WEEKLY DIGEST 2014, November 23 - 30 for High Frequency Trading Review

mql5 review

How to deal with Wall Street and income inequality in one fell swoop.If we want to curb the worst Wall Street abuses, and also make America a more equitable place, here's what to do.

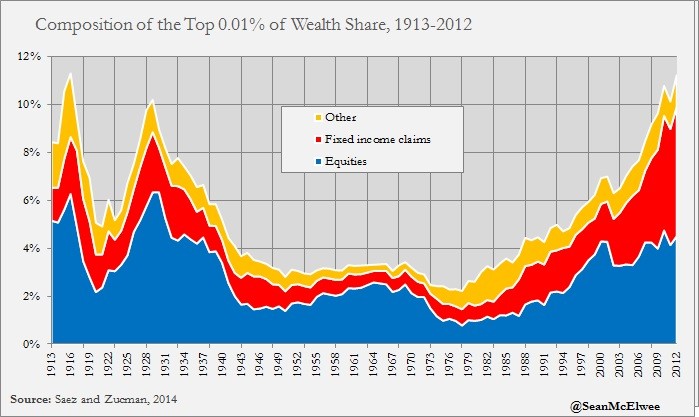

The financial industry is a behemoth. Over the past 150 years, it has grown dramatically as a share of GDP. And entrance into its ranks has become a great way to enter into the top 1 percent of earners. (According to recent data, financial professionals have nearly doubled as a share of Americans in the top 1 percent.) At the same time, Wall Street is one of the most reviled institutions in the United States, with a recent study finding the lowest trust in finance recorded over 40 years.

In this episode of the Keiser Report, Max Keiser and Stacy Herbert discuss the fact that we are all Jack Johnson now - bankrupted by those we trust or, in the case of the central banks - distrust - all in the name of property speculation and other non-wealth producing speculative pursuits. In the second half Max interviews the founder of Nanex, Eric Hunsader, about high frequency trading, market making and scalping markets.

Steps To Becoming A Quant Trader

A lot of people from mathematical or statistical backgrounds aspire to

be quant traders. But in the present era, the job description for a

quant has expanded significantly, due to the advent of high frequency, algorithmic and automated trading.

Jobs in these areas are quite demanding and they require more than just

outstanding skills in data analysis. They also require a wider

understanding, building and execution of automated trading systems.

Flash boys hitting speed bumps as new trading platforms gain momentum

If high-frequency traders felt under siege this month on both sides of

the North American border, they could look to a single place for the

root of their problems: Royal Bank of Canada. RBC, Canada’s biggest bank, is a key shareholder in Aequitas Innovations

Inc., which was blessed by regulators on Nov. 13 with a “recognition

order” approving the creation of a new trading platform and exchange.

While many have stated concern that high-frequency trading can hurt market stability, a new academic study shows the practice contributes to market stability. Since the so-called flash crash of 2010, concern has been raised about high-frequency trading’s relationship to extreme price fluctuations, notably in Michael Lewis’s popular book, Flash Boys.

But the study found that high-frequency trading firms trade in the opposite direction

during extreme price jumps and supply liquidity to non-high-frequency

trading firms as well as contribute to market stability. In addition,

the study shows that during normal times, high-frequency trading firms

as a whole demand more liquidity than they supply, but during times of

financial stress, they provide more liquidity. The late November study was conducted by four professors, including Jonathan Brogaard at the University of Washington.

The dramatic speed of financial transactions can be matched only by the intensity of the controversy surrounding it, especially when it comes to high-frequency trading.

TIDBIT: AND SPEAKING OF HIGH FREQUENCY TRADING, CHECK OUT WHAT HAPPENED TO GOLD…

And speaking of High Frequency Trading and market manipulation possibilities that it affords, consider this story from Zero Hedge from Nov 26 (and thanks to Mr. S.U. for sharing it):

Gold “Price” Spikes to $1,467.50/oz on Computer Glitch?

High Frequency Stock & Options Market Maker Trading Platform

The video: Learn how to trade against "high frequency trading" and understand how

it creates huge moves for bulls and bears in recent market volatility.

High frequency trading (HFT) is the use of sophisticated technological

tools to trade securities like stocks or options, and is typically

characterized by several distinguishing features.