EURJPY

Actively traded 24-hours a day, the EUR/JPY is so popular that it has been called the fifth major! The EUR/JPY mostly trades in wide ranges, providing excellent opportunities for position (medium-term) traders.

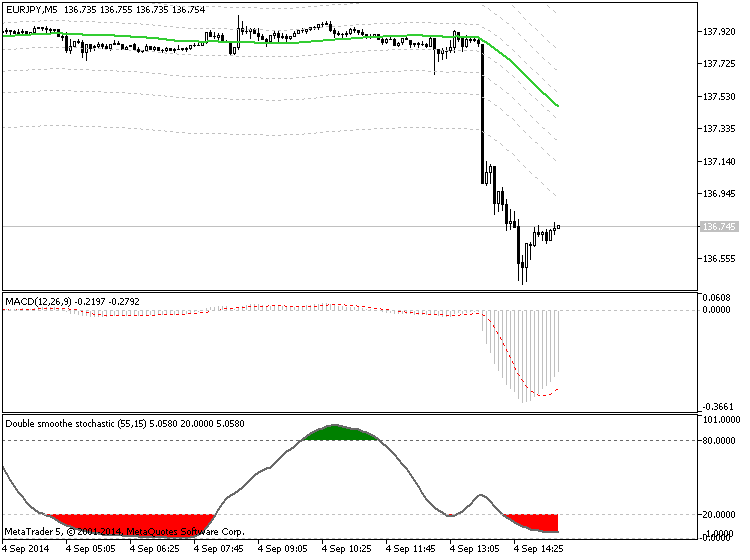

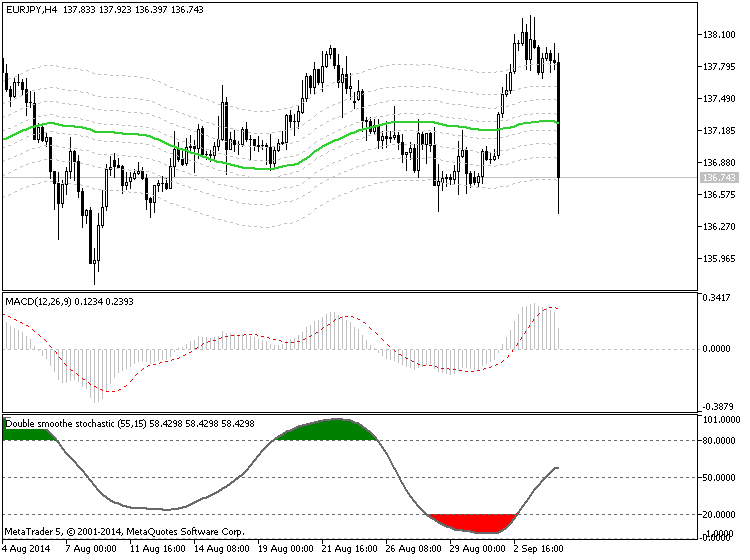

EUR/JPY generally trades in a range, but when breakouts do happen, Fibonacci levels provide a good estimate of where support/resistance will probably occur. Stochastics are excellent for spotting exit and entry points in a rangebound market. Real support and resistance figures, published daily in the Market News & Charts section, can also be used to pick entry and exit points.

EUR/JPY is an excellent gauge for the health of the Japanesse economy

versus the European economy. When data comes out that changes the

prevailing outlook for either country, the result is usually a dramatic

movement in the pair.

What moved EURJPY?

- European and Japanese economic data. This pair often integrates fundamental economic information better than the majors!

- Bank of Japan intervention. The BOJ prevents the Yen from becoming too strong against the dollar. If there is intervention in the USD/JPY, it will create movement for EUR/JPY too.

- Oil prices. Japan is very dependent on exported oil, so a spike in oil prices can cause a marked dip in the Yen.

- Talk of Japanese reserve diversification. The Bank of Japan holds dollar reserves. If reserves are diversified into euros, EUR/JPY could explode as new demand for the euro drives the price up!

Fundamentals to Watch

- European GDP. Gross domestic product. A measurement of output, and more importantly, growth in an economy.

- European trade balance. A measure of how much Europe is importing versus how much it exports. Too many imports mean that the currency will get weaker because more Euros are being sold to purchase foreign goods.

- European CPI. Refers to the European Central Bank's monetary policy. If inflation is too high, the ECB will raise interest rates to slow borrowing and spending. If economic growth is sluggish, lowering interest rates will help boost activity. High interest rates make a currency more attractive.

- ECB rate decision. Refers to the European Central Bank's monetary policy. If inflation is too high, the ECB will raise interest rates to slow borrowing and spending. If economic growth is sluggish, lowering interest rates will help boost activity. High interest rates make a currency more attractive.

- Japanese Inflation. A measure of inflation in Japan. Closely monitored because when too high or too low, it can prompt a change in the interest rate outlook of a country.

- Japanese Consumer Spending. A measure of how much Japanese consumers are spending. The Japanese economy is driven primarily by its export sector, but consumer spending is an important gauge of economic activity and prosperity.

- BoJ Monetary Policy Meeting. When Japanese bank officials meet to determine monetary policy. Has direct implications for currency traders since they often hint at whether or not they intend to intervene to protect the Yen from becoming too expensive—hence making their exports more expensive.

- Japanese Trade Balance. Japanese imports vs. exports - the Japanese economy is highly dependent on exports; a drastic change in this number can have implications on the value of the Yen.

- Japanese Industrial Production. A measure of activity in the Japanese manufacturing sector. This acts as a gauge for the level of production and growth in the economy.

- Tankan Survey. A quarterly business survey gives a detailed assessment of Japanese business conditions. The headline number shows the difference between the proportion of optimistic businesses and the proportion of pessimistic businesses. A large positive number means that optimism pervades.