that revenue at these four trading houses

nearly doubled in the past five years to $816.4 billion.

Over the same period, commodity-trading revenue at the top four U.S. banks involved in the sector dropped 56%, to $3.8 billion, a decline driven by slower trading and a retreat from some businesses amid tougher regulation.

Source: the Wall Street Journal

This year alone, Cargill, an agricultural trading company founded in 1865, struck a deal with Brazil's Copersucar SA to form the world's largest sugar-trading venture. Mercuria Energy Group Ltd., an energy-focused trader that didn't exist 10 years ago, agreed to buy J.P. Morgan Chase JPM & Co.'s physical-commodities business for $3.5 billion.

Agricultural trader Archer Daniels Midland Co. processes enough corn each day to make 99 million boxes of cornflakes. Metals-and-mining titan Glencore in June used its pull to arrange a $1.3 billion loan to the Republic of Chad to help its government acquire Chevron's oil assets in the African country.

In its first set of public results, Trafigura last year posted record annual profits of $2.18 billion and outlined a growth plan aimed at taking advantage of the U.S. oil boom. A Vitol oil-storage affiliate called VTTI Energy Partners LP last month filed to raise $420 million by listing on the New York Stock Exchange.

Investors are taking notice. "They're always willing to do business at a price," said Dario Scaffardi, executive vice president and general manager at Italian refinery Saras SpA.

Through a string of acquisitions and investments, the trading firms have come to hold commanding positions in markets for key raw materials ranging from sugar to copper to oil.

Last year, Glencore and Vitol lent Russian state-owned oil company OAO Rosneft $10 billion in return for five years of oil deliveries.

Arising criticism

Meanwhile, the rise of big commodity traders also has attracted the attention of market watchdogs. In February Britain's Financial Conduct Authority said commodity traders represent a "known unknown," operating largely outside the remit of regulators.

"These firms are playing an increasingly critical role in the functioning of an ever more complex global market," the FCA said in a February report.

At

the same time, the firms must contend with intense competition and

razor-thin profit margins across the sector. Agricultural trading

company Louis Dreyfus Commodities BV said profits slumped 27% to $640

million last year after its wheat business was hit by a severe drought.

Vitol Chief Executive

Ian Taylor

described market conditions in 2013 as "very challenging" and

"extremely competitive." Some see a

problem with the commodity traders' growing reach.

Last year, Australia blocked a $3 billion bid by ADM to buy grain handler GrainCorp Ltd., explaining that the deal would compromise national interests. U.S. regulators are scrutinizing bottlenecks in aluminum warehouses owned by Glencore and Trafigura, among others. Louis Dreyfus, one of the world's largest cotton merchandisers, is being sued in the U.S. on charges of manipulating the cotton market in 2011.

Analysts also note that Glencore was founded by billionaire oil trader Marc Rich, who was a fugitive wanted for years in the U.S. for tax evasion. Gunvor co-founder Gennady Timchenko was placed on a list of sanctioned individuals by the U.S. Treasury in March; the company promptly announced he had already sold his stake to CEO Torbjorn Tornqvist.

"They are traders, they are producers, they are distributors," said Diego Valiante, head of capital markets research at the Centre for European Policy Studies. "The problem is, does this create a conflict?"

Even so, many say opportunities for growth aren't hard to see. The familiar red and yellow Royal Dutch Shell logo hangs over 123 service stations across Kenya - a reliable source of fuel for the country's growing population of middle-class car owners.

But while they retain the logo, Shell has sold down its interest in the business to a joint venture in which Vitol, the energy trader better known for cutting behind-the-scenes deals in isolated and war-torn regions, holds a 40% share. One consumer said he never would have known who was running the stations if a reporter hadn't told him.

"I usually make a bee-line for the Shell station," said Jeremy Wyatt, a 43-year-old sustainable business-development manager based in Nairobi. "The staff hasn't changed, the service hasn't changed."