Commodities are in the fourth year of the 20-year bear super-cycle - Researchers

As commodities continue their fifteen-month freefall, it is starting to look like a full-blown crisis.

Market players are reacting to the weaker demand from China and an end to the

cheap-money era provided by the U.S. central bank. Eight of ten worst performers in the S&P 500 index this year are commodities-related companies.

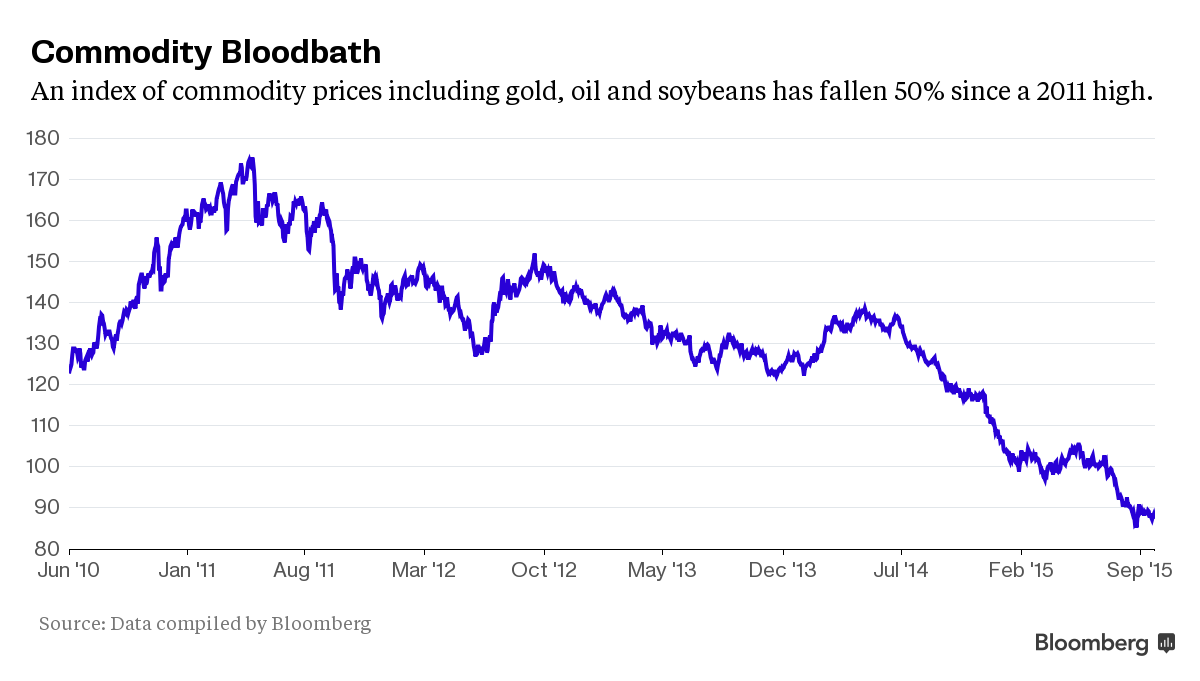

A Bloomberg index of commodity futures has fallen 50 percent since a 2011 high:

Monday marked a culmination of the bloodbath as Glencore Plc, the commodities behemoth that came to symbolize the era with its initial public offering in 2011 and bold acquisition of a rival in 2013, fell by as much as 29 percent in London trading.

Oil’s plunge since June 2014 has been pushed along by OPEC’s November decision to keep pumping despite excess supply and U.S. natural gas prices have fallen to less than a fourth of their 2008 value.

Bear super-cycle

According to analysts John

LaForge and Warren Pies of Venice, Florida-based Ned Davis Research

Group, it will get even worse.

Commodities may be in the fourth year of a 20-year “bear

super-cycle,” according to a research note released on August 14. The analysts looked

at commodity drops dating to the 18th century and found them driven by

factors such as market momentum rather than fundamentals, LaForge said

Monday in an interview. The good news, however, is that the worst period ends in six years.

“In commodities you’re going to get a lot of failures, companies closing up,” LaForge said, adding that it needs to happen to push down supply.

The corporate world has suffered the ripple effects in full

Earlier, MarketWatch columnist referred to two charts - the S&P 500 and Nasdaq ones - which proved that the bear market has begun. Let us now see where commodities rout brought multinationals.

Glencore's bleeding was not prevented even after three weeks ago its chief Ivan Glasenberg announced a debt-reduction strategy and his intention to sell a stake in its agricultural unit. City firm Investec warned yesterday that there is little value for equity shareholders if commodities rout lingers.

Shell will be forced to take financial

charges related to the Alaskan operations, after a failed Arctic exploration campaign that cost $7 billion.

Booming output from China has led Alcoa, the biggest U.S.

aluminum producer, to separate its manufacturing operations from a legacy smelting and refining business.

Still, profits at Chinese industrial companies dropped 8.8 percent in August from 12 months earlier, with losses widening even after five interest-rate cuts since November and government efforts to accelerate projects.

Last week, Caterpillar Inc. said that it would cut as many as 10,000

jobs, or 9 percent of its workforce, as the persistent oil turmoil made the

mining slowdown worse.

Chemical maker Huntsman Corp. fell the most in four years after saying lower titanium prices would have a negative impact on third-quarter earnings.