Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 4618

- Derecelendirme:

- Yayınlandı:

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

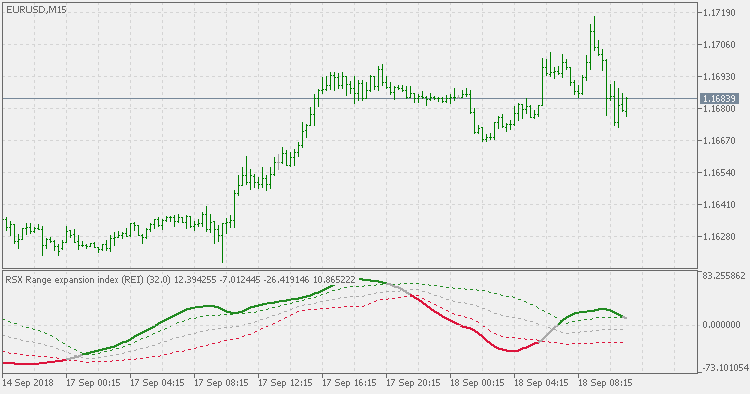

Range Expansion Index (REI) definition :

Range Expansion Index (REI) is an

oscillator that measures price changing rate and signals about

overbought/oversold areas, in case a price shows weakness or strength.

It was developed by Thomas DeMark and described in his book "The New Science of Technical Analysis".

The indicator values change from -100 up to +100. REI is an enhanced oscillator, as it stays neutral during a flat and shows trends only when considerable top or bottom have been reached.

This version :

This version is made according to Mark Jurik's idea : according to him, REI can be made as rsx(high) + rsx(low) - and the result should be much smoother. So, this version is doing exactly that. Also, this version is adding floating levels in order to make the trend changes spotting easier. You have an option to chose between two color changing modes :

- color change when outer levels are crossed

- color change when middle level (a sort of a "zero line") is crossed

Usage :

In this version use color changes change as potential trend start and end signals

RSX range expansion index - with confidence bands

RSX range expansion index - with confidence bands

RSX range expansion index - with confidence bands

Volatility Indicator

Volatility Indicator

Great indicator for Time series analysis as shows stationary properties. Indicator calculates the difference between a 14 period Double exponential moving average and price closes. Great to help identify unusual price activity.