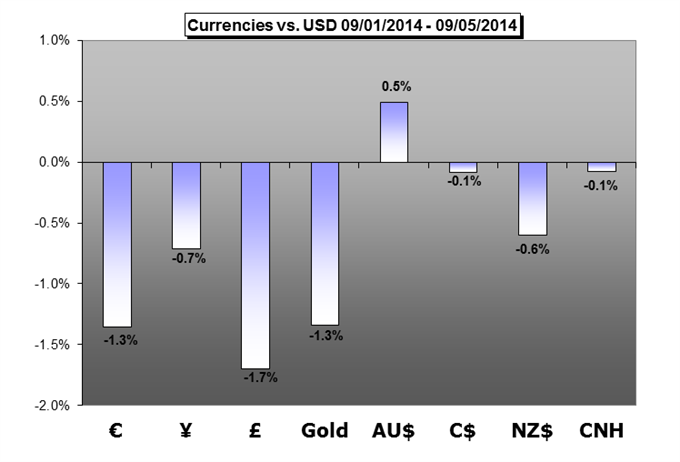

Dollar Matches Longest Run in 15 Years - A Distinct Reversal Risk

If indeed, the dollar is riding high on the difficulties of its most

liquid counterparts; then its trend is fragile and at significant risk

of stalling. For indirect strength, the Euro is a key patron as the ECB

has further turned from the slow tightening path the Fed is on with

another round of rate cuts and the announcement of asset purchases.

British Pound Has Plummeted - Here's What We’re Watching Next

A relatively empty economic calendar for both the UK and the US

suggests that the Sterling might catch a break. Yet we’ll need to keep a

close eye on official commentary ahead of the highly-anticipated

Scottish referendum just two weeks away.

Japanese Yen to Ignore Domestic Data, Focus on Fed Policy Speculation

The Japanese Yen may rise if a round of supportive US economic data

fuels stimulus withdrawal fears, sparking risk aversion and triggering

carry trade liquidation.

AUD To Remain Resilient Amid Drive To Yield And Void of Local Data

Looking ahead, RBA policy bets as well as general market risk appetite

remain the dominant themes to monitor for the Aussie. On the policy

front; a void of local economic data is on the calendar heading into the

end of the month. This is likely to leave the ‘period of stability’

baseline scenario for rates intact.

NZDUSD to Face Larger Rebound If RBNZ Removes Verbal Intervention

The biggest risk surrounding the RBNZ interest rate decision will be a

removal of the verbal intervention on the kiwi as the central bank sees

a more sustainable recovery in New Zealand.

Gold Holds Support Post NFPs- Bearish Sub $1282

Looking ahead to next week, the US economic docket will be rather

light with only Whole sale inventories, retail sales and the preliminary

University of Michigan confidence surveys on tap. The most significant

risks to the upside near-term in gold would be escalating geopolitical

tensions both in the Europe and the Middle East and/or a broader

correction lower in equirty prices.