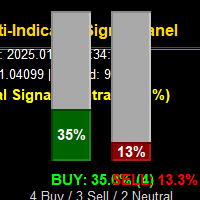

Signal panel

- 指标

- Thabang John Wotsa

- 版本: 1.0

- 激活: 5

Overview

The Multi-Indicator Signal Panel is a comprehensive technical analysis tool for MetaTrader 5 that combines signals from 9 different technical indicators into a single, easy-to-read visual interface. Instead of cluttering your chart with multiple indicators, this tool analyzes them all and presents the combined results through intuitive vertical bar graphs and clear recommendations.

🎯 Visual Interface:

-

Two Vertical Bar Graphs (Green = Buy, Red = Sell)

-

Real-time signal strength display (0-100%)

-

Clean, minimalist design - no indicator clutter

-

Color-coded recommendations

-

Time, price, and spread display

-

Indicator consensus count

⚙️ Customization Options:

-

Adjustable panel position and size

-

Customizable bar colors, width, and height

-

Configurable indicator parameters

-

Adjustable signal thresholds

-

Option to show/hide percentage values

How It Works

Signal Calculation:

-

Each of the 9 indicators generates a signal from -100% to +100%

-

Positive values = Bullish signals

-

Negative values = Bearish signals

-

Absolute value = Signal strength

Bar Graph Display:

-

Buy Bar (Green): Shows combined bullish signal strength

-

Sell Bar (Red): Shows combined bearish signal strength

-

Bar Height: Proportional to signal strength (0-100%)

-

Grows Upward: From bottom to top

Recommendation System:

-

STRONG BUY SIGNAL: Buy bar > 70%, total signal > 60%

-

BUY SIGNAL: Buy bar 40-70%, total signal > 30

-

MILD BUY: Buy bar > sell bar, both < 40%

-

NEUTRAL / WAIT: Both bars low, mixed signals

-

MILD SELL: Sell bar > buy bar, both < 40%

-

SELL SIGNAL: Sell bar 40-70%, total signal < -30

-

STRONG SELL SIGNAL: Sell bar > 70%, total signal < -60

Trading Applications

For Trend Traders:

-

Identify strong trending markets

-

Get confirmation from multiple indicators

-

Avoid false breakouts with consensus signals

📉 For Range Traders:

-

Identify ranging/consolidating markets (both bars short)

-

Spot breakout opportunities when one bar starts growing

-

Use Bollinger Bands and ATR for volatility insights

⚡ For Day Traders:

-

Real-time updates every second

-

Quick visual assessment of market bias

-

Volume analysis for momentum confirmation

📊 For Position Traders:

-

Use with higher timeframes (H4, D1)

-

Combined trend and momentum analysis

-

Multiple confirmation sources for higher accuracy

Interpretation Guidelines

Visual Reading:

-

Compare Bar Heights:

-

Green bar taller = Bullish bias

-

Red bar taller = Bearish bias

-

Similar heights = Mixed/uncertain market

-

-

Check Percentages:

-

< 30% = Weak signal

-

30-70% = Moderate signal

70% = Strong signal

-

-

Read the Numbers:

-

Percentage values on bars

-

Indicator count (e.g., "5 Buy / 2 Sell / 2 Neutral")

-

Total combined signal

-

Trading Signals:

-

Enter Long: Strong buy signal, green bar > 70%, multiple indicators agree

-

Enter Short: Strong sell signal, red bar > 70%, multiple indicators agree

-

Exit/Reduce: Opposite bar starts growing, signal weakens

-

Stay Out: Both bars low, recommendation says "WAIT"

Risk Management:

-

Start Conservative: Use default settings first

-

Adjust Thresholds: Change Buy/Sell Thresholds based on your risk tolerance

-

Combine with Fundamentals: Use for technical timing, not sole decision-making

-

Backtest: Test with historical data on your preferred pairs/timeframes

Benefits

✅ Advantages:

-

Time-saving: No need to analyze 9 indicators separately

-

Clear Visualization: Instant market bias assessment

-

Reduced Analysis Paralysis: Clear buy/sell/hold signals

-

Customizable: Adjust to your trading style

-

Real-time: Updates every second

-

Professional: Clean, trader-friendly interface

⚠️ Limitations:

-

Lagging Indicators: All technical indicators lag to some degree

-

No Guarantees: Signals are probabilistic, not certain

-

Market Conditions: Works best in trending markets, less in choppy ranges

-

Not Standalone: Should be used with risk management and other analysis

Ideal For

👤 Trader Types:

-

Beginner Traders: Simple visual interface, clear signals

-

Intermediate Traders: Customizable, multiple timeframes

-

Advanced Traders: Can adjust parameters for specific strategies

-

Algorithmic Traders: Use signals for EA development

⏰ Timeframes:

-

All Timeframes: From M1 to Monthly

-

Best Results: H1, H4, D1 for reliable signals

-

Scalping: M5-M15 with adjusted parameters

💹 Market Conditions:

-

Trending Markets: Excellent signal clarity

-

Breakouts: Good for identifying momentum shifts

-

Ranging Markets: Identifies low-volatility periods

🎮 Quick Start:

-

Apply to your preferred chart and timeframe

-

Watch the bars - they update every second

-

Follow color-coded recommendations

-

Adjust parameters after observing performance

-

Combine with your strategy - don't rely 100% on any indicator

🔧 Customization:

-

Move panel by changing PanelX, PanelY

-

Change bar colors to match your chart theme

-

Adjust indicator parameters for your trading style

-

Modify signal thresholds based on risk tolerance

Performance Tips

🎯 For Better Accuracy:

-

Use Higher Timeframes: Signals are more reliable on H4/D1

-

Wait for Confirmation: Don't trade on the first signal

-

Combine with Support/Resistance: Use horizontal levels for better entries

-

Consider Market Hours: Major sessions often provide clearer signals

-

Avoid News Events: High volatility can generate false signals

📊 Backtesting:

-

Test on at least 100 trades

-

Use different market conditions

-

Adjust parameters based on results

-

Consider drawdown and win rate

Conclusion

The Multi-Indicator Signal Panel is a powerful technical analysis tool that simplifies complex market analysis by combining multiple indicators into an intuitive visual interface. Whether you're a beginner looking for clear trading signals or an experienced trader wanting to save time on analysis, this indicator provides valuable insights into market sentiment and momentum.

Remember: No indicator is perfect. Use this tool as part of a comprehensive trading plan that includes risk management, fundamental analysis (where applicable), and sound trading psychology.