Fundamentals: Full Text of the Fed’s Statement - Federal Reserve calls end to QE3

- past data is 0.25%

- forecast data is 0.25%

- actual data is 0.25% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

The US Federal Reserve has announced the formal conclusion of its latest bond-buying program, commonly referred to as QE3, while reaffirming plans to hold interest rates at current levels for a "considerable time".

The US central bank said it would make a final $US15 billion taper to its quantitative easing program from next month, concluding a 10-month process that has seen it gradually reduce its bond buying from $US85 billion.

The widely expected move came at the end of a two-day meeting of the Fed’s policy-setting Federal Open Market Committee (FOMC), with market eyes now shifting to the central bank’s view on the US economy and outlook for rate hikes.

“The committee judges that there has been a substantial improvement in the outlook for the labour market since the inception of its current asset purchase program,” the Fed’s statement read.

“Moreover, the committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability.

“Accordingly, the committee decided to conclude its asset purchase program this month.”

“The committee anticipates, based on its current assessment, that it likely will be appropriate to maintain the 0 to 0.25 per cent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month,” the Fed advised.

“However, if incoming information indicates faster progress toward the committee's employment and inflation objectives than the committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated.

“Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.”

The Janet Yellen-led central bank noted that the US economy had expanded at a "moderate" pace since its last meeting in mid-September, while the underutilisation of labour resources was "gradually diminsihing" and long-term inflation expectations remained "stable".

==========

The full text of the Federal Reserve’s policy statement.

==========

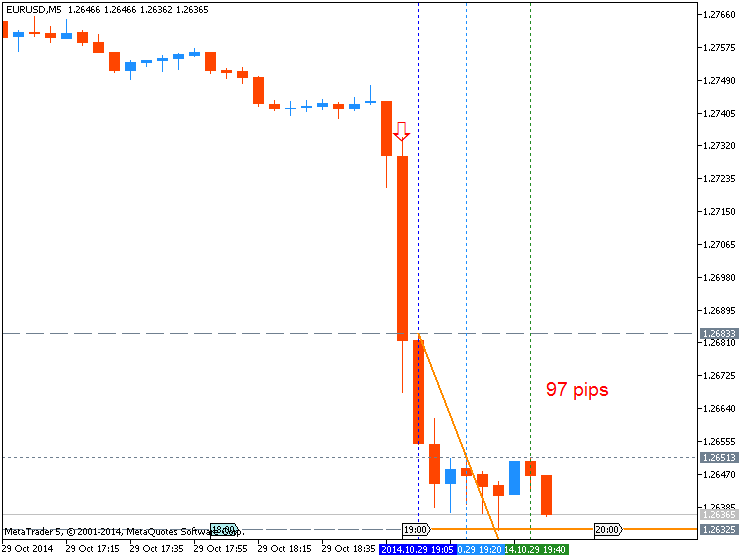

EURUSD M5: 97 pips price movement by USD - Federal Funds Rate news event:

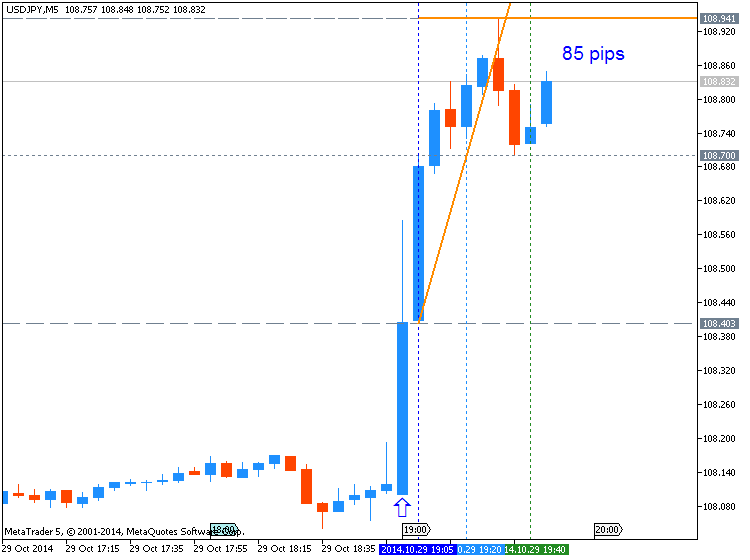

USDJPY M5: 85 pips price movement by USD - Federal Funds Rate news event: