Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 5725

- Derecelendirme:

- Yayınlandı:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

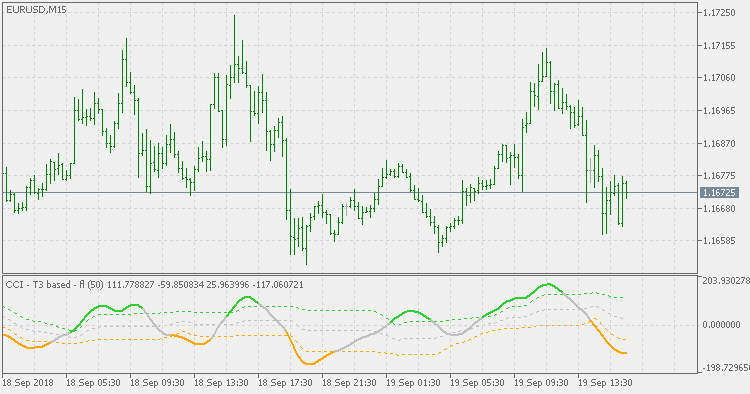

Basics :

Usually CCI is calculated as using average (Simple Moving Average) and mean deviation. That produces the well known CCI that we all are using.

Smoother results can be achieved in multiple ways. Prices can be smoothed prior to being used in calculation (average or deviation), and then the average and deviation can be replaced.

This version :

In this version, average is replaced with T3 and the deviation is replaced with EMA deviation. The reason for not using T3 deviation is simple: T3 deviation can be negative and that makes it non-suitable to be used for CCI calculation, but in any case, the result in this one is responsive and fast (as expected) and also it is smoother than the original CCI (also as expected). It also adds floating levels (instead of using fixed levels) which makes it more responsive to market conditions changes, and also makes it a sort of an adaptive CCI

Usage :

You can use the color changes as signals when using this indicator

Corrected RSX

Corrected RSX

Corrected RSX

High frequency volatility trader ( EURUSD H1 ONLY)

High frequency volatility trader ( EURUSD H1 ONLY)

Expert advisor uses the difference between bar closes and a close moving average to detect unusual activity, it will then buy arbitrary volatility spikes. This is a prototype that I will be expanding on in the future, at the moment the user can input an arbitrary level to buy at. In future developments I plan on building a neural network in the EA that detects and compares volatility levels.