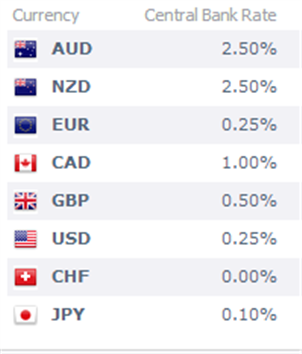

Fundamental traders keep a eye on Central Banks and the policy decisions they make. Those intuitions, through changes in monetary policy, not only can affect an underlying economy but by de facto currency rates as well. Today we will continue our look at market fundamentals by examining Central Banks and how their policy decisions can affect Forex prices.

Central Banks

Central Banks are institutions used by nations around the globe to

assist in managing their country or region with the commercial banking

industry, interest rates, and currency prices. Examples of active

central banks include the Federal Reserve of the United States, European

Central Bank (ECB), Bank of England (BOE), Bank of Canada, and the

Reserve Bank of Australia (RBA). The sphere of influence of a central

bank may range from a single country such as the Reserve Bank of

Australia or, represent policy created for a region or group of

countries such as the ECB. Because of this, the actions of Central Banks

have the ability to move markets and should be on every fundamental

trader’s radar.

Central Banking Rates

Policy Decisions

Policy decisions and economic releases from Central Banks will occur sporadically throughout the month. The best way to track upcoming news is through the use of a good economic calendar. As these decisions are made, it is also important to track the movements of the market!