Swing Trader Pro

- Göstergeler

- Emma-ekong Ben Eshiet

- Sürüm: 2.0

- Etkinleştirmeler: 20

N/B: All our product purchase comes with our free ‘’DAILY SCALPER EA’’ - bit.ly/4qlFLNh

Whatsapp Developer for yours after successful purchase

Swing Failure Master - COMPLETE TRADING GUIDE

WHAT THIS INDICATOR REALLY DOES

Think of this indicator as a "Market Detective" that looks for fake breakouts that trap traders. It finds spots where price tries to break through a level but gets rejected and reverses.

HOW IT WORKS (Simple Terms)

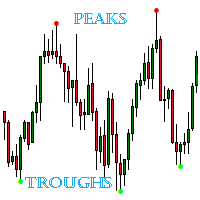

1. Finds Important Levels - Looks for swing highs (mountain tops) and swing lows (valley bottoms)

2. Waits for a "Trap" - Price breaks through that level (this is the "sweep" - it traps traders)

3. Looks for "Proof" - Price reverses and shows strong momentum the other way (this is the "CISD" - Change In State of Delivery)

4. Gives Signal - Says "Hey, that breakout was fake! Price is reversing!"

HOW TO TRADE WITH IT EFFECTIVELY

STEP 1: UNDERSTAND THE SIGNALS

BUY SIGNAL (Green Arrow) = FAKE DOWNSIDE BREAKOUT

· Price breaks below a swing low (liquidity grab)

· Then reverses UP with strong momentum

· "They tried to push it down but got rejected"

SELL SIGNAL (Red Arrow) = FAKE UPSIDE BREAKOUT

· Price breaks above a swing high (liquidity grab)

· Then reverses DOWN with strong momentum

· "They tried to push it up but got rejected"

STEP 2: WAIT FOR CONFIRMATION

DO NOT BUY AT THE ARROW! The arrow shows where the signal triggered, but you need:

For BUY Signals:

1. Wait for price to CLOSE above the PIVOT line (dashed green line)

2. Enter on retest to pivot line or on next bullish candle

3. Stop Loss: Below the swing low that was broken

4. Take Profit: Use the lines shown or 1:1.5 Risk:Reward

For SELL Signals:

1. Wait for price to CLOSE below the PIVOT line (dashed red line)

2. Enter on retest to pivot line or on next bearish candle

3. Stop Loss: Above the swing high that was broken

4. Take Profit: Use the lines shown or 1:1.5 Risk:Reward

STEP 3: READ THE CHART OBJECTS

When a signal appears, you'll see:

```

PIVOT LINE (Dashed) ────────┐

│ This was the level that got broken

ENTRY LINE (Blue) ───────┤ Your entry price

STOP LOSS (Red) ───────┤ Where to exit if wrong

TAKE PROFIT (Green) ───────┤ Where to take profits

```

The distance between ENTRY and SL = Your risk

The distance between ENTRY and TP = Your reward

WHAT MAKES SIGNALS "POP-UP"

The indicator looks for 3 specific conditions:

CONDITION 1: THE SWEEP (The Trap)

· Price must break a previous swing high/low

· This happens within last 50 bars (configurable)

· Why this matters: This sweeps stop losses and creates liquidity

CONDITION 2: THE CISD (The Proof)

· After the sweep, candle structure changes direction

· Strong momentum in opposite direction

· Must meet minimum strength (TrendNoiseFilter = 0.7)

· Why this matters: Shows institutional players stepping in

CONDITION 3: THE PATIENCE (The Timing)

· Must happen within 7 bars (configurable) of the sweep

· Why this matters: Ensures reaction is immediate and relevant

HOW VALID ARE THE SIGNALS?

VALIDITY FACTORS (Strongest to Weakest)

HIGH VALIDITY SIGNALS:

1. On Higher Timeframes (H4, Daily signals are stronger than M5, M15)

2. At Key Market Hours (London/NY open overlap)

3. With Volume Confirmation (High volume on reversal)

4. At Major Support/Resistance (Combined with trendlines, Fibonacci)

5. Multiple Timeframe Alignment (Signal on H1, confirmed on H4)

MEDIUM VALIDITY SIGNALS:

1. During normal trading hours

2. At minor support/resistance

3. Single timeframe only

LOW VALIDITY SIGNALS:

1. During low liquidity (Asian session)

2. During news events

3. In choppy/range-bound markets

4. Very small sweeps (tiny breakouts)

SUCCESS RATE ENHANCERS:

Add these to increase success:

· Trend Filter: Only trade in direction of higher timeframe trend

· Volume Spike: Look for above-average volume on reversal candle

· Market Structure: Signal aligns with market structure shift

· Confluence: Signal appears at Fibonacci level, pivot point, etc.

PRACTICAL TRADING SETUP

RECOMMENDED SETTINGS:

For DAY TRADING (M5-M15):

· PivotLength: 8-10

· MaxPivotEdge: 30-40

· Patience: 3-5

· TrendNoiseFilter: 0.6

For SWING TRADING (H4-Daily):

· PivotLength: 12-15

· MaxPivotEdge: 50-60

· Patience: 7-10

· TrendNoiseFilter: 0.7-0.8

TRADE MANAGEMENT:

Entry:

1. Wait for signal arrow

2. Wait for price to close beyond pivot line

3. Enter on retest or next candle in direction

Stop Loss:

· Use the red SL line shown

· Or below/above the swept level

· Never move stop loss against your trade

Take Profit:

· Use the green TP line shown

· Take partial profit at 1:1 RR

· Move stop to breakeven at 1:1 RR

· Let runner go to TP2 (if shown)

COMMON MISTAKES TO AVOID

1. Trading every signal - Quality over quantity

2. Entering at the arrow - Wait for confirmation

3. Ignoring higher timeframe trend - Trade with the trend

4. Moving stop losses - Respect your initial risk

5. Overtrading during news - Avoid high-impact news times

SCANNER USE

For Finding Opportunities:

1. Click "SCAN MARKET" button

2. Look for symbols showing "BUY" or "SELL"

3. Check which timeframe the signal is on

4. Higher "Strength" numbers = stronger signals

5. ALWAYS verify on chart before trading

REAL EXAMPLE SCENARIO

Perfect BUY Signal:

1. EURUSD daily chart shows uptrend

2. Price breaks below yesterday's low (sweep)

3. Next candle closes as bullish engulfing (CISD)

4. Signal appears at key Fibonacci 61.8% level

5. High volume on reversal candle

6. Result: High probability reversal trade

Perfect SELL Signal:

1. GBPUSD 4H chart shows downtrend

2. Price breaks above recent swing high (sweep)

3. Next candle closes as bearish engulfing (CISD)

4. Signal at major resistance level

5. Rejection wick visible

6. Result: High probability continuation trade

PRO TIPS

1. Paper trade first - Test for 2 weeks before real money

2. Keep journal - Record every trade, win or lose

3. Start small - 0.5% risk per trade maximum

4. Be patient - 2-3 good signals per day is plenty

5. Use multiple timeframes - H4 for direction, H1 for entry

QUICK REFERENCE

Green Arrow + PIVOT Line = Potential BUY

· Means: Fake downside breakout, going up

· Entry: Above pivot line, on retest

· SL: Below swept low

· TP: 1.5x your risk minimum

Red Arrow + PIVOT Line = Potential SELL

· Means: Fake upside breakout, going down

· Entry: Below pivot line, on retest

· SL: Above swept high

· TP: 1.5x your risk minimum

Remember: The market is always right. This indicator helps you read what the market is telling you about fake breakouts and liquidity grabs. Trade with patience, follow your rules, and let the probabilities work in your favor!

ANY TIME YOU SEE A SIGNAL, ASK:

1. "Is this in the direction of the higher timeframe trend?"

2. "Is there volume confirmation?"

3. "Is this at a key level?"

4. "Am I following my risk management?"

If YES to all 4, you have a high-probability trade!

ATTENTION ALL TRADERS!

Are You Tired of Getting STOPPED OUT Just Before Price Reverses?

What if you could see exactly where the "smart money" is trapping retail traders and RIDE THEIR LIQUIDITY to consistent profits?

---

INTRODUCING: SWING FAILURE MASTER PRO

The World's First Complete "Liquidity Hunt" Detection System That Reveals Institutional Traps in REAL-TIME!

---

THE PAINFUL TRUTH ABOUT WHY YOU'RE LOSING MONEY:

You buy the "breakout" only to watch it reverse immediately

You get stopped out at the exact low/high before price moves your way

You can't distinguish between REAL breakouts and FAKE liquidity grabs

You're trading blind while institutions are actively hunting your stops

You lack a clear system for entries, stops, and profit targets

Sound familiar? That's because you're being LIQUIDITY for the banks and hedge funds.

---

REMEMBER:

The banks and institutions are making billions by understanding market structure and liquidity. Now YOU have the same tool they use. The question is: Will you keep giving them YOUR money, or will you start taking THEIRS?