Young Ho Seo / Profil

- Bilgiler

|

12+ yıl

deneyim

|

62

ürünler

|

1206

demo sürümleri

|

|

4

işler

|

0

sinyaller

|

0

aboneler

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

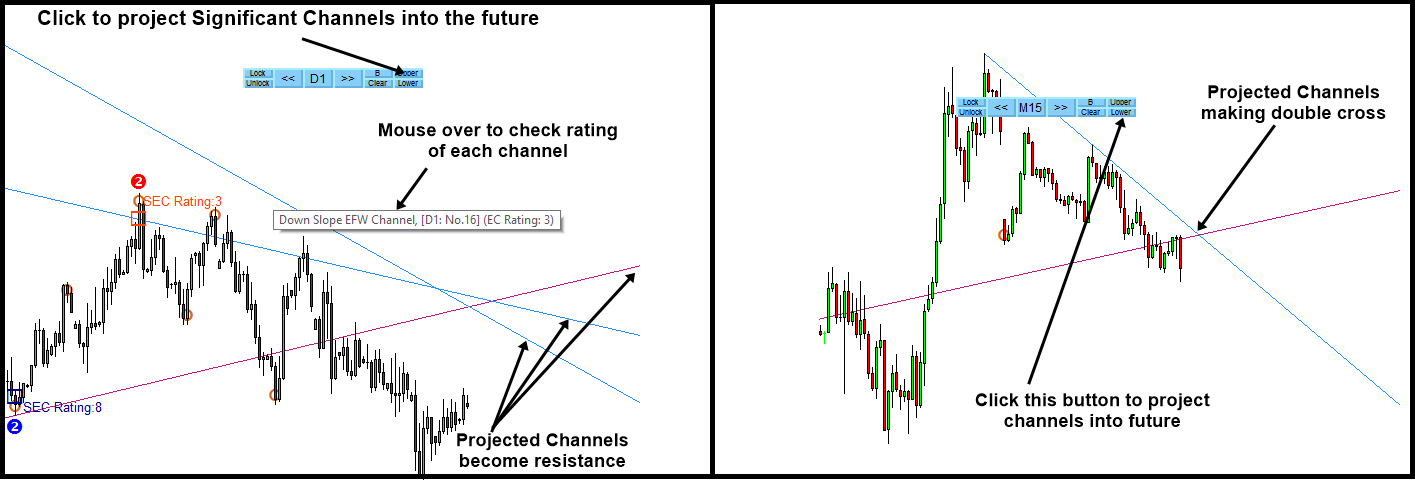

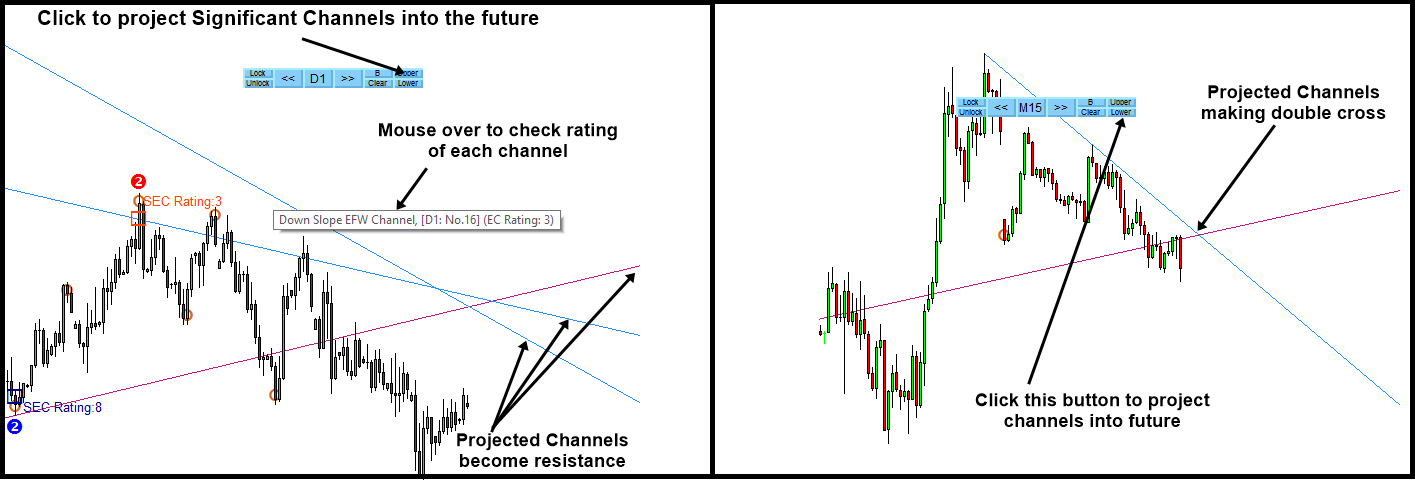

Projecting Significant Channels into Future with EFW Analytics

EFW Analytics is a powerful tool for your trading. EFW analytics contains multiple of features. One of them is project significant channels into future (available from version 10.6). The concept behind this is similar to viewing neighboring Channel feature. The difference is that this feature project the channels into future instead of showing them the past footage. Of course, this is fully automatic feature in just one button click. To project the channels into upper price range, just click “Upper” button. To project the channels into lower price range, just click “Lower” button. Once button is clicked, EFW analytics will show 1 to several important lines for your trading. If you want to fine tune the lines, then you can check their rating information. To do so, just move your mouse over each line. Then you can read rating of each channel in your chart. If you believe that some lines are absolutely important, then make sure that you lock them in your chart for nurture reference. To lock the lines, just click over the lines. That is all. Your trading will be ready in 1 minutes. No rocket science at all. It is just one button click.

Below is the link to the EFW Analytics (Equilibrium Fractal Wave Analytics):

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

EFW Analytics is a powerful tool for your trading. EFW analytics contains multiple of features. One of them is project significant channels into future (available from version 10.6). The concept behind this is similar to viewing neighboring Channel feature. The difference is that this feature project the channels into future instead of showing them the past footage. Of course, this is fully automatic feature in just one button click. To project the channels into upper price range, just click “Upper” button. To project the channels into lower price range, just click “Lower” button. Once button is clicked, EFW analytics will show 1 to several important lines for your trading. If you want to fine tune the lines, then you can check their rating information. To do so, just move your mouse over each line. Then you can read rating of each channel in your chart. If you believe that some lines are absolutely important, then make sure that you lock them in your chart for nurture reference. To lock the lines, just click over the lines. That is all. Your trading will be ready in 1 minutes. No rocket science at all. It is just one button click.

Below is the link to the EFW Analytics (Equilibrium Fractal Wave Analytics):

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

Glossary of Terms for Forex

M1: One minute timeframe in chart

M5: Five minute timeframe in chart

M15: Fifteen minute timeframe in chart

M30: Thirty minute timeframe in chart

H1: One hourly timeframe in chart

H4: Four hourly timeframe in chart

D1: One day timeframe in chart

W1: One week timeframe in chart

MN1: One month timeframe in chart

Artificial Intelligence: Any intelligence demonstrated by machines, in contrast to the natural intelligence displayed by humans and other animals.

Bear Market: A market in which stock prices are falling.

Bearish: Believing that a particular security, sector, or the overall market is about to fall. Opposite of bullish. “Bear” is a trader who believes the market will fall.

Bitcoin: The first global, decentralized currency.

Bull Market: A market in which stock prices are rising.

Bullish: Bullish refers to having a positive outlook on a particular security or an investment. A situation where groups of financial securities are rising.

Candlestick: A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period like 1 hour, 1 day, 1 week and so on.

Commodities: Products used for commerce that are traded on a separate, authorized commodities exchange. Commodities include agricultural products and natural resources such as timber, oil and metals. Commodities are the basis for futures contracts traded on these exchanges.

Crude oil: One of the commodities traded in Forex market, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity.

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA), also known as the Dow 30, is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange (NYSE) and the Nasdaq. The Dow Jones is named after Charles Dow, who created the index in 1896 along with his business partner Edward Jones.

Equities: Common and preferred stocks, which represent a share in the ownership of a company.

Ethereum: A public blockchain network and decentralized software platform upon which developers build and run applications. As it is a proper noun, it should always be capitalized.

EURUSD or EUR/USD: EURUSD is the rate that euros can be exchanged for US dollars. If the rate is 1.50, it means it takes 1.5 US dollars to buy 1 Euro.

Fractal: In math, a fractal is an infinite pattern that appears similar no matter how closely you look at it. This is also called self-similarity. In layman’s terms, fractal is any curve or geometric shape for which any suitably chosen part is similar in shape to a given larger or smaller part when magnified or reduced to the same size.

Fractal Wave: Fractal or self-similar geometric structure observed in the wave form. Fractal wave is typically observed in the financial market including stock market, forex market and commodity market.

Fractal Triangle: It is the endlessly repeating triangle that represents the market cycles in Forex and Stock market. A Fractal triangle typically consists of one swing high and one swing low.

GBPUSD or GBP/USD: GBPUSD is the rate that British pounds can be exchanged for US dollars. If the rate is 1.20, it means it takes 1.2 US dollars to buy 1 British pounds.

GoldUSD or Gold/USD or XAUUSD: XAUUSD is the rate that an ounce of gold can be exchanged for US dollars. If the rate is 1200, it means it takes 1200 US dollars to buy an ounce of gold.

Rally: A brisk rise in the general price level of the market or price of a stock.

Range: The difference between the highest and lowest price of an asset during a given trading session.

Securities: Transferable certificates of ownership of investment products such as notes, bonds, stocks, futures contracts and options.

Spread: The difference between the bid and the ask prices of a stock.

S&P 500 Index: S&P 500 index is the Standard & Poor’s 500 Composite Stock Price Index, a widely recognized, unmanaged index of common stock prices. You may not invest directly in the S&P 500 Index, and, unlike the Fund, benchmark indices do not incur fees or expenses.

Swing high: Swing high refers to the rising price action from trough toward a peak.

Swing low: Swing low refers to the falling price action from a peak toward a trough.

About this Article

This article is the part taken from the draft version of the Book: Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

M1: One minute timeframe in chart

M5: Five minute timeframe in chart

M15: Fifteen minute timeframe in chart

M30: Thirty minute timeframe in chart

H1: One hourly timeframe in chart

H4: Four hourly timeframe in chart

D1: One day timeframe in chart

W1: One week timeframe in chart

MN1: One month timeframe in chart

Artificial Intelligence: Any intelligence demonstrated by machines, in contrast to the natural intelligence displayed by humans and other animals.

Bear Market: A market in which stock prices are falling.

Bearish: Believing that a particular security, sector, or the overall market is about to fall. Opposite of bullish. “Bear” is a trader who believes the market will fall.

Bitcoin: The first global, decentralized currency.

Bull Market: A market in which stock prices are rising.

Bullish: Bullish refers to having a positive outlook on a particular security or an investment. A situation where groups of financial securities are rising.

Candlestick: A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period like 1 hour, 1 day, 1 week and so on.

Commodities: Products used for commerce that are traded on a separate, authorized commodities exchange. Commodities include agricultural products and natural resources such as timber, oil and metals. Commodities are the basis for futures contracts traded on these exchanges.

Crude oil: One of the commodities traded in Forex market, with the two most popularly traded grades of oil being Brent Crude and West Texas Intermediate (WTI). Crude oil prices reflect the market’s volatile and liquid nature, as well as oil being a benchmark for global economic activity.

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA), also known as the Dow 30, is a stock market index that tracks 30 large, publicly-owned blue-chip companies trading on the New York Stock Exchange (NYSE) and the Nasdaq. The Dow Jones is named after Charles Dow, who created the index in 1896 along with his business partner Edward Jones.

Equities: Common and preferred stocks, which represent a share in the ownership of a company.

Ethereum: A public blockchain network and decentralized software platform upon which developers build and run applications. As it is a proper noun, it should always be capitalized.

EURUSD or EUR/USD: EURUSD is the rate that euros can be exchanged for US dollars. If the rate is 1.50, it means it takes 1.5 US dollars to buy 1 Euro.

Fractal: In math, a fractal is an infinite pattern that appears similar no matter how closely you look at it. This is also called self-similarity. In layman’s terms, fractal is any curve or geometric shape for which any suitably chosen part is similar in shape to a given larger or smaller part when magnified or reduced to the same size.

Fractal Wave: Fractal or self-similar geometric structure observed in the wave form. Fractal wave is typically observed in the financial market including stock market, forex market and commodity market.

Fractal Triangle: It is the endlessly repeating triangle that represents the market cycles in Forex and Stock market. A Fractal triangle typically consists of one swing high and one swing low.

GBPUSD or GBP/USD: GBPUSD is the rate that British pounds can be exchanged for US dollars. If the rate is 1.20, it means it takes 1.2 US dollars to buy 1 British pounds.

GoldUSD or Gold/USD or XAUUSD: XAUUSD is the rate that an ounce of gold can be exchanged for US dollars. If the rate is 1200, it means it takes 1200 US dollars to buy an ounce of gold.

Rally: A brisk rise in the general price level of the market or price of a stock.

Range: The difference between the highest and lowest price of an asset during a given trading session.

Securities: Transferable certificates of ownership of investment products such as notes, bonds, stocks, futures contracts and options.

Spread: The difference between the bid and the ask prices of a stock.

S&P 500 Index: S&P 500 index is the Standard & Poor’s 500 Composite Stock Price Index, a widely recognized, unmanaged index of common stock prices. You may not invest directly in the S&P 500 Index, and, unlike the Fund, benchmark indices do not incur fees or expenses.

Swing high: Swing high refers to the rising price action from trough toward a peak.

Swing low: Swing low refers to the falling price action from a peak toward a trough.

About this Article

This article is the part taken from the draft version of the Book: Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

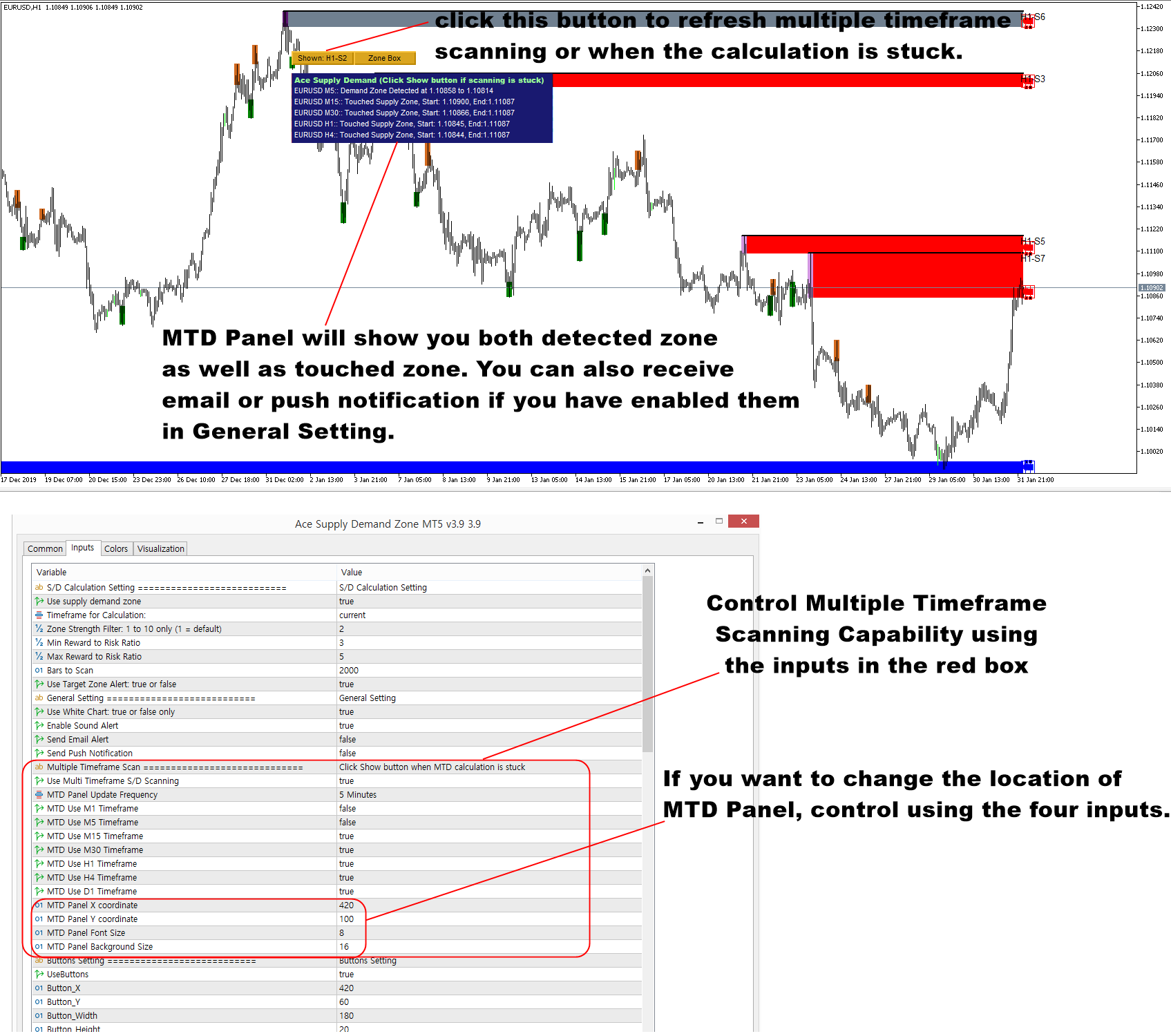

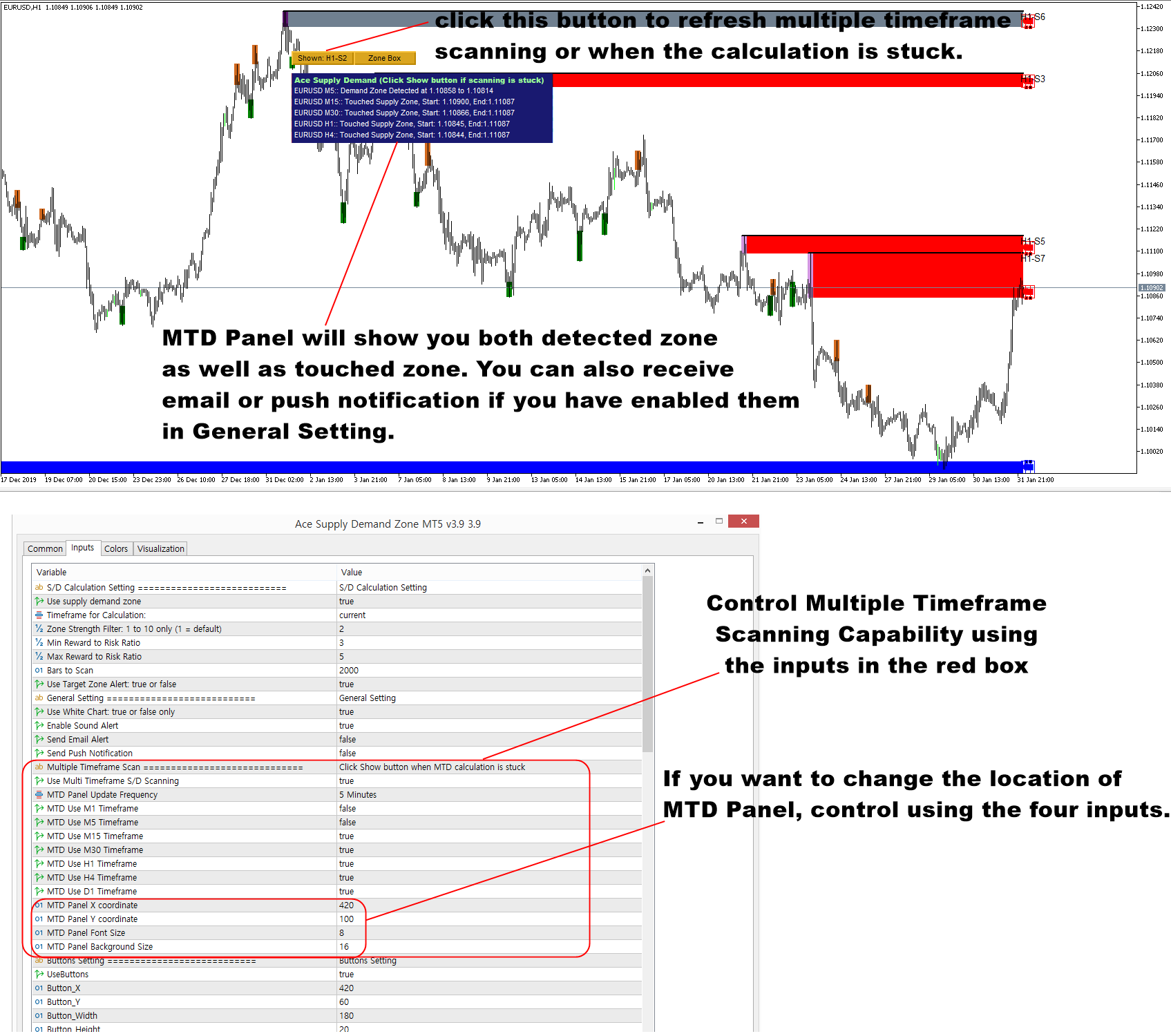

Scan Supply Demand Zone Across All Timeframe

In Ace Supply Demand Zone indicator, you can scan the supply and demand zone across all timeframe for your Forex trading. This is a powerful feature included in Ace Supply Demand Zone indicator. Controlling the Multiple Timeframe scanning is similar to our other MetaTrader products like Harmonic Pattern Plus or X3 Chart Pattern Scanner. You can control them from the inputs under the Multiple Timeframe Scanning. With the inputs, you can enable or disable multiple timeframe scanning. You can also choose to switch on or off specific timeframe from your dashboard. In addition, you can also control how frequently the indicator should scan. The default value for update frequency is M5 timeframe. However, you can use M1 for update frequency if you need to scan them more frequently.

If you enabled email or push notification in the inputs under General Setting, then you can also receive the alert for the detected supply and demand zone as well as the touched supply and demand zone. The thing you need to understand about multiple timeframe scanning is that it requires multiple computation too per each timeframe. The computation can be heavier up to 7 times or more when you enabled M1 to D1 timeframes. Hence, due to data loading issues, the calculation might be stuck sometimes. In that case, just click Show button to refresh all the calculation. Of course, it is possible to switch off the multiple timeframe scanning if you only want to trade one timeframe.

Ace Supply Demand Zone in MetaTrader 4 and MetaTrader 5

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Landing page for Ace Supply Demand Zone.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In Ace Supply Demand Zone indicator, you can scan the supply and demand zone across all timeframe for your Forex trading. This is a powerful feature included in Ace Supply Demand Zone indicator. Controlling the Multiple Timeframe scanning is similar to our other MetaTrader products like Harmonic Pattern Plus or X3 Chart Pattern Scanner. You can control them from the inputs under the Multiple Timeframe Scanning. With the inputs, you can enable or disable multiple timeframe scanning. You can also choose to switch on or off specific timeframe from your dashboard. In addition, you can also control how frequently the indicator should scan. The default value for update frequency is M5 timeframe. However, you can use M1 for update frequency if you need to scan them more frequently.

If you enabled email or push notification in the inputs under General Setting, then you can also receive the alert for the detected supply and demand zone as well as the touched supply and demand zone. The thing you need to understand about multiple timeframe scanning is that it requires multiple computation too per each timeframe. The computation can be heavier up to 7 times or more when you enabled M1 to D1 timeframes. Hence, due to data loading issues, the calculation might be stuck sometimes. In that case, just click Show button to refresh all the calculation. Of course, it is possible to switch off the multiple timeframe scanning if you only want to trade one timeframe.

Ace Supply Demand Zone in MetaTrader 4 and MetaTrader 5

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Landing page for Ace Supply Demand Zone.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

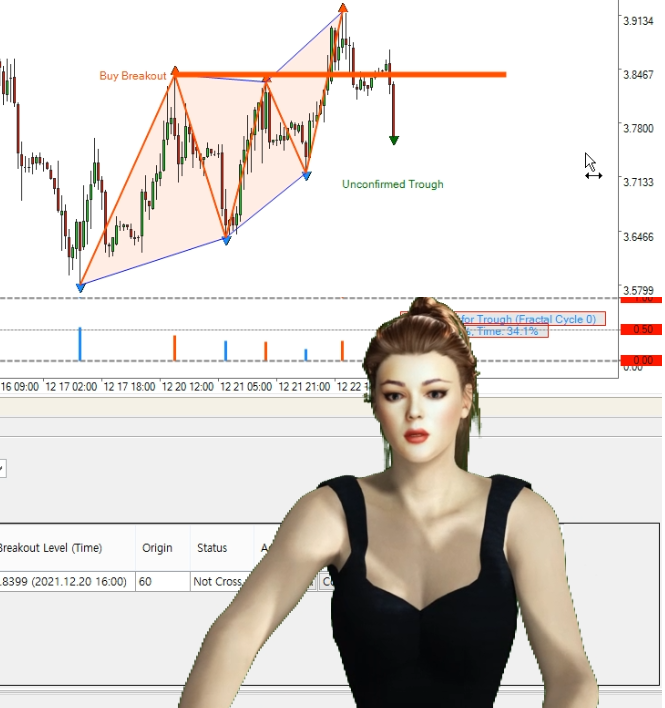

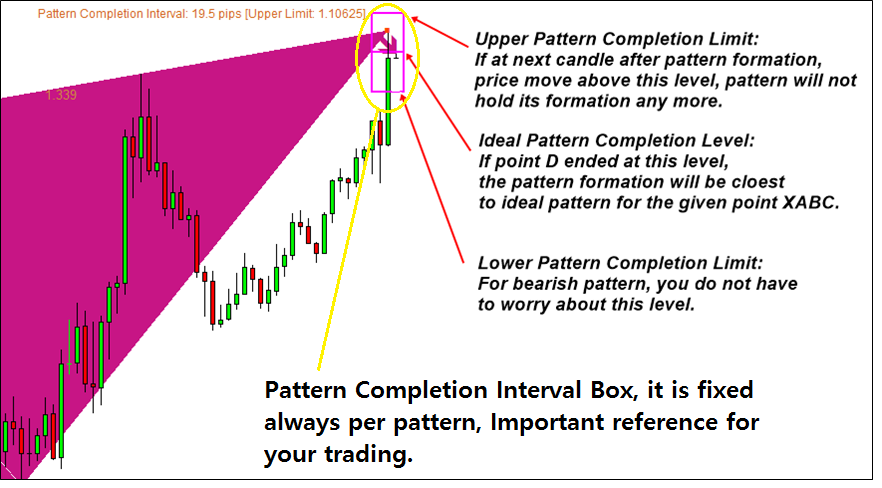

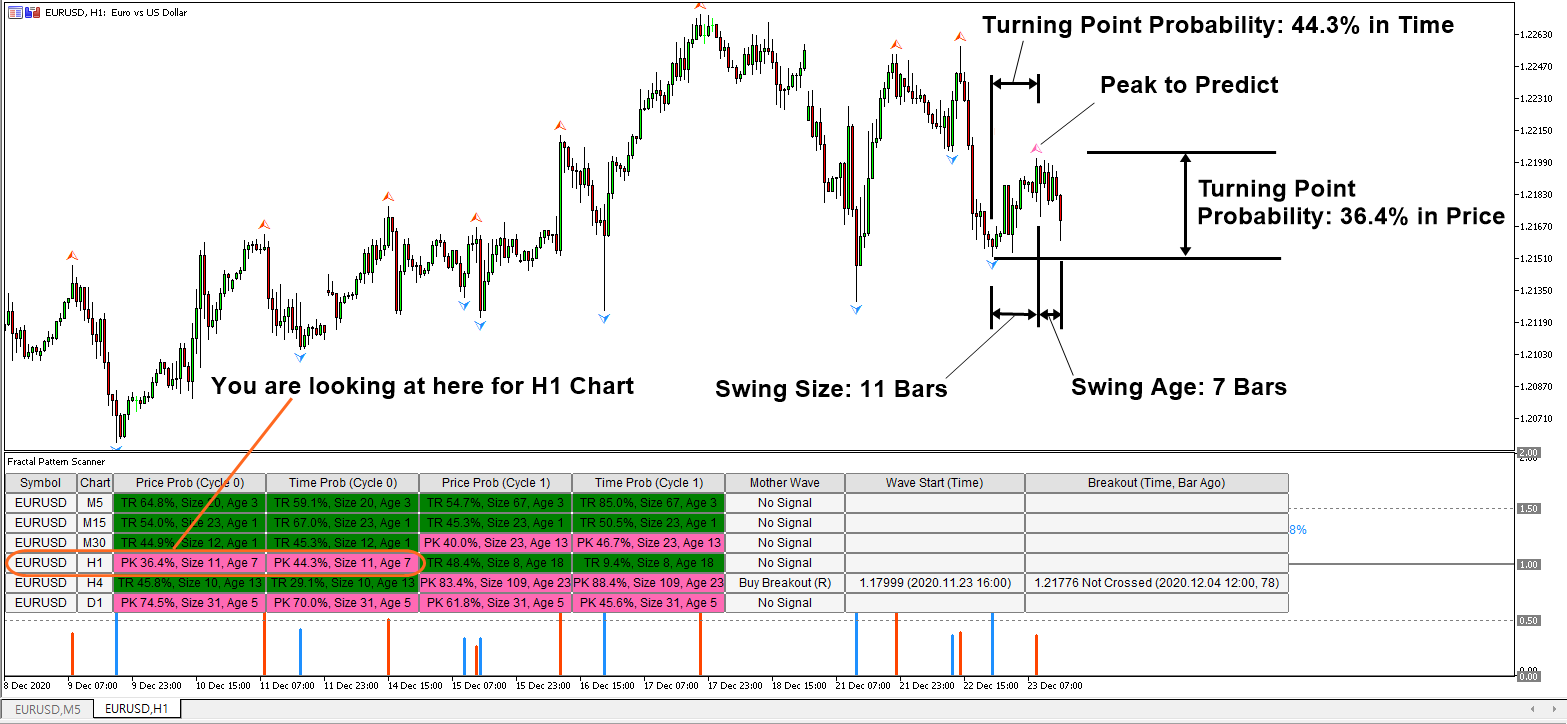

Improve Your Trading Performance with Free Forex Market Prediction

Here is the short informative article sharing the Free Forex Market Prediction with you. As you know, from our website, we provide the advanced MetaTrader Trading Systems and Pattern Scanners as well as many educational materials for Forex trading. We also decided to provide you advanced Forex Market Prediction for free to help you to stay in the winning side.

You can access the Free Forex Market Prediction from the link below. Although these are free and convenient to use , these are also advanced market prediction. Each market prediction for each forex symbol can help you to decide good entry and exit for your trading. We provide these prediction covering the most of major Forex symbols like EURUSD, GBPUSD, USDJPY and so on. The market prediction is updated every hour to provide you the edge for your trading. You can also use these Forex market prediction with our MetaTrader 4 and MetaTrader 5 products together if you have one already.

Do not hesitate to visit this link below. You are just one click away from getting these powerful market prediction.

https://algotrading-investment.com/2020/10/23/price-prediction-for-day-trading/

All the detailed instruction on how to use our Free Forex Market Prediction can be found from the above link too.

Providing the Free Forex Market Prediction to everyone requires noticeable amount of time and efforts from us. Make sure to give us the positive reviews on our MetaTrader products and Books. Then we always try to return more to the Forex trading community. Here is some good forex educational materials you can read for free too.

https://algotrading-investment.com/2019/07/23/trading-education/

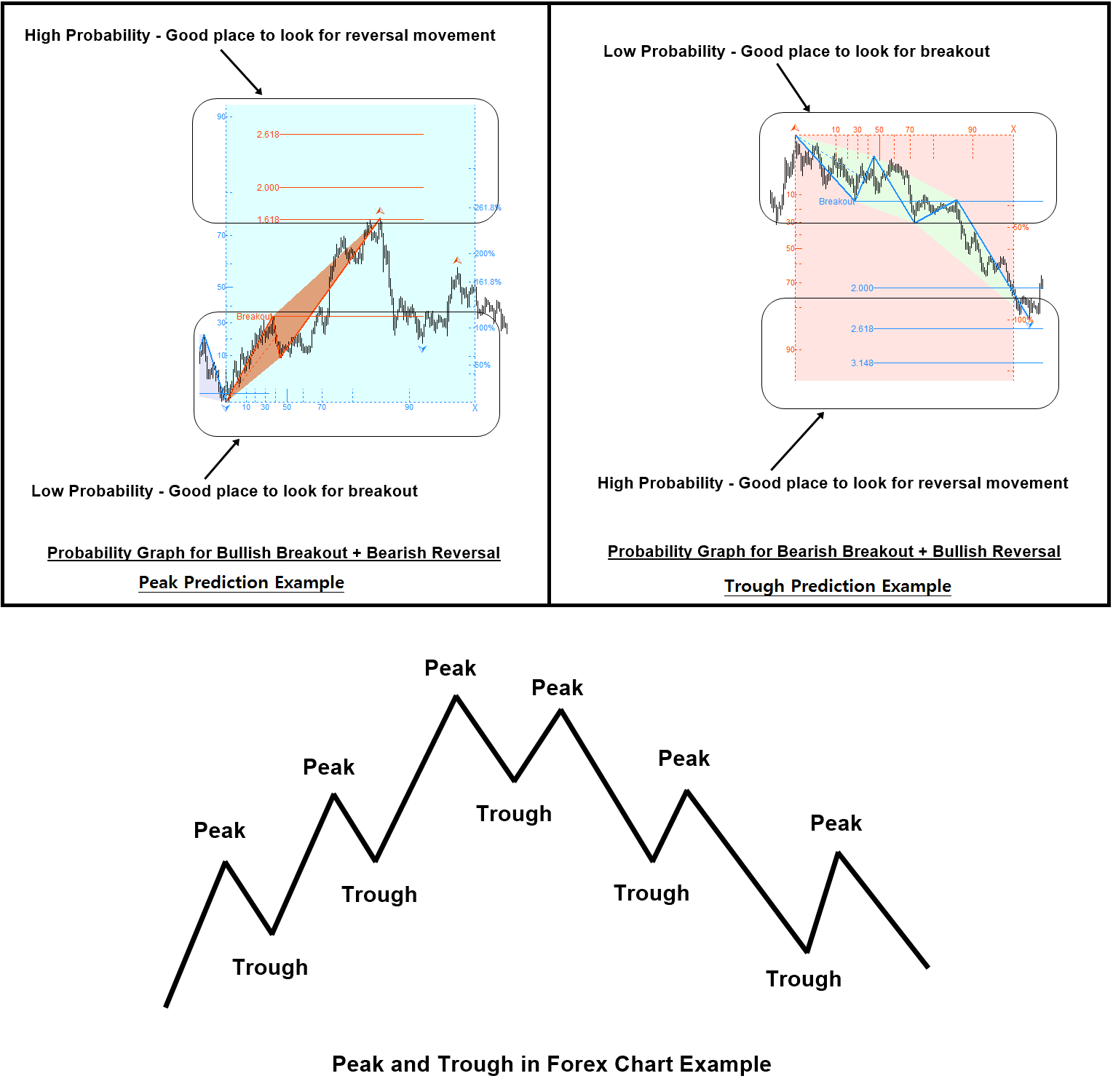

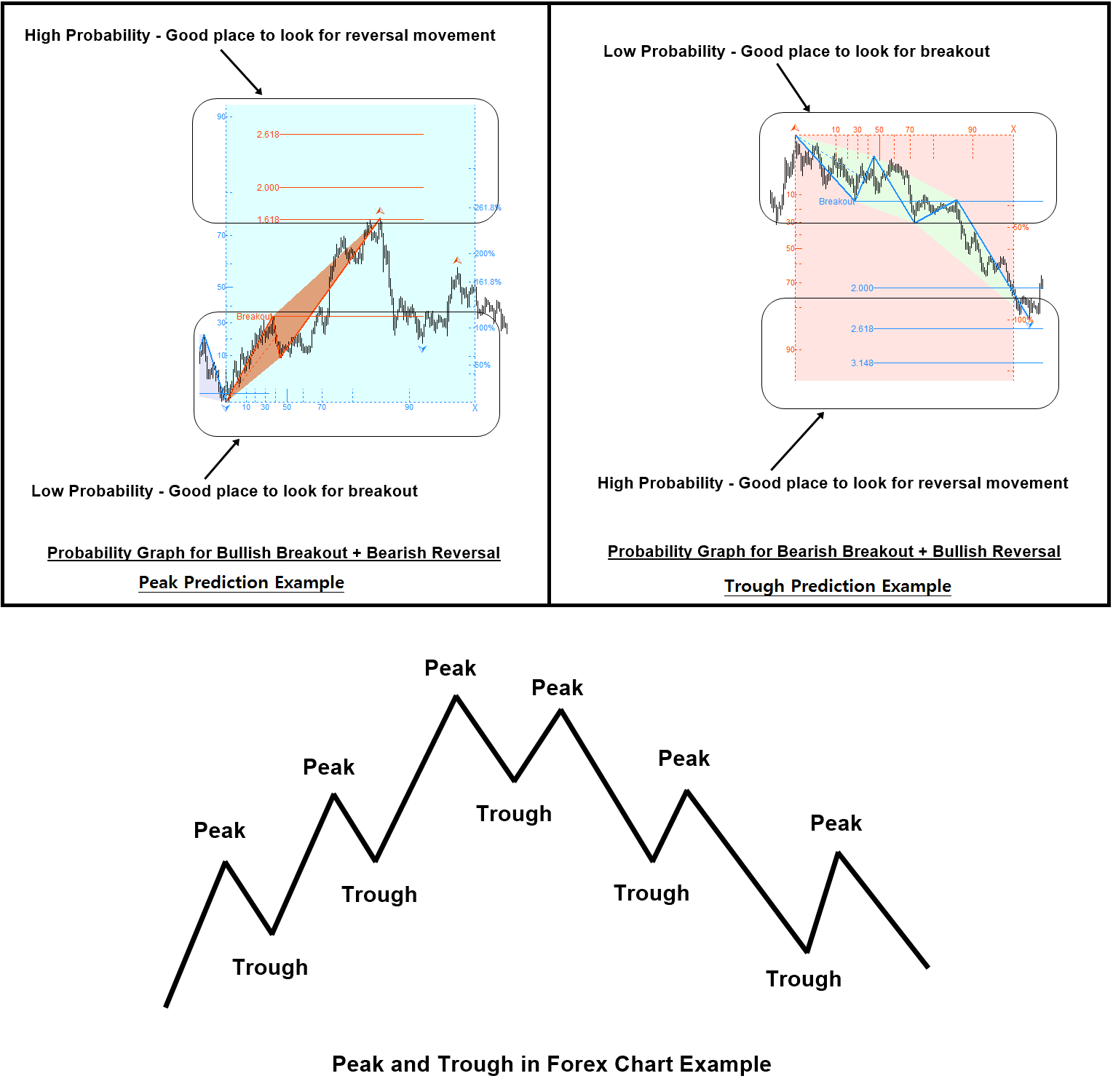

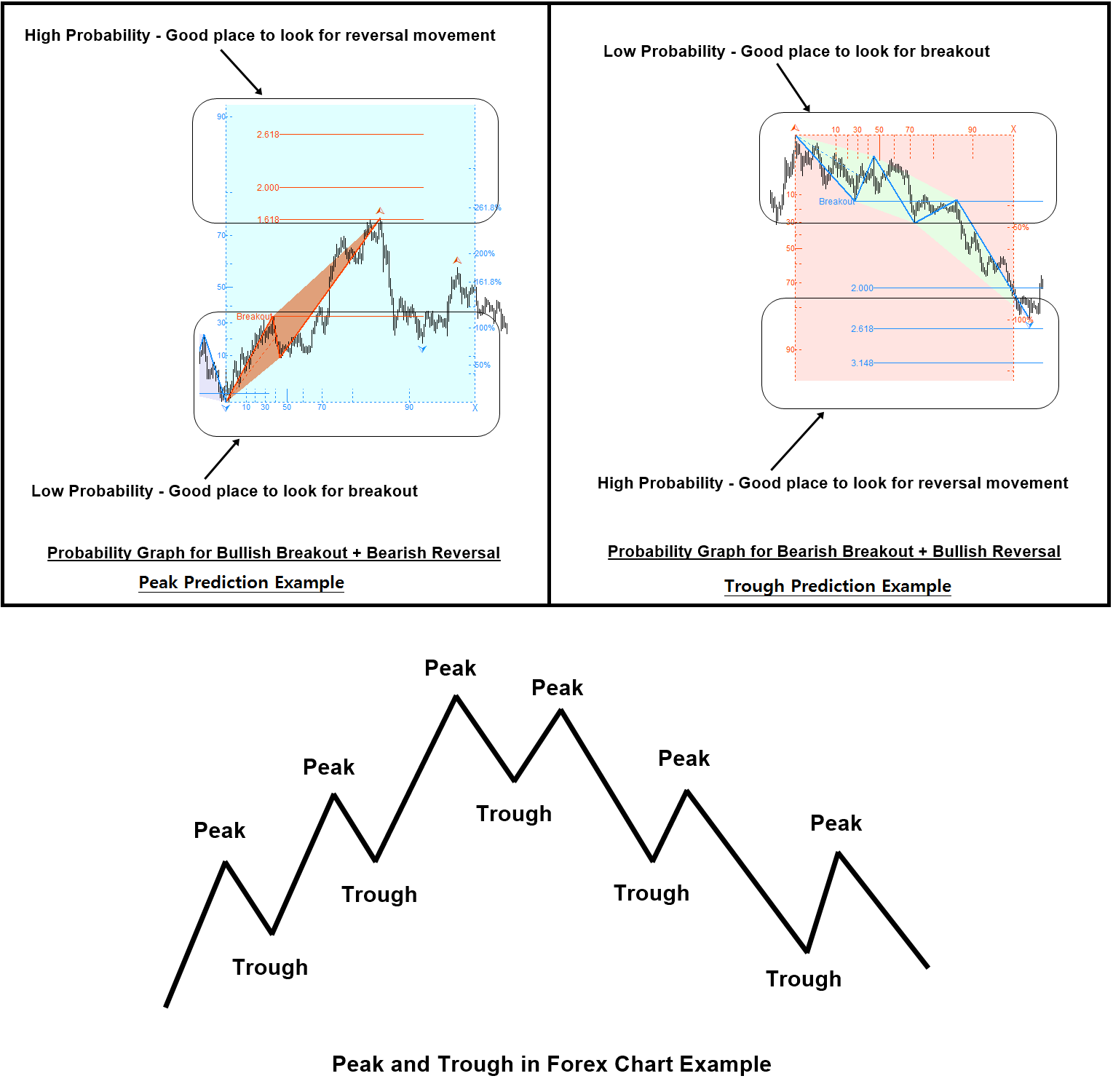

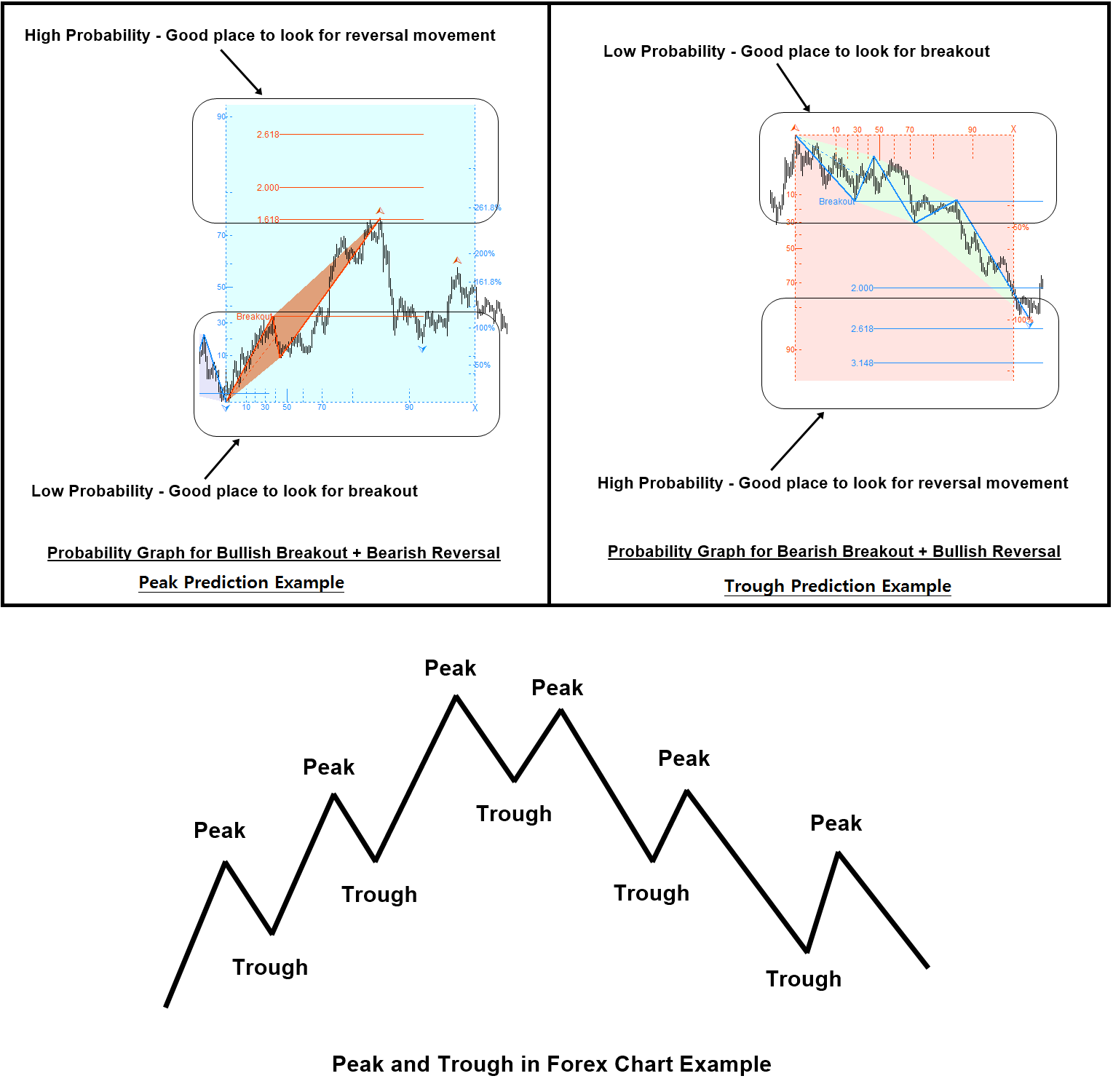

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

At the same time, if you want to have the market prediction scanner for the MetaTrader 4 or MetaTrader 5, here is the links to Fractal Pattern Scanner. In Fractal Pattern Scanner, you can access the turning point probability scanner + mother wave breakout signals, reversal signals, and many more advanced features.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Here is the short informative article sharing the Free Forex Market Prediction with you. As you know, from our website, we provide the advanced MetaTrader Trading Systems and Pattern Scanners as well as many educational materials for Forex trading. We also decided to provide you advanced Forex Market Prediction for free to help you to stay in the winning side.

You can access the Free Forex Market Prediction from the link below. Although these are free and convenient to use , these are also advanced market prediction. Each market prediction for each forex symbol can help you to decide good entry and exit for your trading. We provide these prediction covering the most of major Forex symbols like EURUSD, GBPUSD, USDJPY and so on. The market prediction is updated every hour to provide you the edge for your trading. You can also use these Forex market prediction with our MetaTrader 4 and MetaTrader 5 products together if you have one already.

Do not hesitate to visit this link below. You are just one click away from getting these powerful market prediction.

https://algotrading-investment.com/2020/10/23/price-prediction-for-day-trading/

All the detailed instruction on how to use our Free Forex Market Prediction can be found from the above link too.

Providing the Free Forex Market Prediction to everyone requires noticeable amount of time and efforts from us. Make sure to give us the positive reviews on our MetaTrader products and Books. Then we always try to return more to the Forex trading community. Here is some good forex educational materials you can read for free too.

https://algotrading-investment.com/2019/07/23/trading-education/

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

At the same time, if you want to have the market prediction scanner for the MetaTrader 4 or MetaTrader 5, here is the links to Fractal Pattern Scanner. In Fractal Pattern Scanner, you can access the turning point probability scanner + mother wave breakout signals, reversal signals, and many more advanced features.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Young Ho Seo

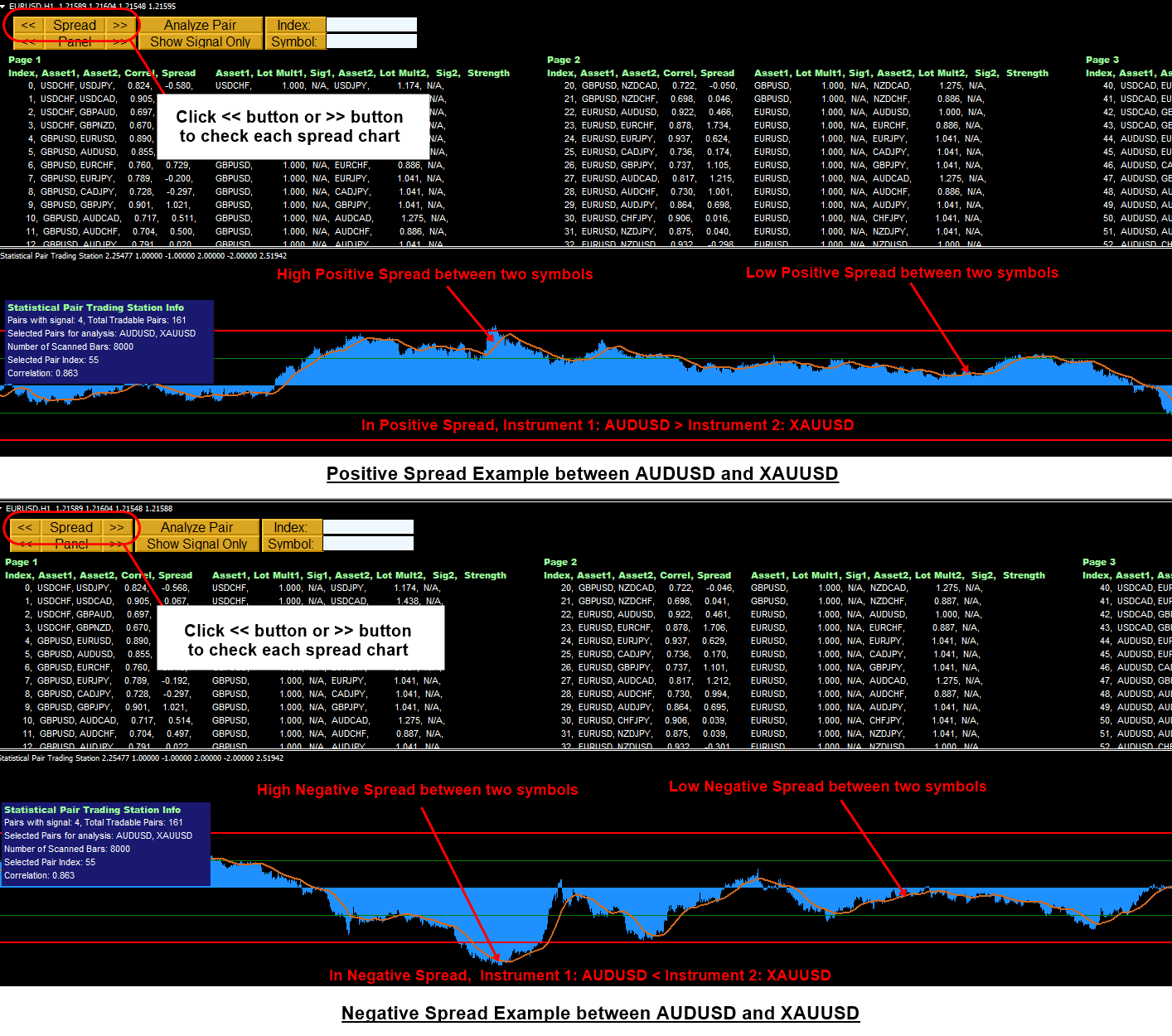

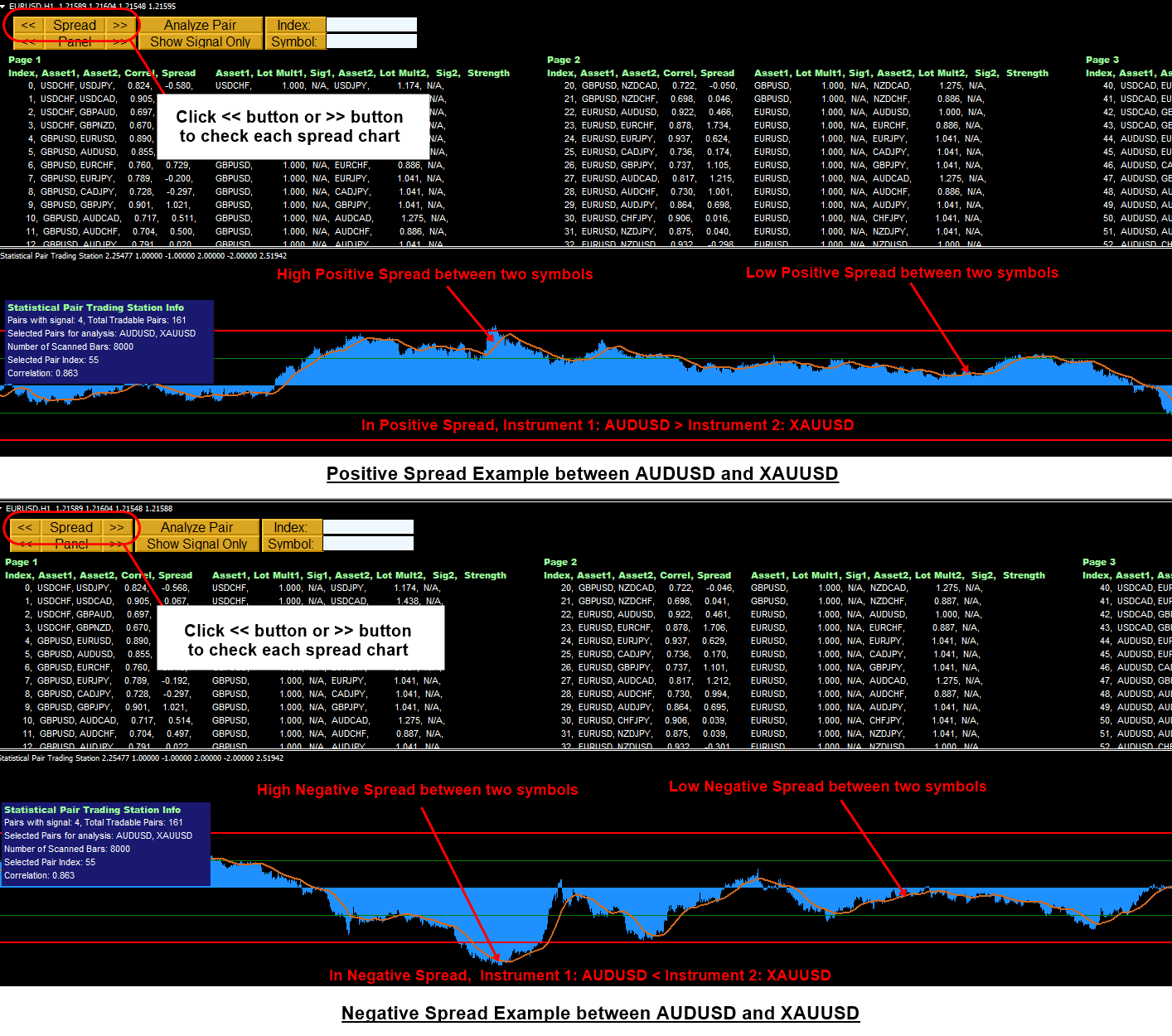

Manual For Pair Trading Station

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Young Ho Seo

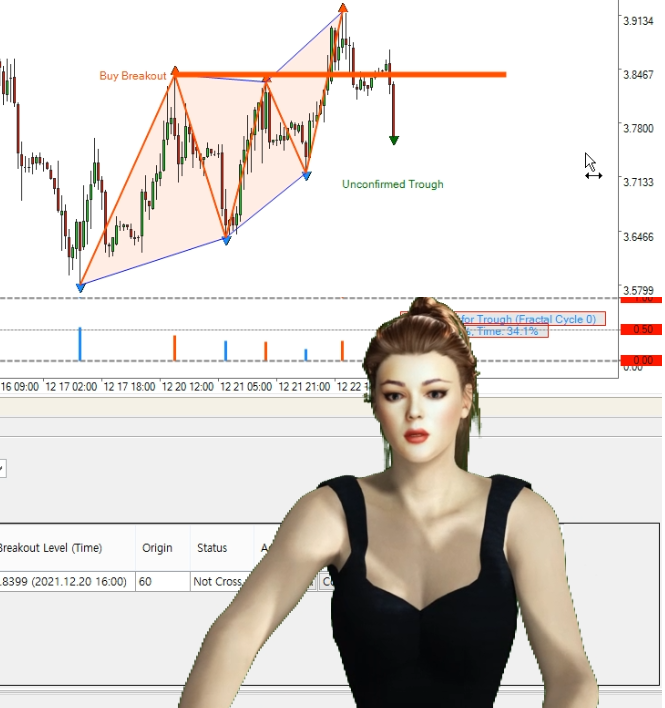

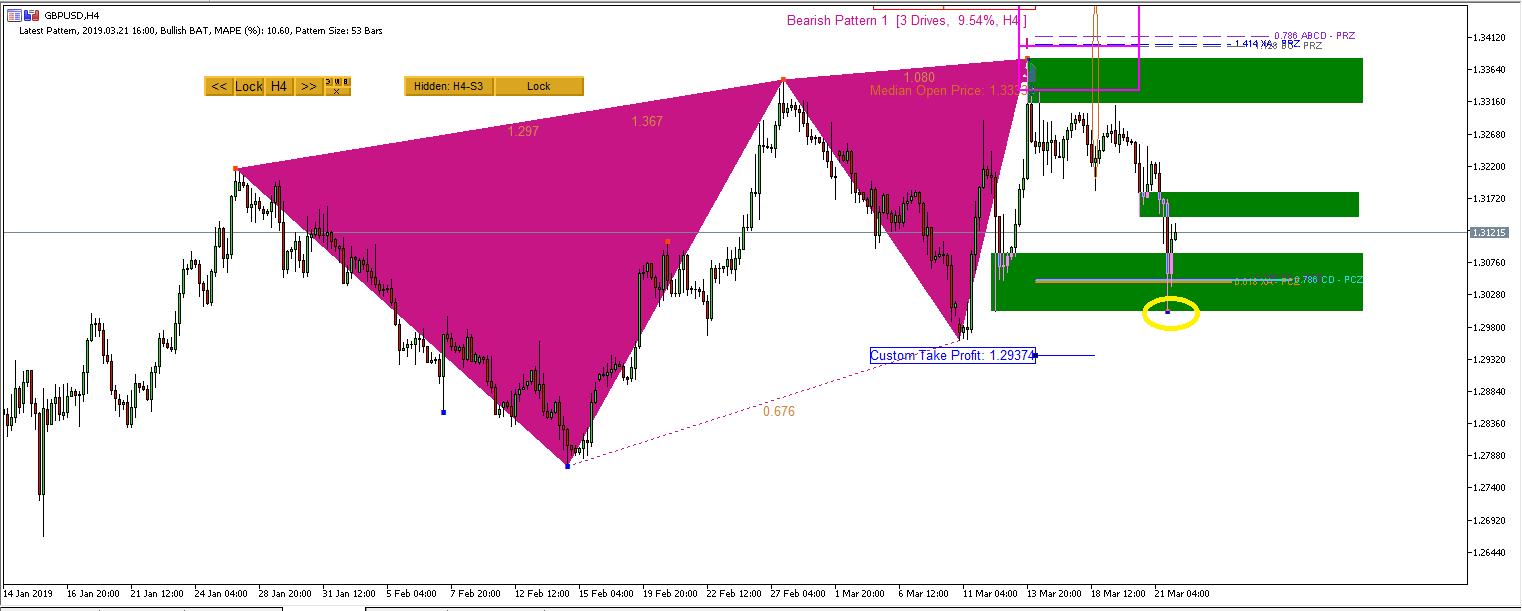

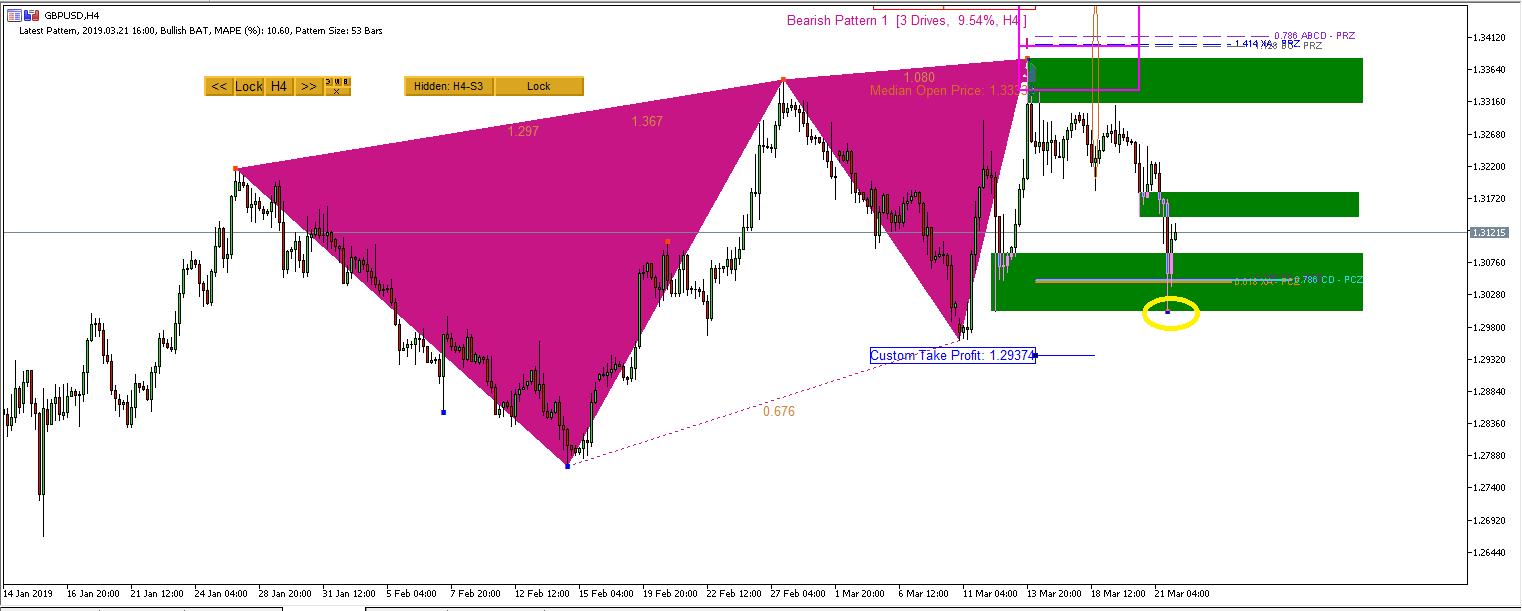

Advanced Harmonic Pattern Detection Indicator

Harmonic Pattern Scenario Planner is an advanced Harmonic Pattern Detection Indicator. This is probably the most sophisticated harmonic pattern detection indicator in the market.

Harmonic Pattern Scenario planner can be used like Harmonic Pattern Plus. Hence, it is easy and friendly to use. At the same time, it combines powerful Monte Carlos Simulation to provide you advanced harmonic pattern search capability.

Monte Carlo Simulation can help you to find future reversal points in advance.

For your information, we provide two YouTube videos with title and links below. Although these two videos are not created using the Harmonic Pattern Scenario Planner, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Here is the product link to Harmonic Pattern Scenario Planner. You can find more about the features of this advanced Harmonic Pattern Scenario Planner.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Harmonic Pattern Scenario Planner is an advanced Harmonic Pattern Detection Indicator. This is probably the most sophisticated harmonic pattern detection indicator in the market.

Harmonic Pattern Scenario planner can be used like Harmonic Pattern Plus. Hence, it is easy and friendly to use. At the same time, it combines powerful Monte Carlos Simulation to provide you advanced harmonic pattern search capability.

Monte Carlo Simulation can help you to find future reversal points in advance.

For your information, we provide two YouTube videos with title and links below. Although these two videos are not created using the Harmonic Pattern Scenario Planner, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Here is the product link to Harmonic Pattern Scenario Planner. You can find more about the features of this advanced Harmonic Pattern Scenario Planner.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Young Ho Seo

Special Discount for Happy Christmas on MetaTrader Indicators and Scanners

The Festive Season is a time for celebration, enjoyment, and goodwill, especially at the Christmas. However, Christmas is bound to look different this year due to the attack of the COVID 19. However, still, we can have the best Christmas this year with our family and friends. Just make sure to keep the basic guide line to be safe from the COVID 19 during this Festive Season.

By the way, in this Christmas, we will provide over 50 dollar direct discounts on the following MetaTrader 4 and MetaTrader 5 products on mql5.com. Make sure that you get these MetaTrader indicators and scanners before they go back to the original price.

◾Ace Supply Demand Zone indicator (150 to 100 dollar)

◾Advanced Price Pattern Scanner (230 to 180 dollar)

◾Elliott Wave Trend (250 to 200 dollar)

◾Price Breakout Pattern Scanner (150 to 100 dollar)

◾Harmonic Pattern Scenario Planner (150 to 100 dollar)

◾X3 Chart Pattern Scanner (358 to 280 dollar)

◾Excessive Momentum Indicator (250 to 200 dollar)

For your information, above price does not include 20% VAT. The discounted MetaTrader products are available from the link below:

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

The Festive Season is a time for celebration, enjoyment, and goodwill, especially at the Christmas. However, Christmas is bound to look different this year due to the attack of the COVID 19. However, still, we can have the best Christmas this year with our family and friends. Just make sure to keep the basic guide line to be safe from the COVID 19 during this Festive Season.

By the way, in this Christmas, we will provide over 50 dollar direct discounts on the following MetaTrader 4 and MetaTrader 5 products on mql5.com. Make sure that you get these MetaTrader indicators and scanners before they go back to the original price.

◾Ace Supply Demand Zone indicator (150 to 100 dollar)

◾Advanced Price Pattern Scanner (230 to 180 dollar)

◾Elliott Wave Trend (250 to 200 dollar)

◾Price Breakout Pattern Scanner (150 to 100 dollar)

◾Harmonic Pattern Scenario Planner (150 to 100 dollar)

◾X3 Chart Pattern Scanner (358 to 280 dollar)

◾Excessive Momentum Indicator (250 to 200 dollar)

For your information, above price does not include 20% VAT. The discounted MetaTrader products are available from the link below:

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Young Ho Seo

New Article Released -Turning Point, Peak, Trough, Swing High, Swing Low, and ZigZag

We have released an important article for your practical financial trading. Please make sure to read this article to enhance your trading performance. This article explains the important terminology for your trading like Turning point, peak, trough, swing high, swing low and zigzag.

More articles will be followed shortly. Then enjoy this free articles for your trading education.

https://algotrading-investment.com/2020/04/06/turning-point-peak-trough-swing-high-swing-low-and-zigzag/

https://algotrading-investment.com/2019/07/23/trading-education/

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

Below is the landing page for Fractal Pattern Scanner.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Below is the landing page for Optimum Chart

https://algotrading-investment.com/2019/07/23/optimum-chart/

We have released an important article for your practical financial trading. Please make sure to read this article to enhance your trading performance. This article explains the important terminology for your trading like Turning point, peak, trough, swing high, swing low and zigzag.

More articles will be followed shortly. Then enjoy this free articles for your trading education.

https://algotrading-investment.com/2020/04/06/turning-point-peak-trough-swing-high-swing-low-and-zigzag/

https://algotrading-investment.com/2019/07/23/trading-education/

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

Below is the landing page for Fractal Pattern Scanner.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Below is the landing page for Optimum Chart

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

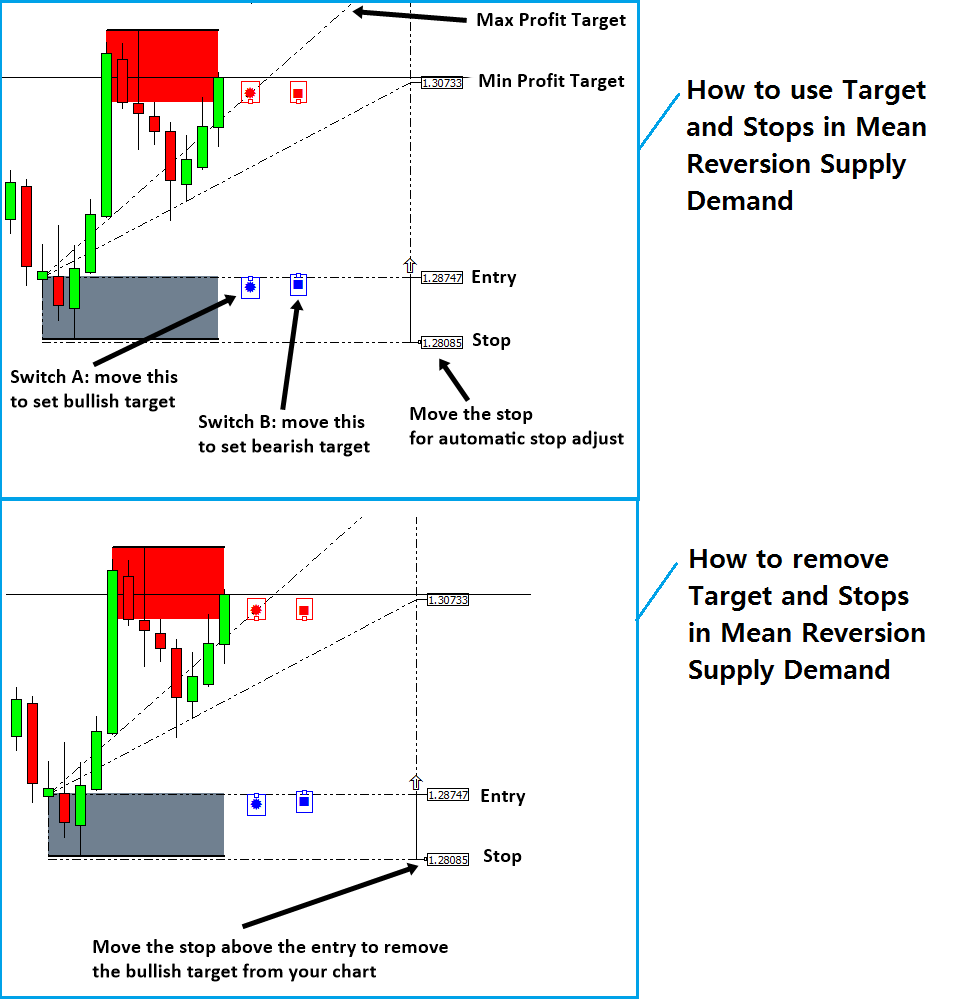

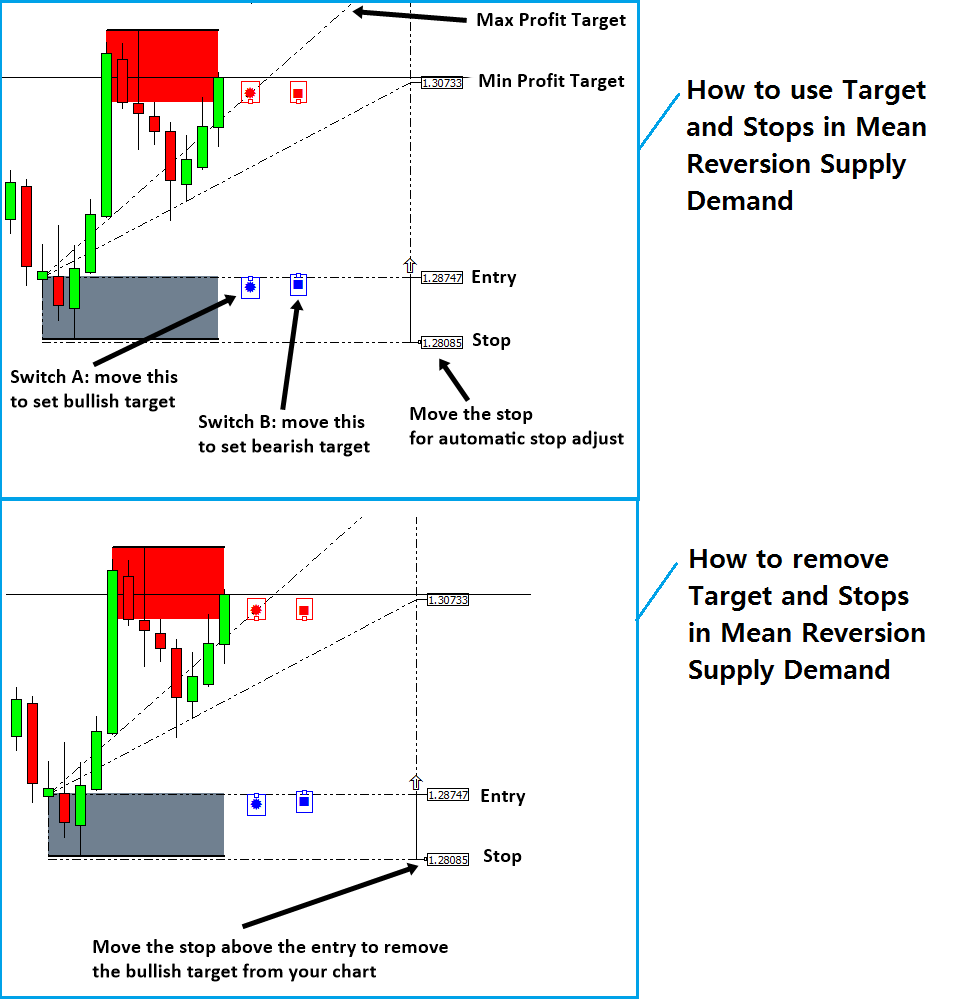

Ace Supply Demand Zone Indicator – How to Remove Take Profit and Stop Loss Levels

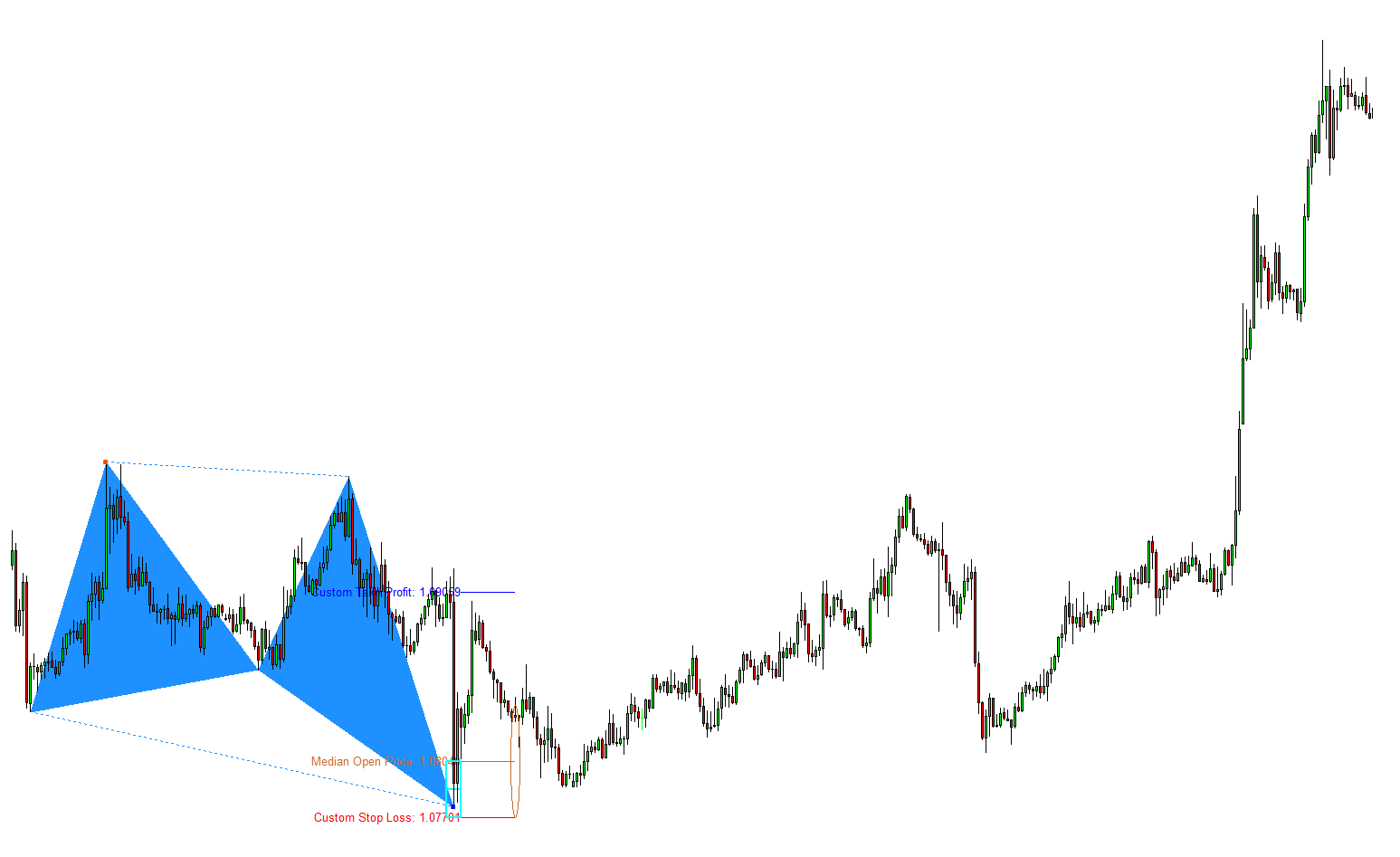

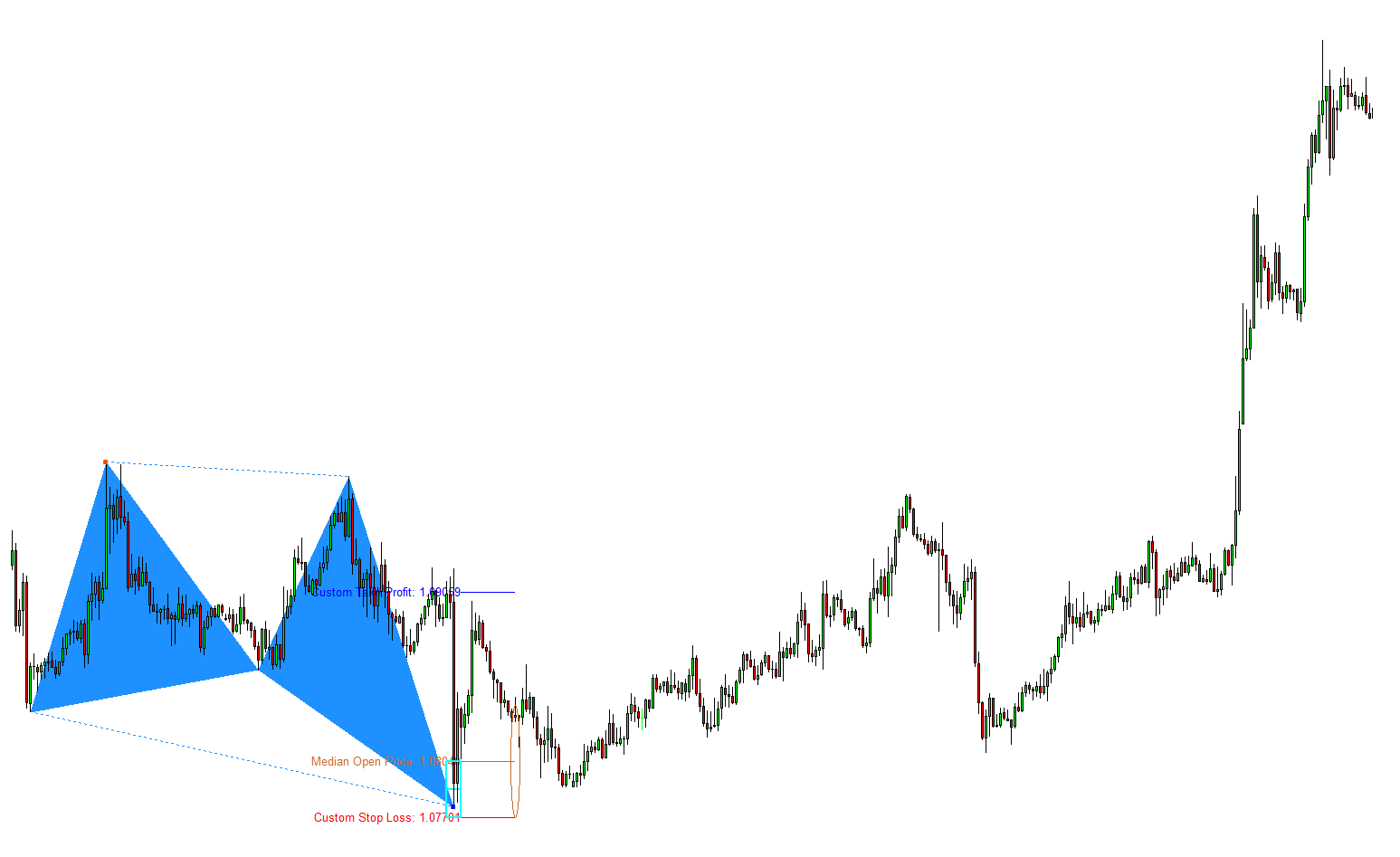

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

New Article – Insignificant Turning Point, Local Turning Point and Global Turning Point

Here is another article explaining some useful concept for your Forex and Stock Market Trading. Of course, this is free article to improve your trading performance. The article explain what are the insignificant turning point, global turning point and local turning point when you trade with reversal trading setup.

https://algotrading-investment.com/2020/06/01/insignificant-turning-point-local-turning-point-and-global-turning-point/

In addition, you can also have an access to important free articles for your trading here.

https://algotrading-investment.com/2019/07/23/trading-education/

=======================

There are several class of technical analysis useful to pick up the turning point. For example, Harmonic Pattern and Elliott Wave Patterns are one of them. Here is the list of few Harmonic Pattern Indicator available in MetaTrader 4 and MetaTrader 5.

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the repainting but non lagging Harmonic Pattern Scanner. You can get them for the affordable price. Below is links for them.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern, Elliott Wave pattern and X3 pattern Scanner. Below is links for them.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Here is another article explaining some useful concept for your Forex and Stock Market Trading. Of course, this is free article to improve your trading performance. The article explain what are the insignificant turning point, global turning point and local turning point when you trade with reversal trading setup.

https://algotrading-investment.com/2020/06/01/insignificant-turning-point-local-turning-point-and-global-turning-point/

In addition, you can also have an access to important free articles for your trading here.

https://algotrading-investment.com/2019/07/23/trading-education/

=======================

There are several class of technical analysis useful to pick up the turning point. For example, Harmonic Pattern and Elliott Wave Patterns are one of them. Here is the list of few Harmonic Pattern Indicator available in MetaTrader 4 and MetaTrader 5.

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the repainting but non lagging Harmonic Pattern Scanner. You can get them for the affordable price. Below is links for them.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern, Elliott Wave pattern and X3 pattern Scanner. Below is links for them.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Young Ho Seo

Special Discount for Happy Christmas on MetaTrader Indicators and Scanners

The Festive Season is a time for celebration, enjoyment, and goodwill, especially at the Christmas. However, Christmas is bound to look different this year due to the attack of the COVID 19. However, still, we can have the best Christmas this year with our family and friends. Just make sure to keep the basic guide line to be safe from the COVID 19 during this Festive Season.

By the way, in this Christmas, we will provide over 50 dollar direct discounts on the following MetaTrader 4 and MetaTrader 5 products on mql5.com. Make sure that you get these MetaTrader indicators and scanners before they go back to the original price.

Ace Supply Demand Zone indicator (150 to 100 dollar)

Advanced Price Pattern Scanner (230 to 180 dollar)

Elliott Wave Trend (250 to 200 dollar)

Price Breakout Pattern Scanner (150 to 100 dollar)

Harmonic Pattern Scenario Planner (150 to 100 dollar)

X3 Chart Pattern Scanner (358 to 280 dollar)

Excessive Momentum Indicator (250 to 200 dollar)

For your information, above price does not include 20% VAT. The discounted MetaTrader products are available from the link below:

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

The Festive Season is a time for celebration, enjoyment, and goodwill, especially at the Christmas. However, Christmas is bound to look different this year due to the attack of the COVID 19. However, still, we can have the best Christmas this year with our family and friends. Just make sure to keep the basic guide line to be safe from the COVID 19 during this Festive Season.

By the way, in this Christmas, we will provide over 50 dollar direct discounts on the following MetaTrader 4 and MetaTrader 5 products on mql5.com. Make sure that you get these MetaTrader indicators and scanners before they go back to the original price.

Ace Supply Demand Zone indicator (150 to 100 dollar)

Advanced Price Pattern Scanner (230 to 180 dollar)

Elliott Wave Trend (250 to 200 dollar)

Price Breakout Pattern Scanner (150 to 100 dollar)

Harmonic Pattern Scenario Planner (150 to 100 dollar)

X3 Chart Pattern Scanner (358 to 280 dollar)

Excessive Momentum Indicator (250 to 200 dollar)

For your information, above price does not include 20% VAT. The discounted MetaTrader products are available from the link below:

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Young Ho Seo

Tutorial Using Excessive Momentum and Fibonacci Ratio Analysis

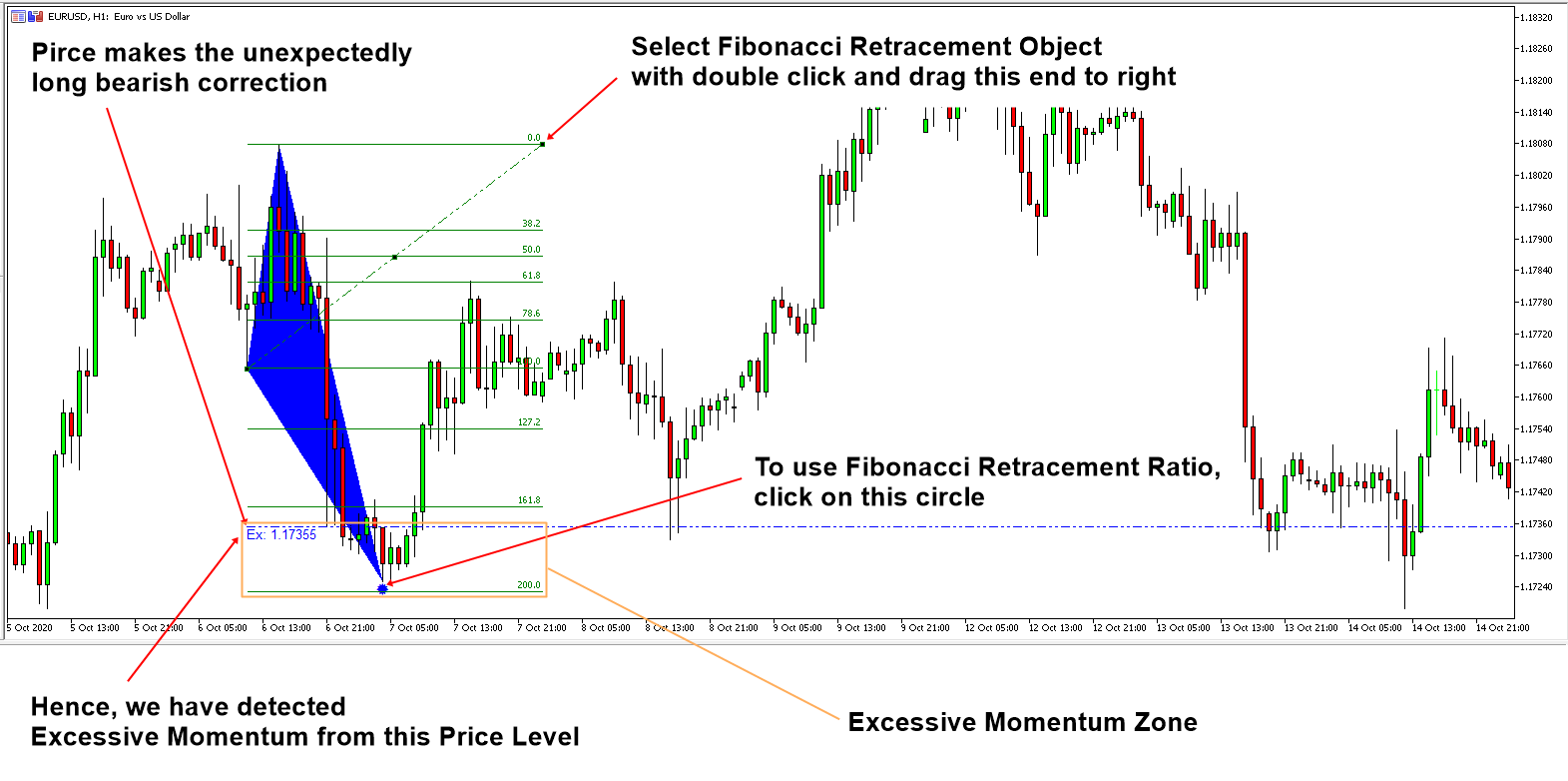

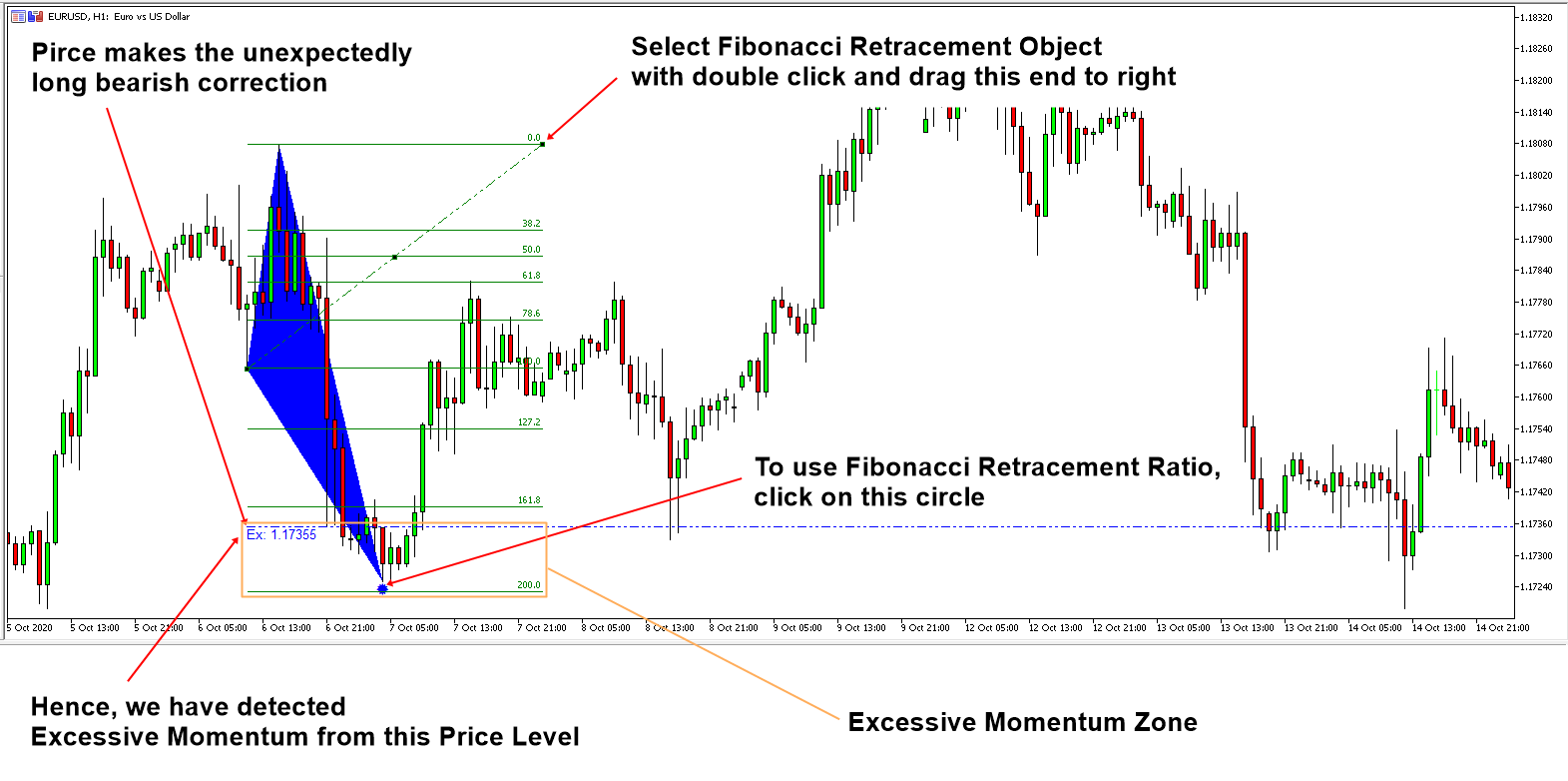

With Excessive Momentum Indicator, you can access to the automatic Fibonacci Ratio Analysis. Combining these two powerful trading system are the excellent ways to trade in Forex market. In this article, we will show you how to combine both with step by step guide.

When there is an unexpectedly long bearish and bullish price movement, the indicator will detect these excessive momentum area for your trading. This excessive momentum zone are often the true accumulation and distribution area in the Volume Spread Analysis. What does this mean for your trading ?This means that entry around this excessive momentum area can provide you the great advantage that favors your Reward and Risk for your trading whether they are breakout trading or reversal trading. The indicator provides such a great opportunity automatically.

In addition, Fibonacci retracement level can provide further idea about when the price can move according to our expectation. To call the Fibonacci retracement level automatically, simply click on the circle at the Excessive Momentum Zone. Then it will place the Fibonacci retracement level automatically in your chart. The thing is that the placed Fibonacci Retracement level might be too short in its width. Sometime, you want to project the Fibonacci Retracement level far right to see the price action around the retracement level. It is doable too.

To do so, double click on the Fibonacci retracement object in your chart. Then you will see the three anchor points in the retracement object. Drag the right anchor point to the right. You can drag them as far as you want to cover the chart area at your interest. Please check the screenshot attached to complete this tutorial.

This Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can watch the YouTube videos to find more about the Excessive Momentum Indicator.

YouTube Video 1: https://youtu.be/oztARcXsAVA

YouTube Video 2: https://youtu.be/A4JcTcakOKw

===========================================================================

Here is link to Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

With Excessive Momentum indicator, you can use our Free Volume Spread Pattern Detector. Volume Spread Pattern Detector is a great free tool to complete your Volume Spread Analysis to detect Accumulation and Distribution. Or even you can use them to detect important support and resistance for your trading too. Here is the link to the free Volume Spread Pattern Detector.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

In addition, Volume Spread Pattern Indicator is the more advanced version of Volume Spread Pattern Detector. If you want to improve your trading performance even more, then we recommend using Volume Spread Pattern Indicator. This is not free indicator but it is affordable. Here is the link to the Advanced Volume Spread Analysis indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

With Excessive Momentum Indicator, you can access to the automatic Fibonacci Ratio Analysis. Combining these two powerful trading system are the excellent ways to trade in Forex market. In this article, we will show you how to combine both with step by step guide.

When there is an unexpectedly long bearish and bullish price movement, the indicator will detect these excessive momentum area for your trading. This excessive momentum zone are often the true accumulation and distribution area in the Volume Spread Analysis. What does this mean for your trading ?This means that entry around this excessive momentum area can provide you the great advantage that favors your Reward and Risk for your trading whether they are breakout trading or reversal trading. The indicator provides such a great opportunity automatically.

In addition, Fibonacci retracement level can provide further idea about when the price can move according to our expectation. To call the Fibonacci retracement level automatically, simply click on the circle at the Excessive Momentum Zone. Then it will place the Fibonacci retracement level automatically in your chart. The thing is that the placed Fibonacci Retracement level might be too short in its width. Sometime, you want to project the Fibonacci Retracement level far right to see the price action around the retracement level. It is doable too.

To do so, double click on the Fibonacci retracement object in your chart. Then you will see the three anchor points in the retracement object. Drag the right anchor point to the right. You can drag them as far as you want to cover the chart area at your interest. Please check the screenshot attached to complete this tutorial.

This Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can watch the YouTube videos to find more about the Excessive Momentum Indicator.

YouTube Video 1: https://youtu.be/oztARcXsAVA

YouTube Video 2: https://youtu.be/A4JcTcakOKw

===========================================================================

Here is link to Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

With Excessive Momentum indicator, you can use our Free Volume Spread Pattern Detector. Volume Spread Pattern Detector is a great free tool to complete your Volume Spread Analysis to detect Accumulation and Distribution. Or even you can use them to detect important support and resistance for your trading too. Here is the link to the free Volume Spread Pattern Detector.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

In addition, Volume Spread Pattern Indicator is the more advanced version of Volume Spread Pattern Detector. If you want to improve your trading performance even more, then we recommend using Volume Spread Pattern Indicator. This is not free indicator but it is affordable. Here is the link to the Advanced Volume Spread Analysis indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Young Ho Seo

Forex Market Analysis with Artificial Intelligence telling the breakout trading opportunity. Sit back and enjoy the presentation delivered by Artificial Intelligence Forex Market Analyst for your day trading.

We try to produce the useful videos for Forex trader more often. Please subscribe to the YouTube Channel if you wish to receive the immediate alert when we upload new forex market prediction video.

https://youtu.be/KzIacVFHYd0

We try to produce the useful videos for Forex trader more often. Please subscribe to the YouTube Channel if you wish to receive the immediate alert when we upload new forex market prediction video.

https://youtu.be/KzIacVFHYd0

Young Ho Seo

New Article –Rolling Ball Effect and Harmonic Pattern Trading

Rolling ball effect is something you must understand for your reversal trading. Especially, if you are interested in harmonic pattern trading or elliott wave trading or rising wedge or falling wedge patterns, then this is a must understand concept before using them in practice. You can save tons of money in trading by reading this simple article.

Read entire free article from below link:

https://algotrading-investment.com/2020/06/01/rolling-ball-effect-and-harmonic-pattern-trading/

In addition, you can also have an access to important free articles for your trading here.

https://algotrading-investment.com/2019/07/23/trading-education/

You can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

In addition, here is the landing page for two harmonic pattern scanner available in MetaTrader 4 and MetaTrader 5 platform in regards to above YouTube video. First one is harmonic pattern plus and the second one is the X3 Chart Pattern Scanner.

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the powerful harmonic pattern indicator at affordable cost with tons of advanced features. Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the repainting but non lagging Harmonic Pattern Scanner. Below is links for Harmonic Pattern Plus.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern and X3 pattern Scanner. X3 Chart Pattern Scanner is the most advanced Harmonic Pattern and X3 Price Pattern Scanner. In addition, X3 Chart Pattern Scanner is built in with 52 Japanese Candlestick patterns + advanced Channel. Below is links for X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Rolling ball effect is something you must understand for your reversal trading. Especially, if you are interested in harmonic pattern trading or elliott wave trading or rising wedge or falling wedge patterns, then this is a must understand concept before using them in practice. You can save tons of money in trading by reading this simple article.

Read entire free article from below link:

https://algotrading-investment.com/2020/06/01/rolling-ball-effect-and-harmonic-pattern-trading/

In addition, you can also have an access to important free articles for your trading here.

https://algotrading-investment.com/2019/07/23/trading-education/

You can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

In addition, here is the landing page for two harmonic pattern scanner available in MetaTrader 4 and MetaTrader 5 platform in regards to above YouTube video. First one is harmonic pattern plus and the second one is the X3 Chart Pattern Scanner.

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the powerful harmonic pattern indicator at affordable cost with tons of advanced features. Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the repainting but non lagging Harmonic Pattern Scanner. Below is links for Harmonic Pattern Plus.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern and X3 pattern Scanner. X3 Chart Pattern Scanner is the most advanced Harmonic Pattern and X3 Price Pattern Scanner. In addition, X3 Chart Pattern Scanner is built in with 52 Japanese Candlestick patterns + advanced Channel. Below is links for X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Supply and Demand Zone with Harmonic Pattern Indicator

Supply and Demand Zone are the most important concept for your trading. Supply and Demand zone can be effectively combined with Harmonic Pattern Indicator to improve your trading performance. This is not about the number but about geometry. Your ability to combine these geometry together with Harmonic Pattern Indicator can typically form the secret trading recipes for your successful career. Here is the list of Supply and Demand Zone Indicator that can go together with your harmonic pattern indicator.

Mean Reversion Supply Demand

Classic supply and demand zone indicator. This tools is the great to produce highly accurate supply and demand zone.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

This is also great supply and demand zone tool extending the ability of Mean Reversion Supply Demand. What is even better? This is non repainting one. This is the great tool for different level of trader.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Supply and Demand Zone are the most important concept for your trading. Supply and Demand zone can be effectively combined with Harmonic Pattern Indicator to improve your trading performance. This is not about the number but about geometry. Your ability to combine these geometry together with Harmonic Pattern Indicator can typically form the secret trading recipes for your successful career. Here is the list of Supply and Demand Zone Indicator that can go together with your harmonic pattern indicator.

Mean Reversion Supply Demand

Classic supply and demand zone indicator. This tools is the great to produce highly accurate supply and demand zone.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

This is also great supply and demand zone tool extending the ability of Mean Reversion Supply Demand. What is even better? This is non repainting one. This is the great tool for different level of trader.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

Introduction to Harmonic Pattern Scenario Planner

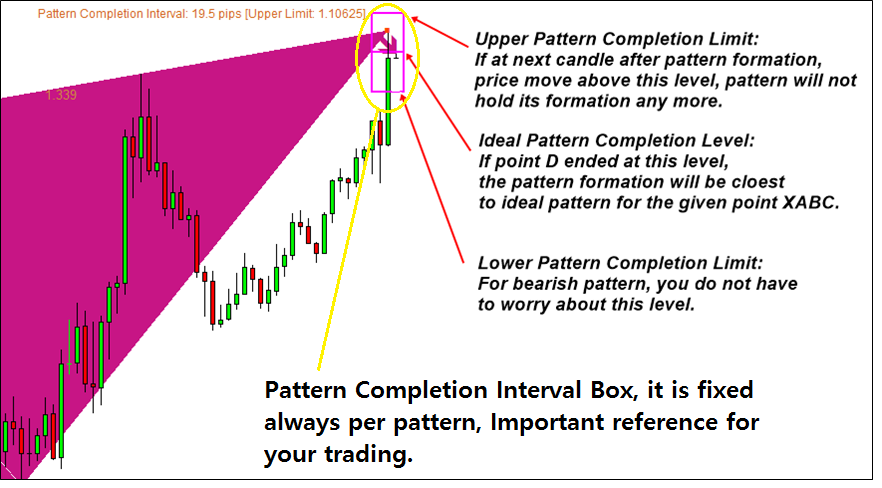

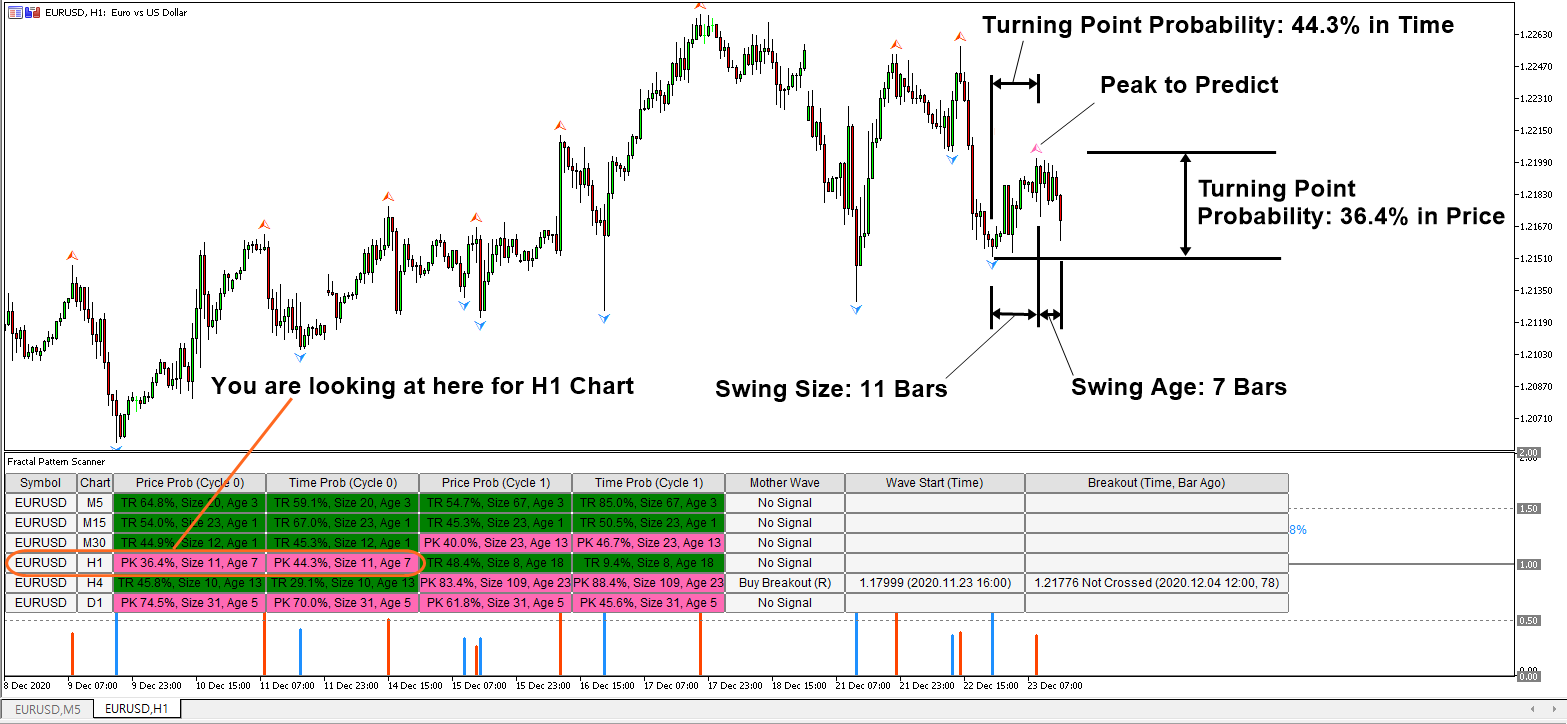

The present state of Forex market can go through many different possible price paths to reach its future destination. Future is dynamic. Therefore, planning your trade with possible future scenario is an important step for your success. To meet such a powerful concept, we introduce the Harmonic Pattern Scenario Planner, the first predictive Harmonic Pattern Tool in the world among its kind.

Main Features

Predicting future patterns for scenario analysis

11 Harmonic Pattern Detection

Automatic stop loss and take profit recognition for superb risk management

Pattern Completion Interval for precision trading

Potential Continuation Zone Detection for future price prediction

Potential Reversal Zone Detection for Point D identification

Automatic Channel Detection to go with Harmonic Pattern (Optional)

Multiple timeframe Pattern Analysis

Multiple timeframe Pattern Detection

Guided Trading Instruction for professional traders

Pattern Locking and Unlocking feature in your chart

Even more, please find it out.

Scenario Simulation for Future Harmonic Pattern

There are powerful simulation techniques known to generate possible future price patterns like Monte Carlos Simulation, Brownian motion simulation, etc. To do so, we need to understand the price behavior including distribution and its randomness. Then we repeat the simulation as many times as possible to identify various future price path. Some future price path may be very important for your trading whereas some other price path may be insignificant. Harmonic Pattern Scenario Planner collects those significant price paths only for your advance trading decision.

How to Use

You can run Harmonic Pattern Scenario Planner like Harmonic Pattern Plus to pick up the turning point. At the same time, you can predict the future patterns for the advanced scenario analysis. The predicted pattern can be used for the earlier decision making for your trading.

Reduce commission and slippage using pending orders in advance

Worst case scenario planning before taking position

Early identification of important support and resistance lines automatically in advance

More accurate prediction of entry and exit timing

How to Trade

Each Harmonic Pattern provides you the potential entry for the turning point. You might apply few other filters to improve your trading. Some of the basic filters you can apply include RSI, CCI, MACD, Bollinger Bands, and Moving Average. More advanced filter can include Price Breakout Pattern Scanner, Mean Reversion Supply Demand, Elliott Wave Trend, and Harmonic Volatility Indicator. Please note that the trading performance can vary for your trading experience and trading skills.

Indicator Input

Here we list part of input setting. For full input setting, visit this webpage:

https://algotrading-investment.com/2018/10/25/short-guideline-for-harmonic-pattern-plus-and-harmonic-pattern-scenario-planner/

Harmonic Pattern Parameters 1 ( User Option ) ===========================

These parameters below concerns operations of Harmonic patterns. You can change button size, timeframe to detect patterns and alerts using these parameters. You can change timeframe of pattern detection. However, you cannot use smaller timeframe pattern detection for higher timeframe. For example, you cannot set Timeframe to detect patterns = H1 timeframe while you are using D1 chart.

Timeframe to detect Patterns

Max number of patterns to display

Pattern Index from which to display

Enable sound alert

Send email if pattern is found

Send notification if pattern is found

Display Fibo retracement (DC Future Price Projection)

Fibo Retracement Length

Fibo Retracement Color for pattern

Fibo Retracment Wdith for pattern

Use white background for chart

Amount of bars to scan for pattern search (1500 = default)

Detect Pattern at Every Tick: true or false only

Pattern Update Frequency (Period)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

The present state of Forex market can go through many different possible price paths to reach its future destination. Future is dynamic. Therefore, planning your trade with possible future scenario is an important step for your success. To meet such a powerful concept, we introduce the Harmonic Pattern Scenario Planner, the first predictive Harmonic Pattern Tool in the world among its kind.

Main Features

Predicting future patterns for scenario analysis

11 Harmonic Pattern Detection

Automatic stop loss and take profit recognition for superb risk management

Pattern Completion Interval for precision trading

Potential Continuation Zone Detection for future price prediction

Potential Reversal Zone Detection for Point D identification

Automatic Channel Detection to go with Harmonic Pattern (Optional)

Multiple timeframe Pattern Analysis

Multiple timeframe Pattern Detection

Guided Trading Instruction for professional traders

Pattern Locking and Unlocking feature in your chart

Even more, please find it out.

Scenario Simulation for Future Harmonic Pattern

There are powerful simulation techniques known to generate possible future price patterns like Monte Carlos Simulation, Brownian motion simulation, etc. To do so, we need to understand the price behavior including distribution and its randomness. Then we repeat the simulation as many times as possible to identify various future price path. Some future price path may be very important for your trading whereas some other price path may be insignificant. Harmonic Pattern Scenario Planner collects those significant price paths only for your advance trading decision.

How to Use

You can run Harmonic Pattern Scenario Planner like Harmonic Pattern Plus to pick up the turning point. At the same time, you can predict the future patterns for the advanced scenario analysis. The predicted pattern can be used for the earlier decision making for your trading.

Reduce commission and slippage using pending orders in advance

Worst case scenario planning before taking position