VWAP Diaria

- Göstergeler

- Samuel De Souza Ferreira

- Sürüm: 1.0

Daily VWAP — Institutional Reference for Intraday Value

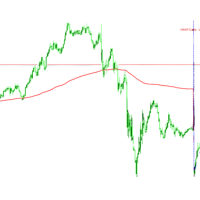

The Daily VWAP is a professional indicator based on the Volume-Weighted Average Price (VWAP), designed to reveal the true balance between price and volume throughout the trading session.

Unlike traditional moving averages, the Daily VWAP incorporates the weight of traded volume in every price movement, providing a much more accurate reference to the behavior of institutional traders and large market participants.

What the indicator delivers

📊 Session-Based Cumulative VWAP

The VWAP line is calculated continuously from market open to a user-defined close and is automatically reset at the end of the session. This ensures a clean and consistent daily reading without contamination from previous days.

⏰ Customizable Market Hours

Users can define:

-

Session opening time

-

Session closing/reset time

This allows perfect adaptation to different markets, brokers, and time zones.

🔄 Intelligent Volume Handling

-

Prioritizes real volume whenever available

-

Automatically falls back to tick volume when necessary to maintain calculation continuity and stability.

How to interpret it in practice

-

Price above VWAP → bullish bias (acceptance of higher prices).

-

Price below VWAP → bearish bias (acceptance of lower prices).

-

Touches and returns to VWAP → potential equilibrium zones and market reactions.

-

Extreme distance from VWAP → possible overstretch or exhaustion of the move.

Ideal for

✔ Day traders and scalpers

✔ Index, currency, and commodity traders

✔ Equity and Nasdaq traders

✔ Forex and crypto traders

✔ Strategies based on flow, mean reversion, and breakouts

Why choose Daily VWAP

The Daily VWAP is not just another average — it is an intraday value map that helps traders to:

-

Read institutional flow

-

Filter low-probability trades

-

Identify zones of imbalance and fair value

-

Trade with more context and less noise