On Monday the Russian central bank was reported to be active in the currency markets as it sought to restrain what seemed like the biggest one-day fall in the ruble since the debt default of 1998. It is understandable why Moscow backtracked. The ruble was down by more than 6% against the dollar in early trading and is vying with the Ukranian hryvnia as the world’s worst performing currency of 2014. If the word “freefall” is ever overused in financial markets, it is not this time, says Larry Elliott in The Guardian's blog.

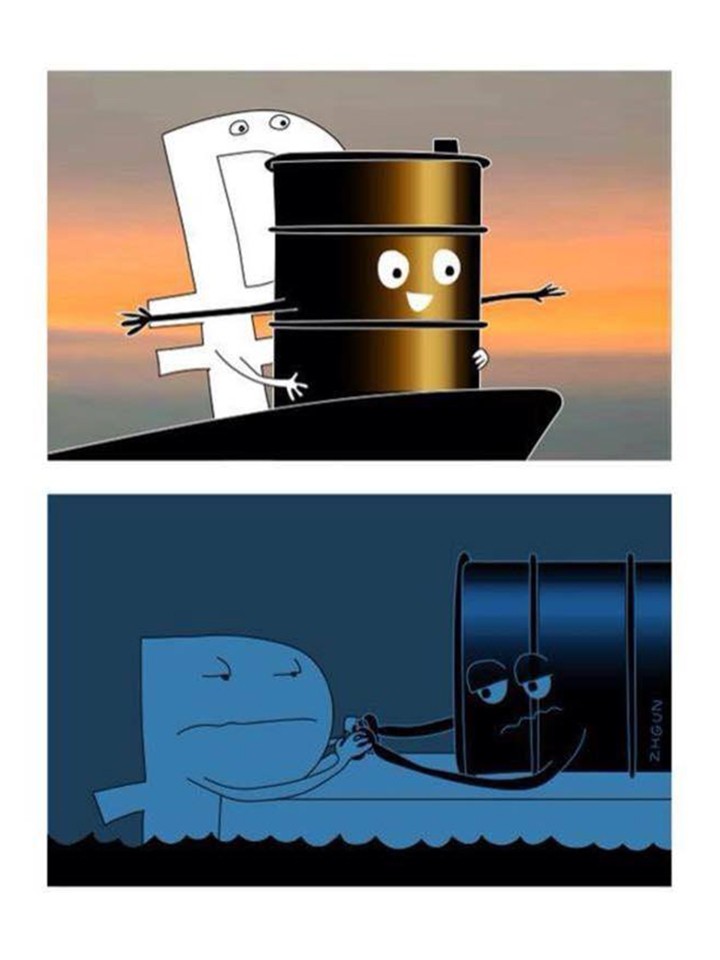

Since the summer the price of crude has dropped by 40%, while more than two-thirds of Russia’s exports are from the energy sector. The selloff has accelerated since the OPEC oil cartel decided against production curbs at last week’s meeting. Downward pressure on the ruble intensified amid market speculation that there would be no intervention.

There were reasons for adopting a hands-off approach. Chucking a chunk of Russia’s sizeable reserves at a rapidly falling ruble could be an expensive and ultimately pointless exercise. Intervention is normally more effective when it is going with the grain of market sentiment, and the ruble is currently toxic.

Moreover, a weaker currency should help to support growth and take some of the pressure off the budget by boosting the ruble value of Russia’s oil reserves.

So why did Moscow blink, given that the central bank’s official line has been that it would only step in to defend the ruble if there is a threat to financial stability?

That, though, is precisely the point. A ruble in freefall does pose a threat to financial stability in two big ways.

Firstly, it increases the foreign currency value of Russia’s foreign liabilities, currently worth around $200 bn.

Secondly, a continued fall in the exchange rate is motivating Russian citizens to convert rubles into dollars and euros, thus increasing the risk of bank runs, considers Larry Elliott.

Banks in Russia are in better shape than they were in 1998 and the authorities have the financial firepower to help them out should they get into trouble. However, a plunging oil price and a plunging ruble still make the banks vulnerable. That is why there is a need to intervene.