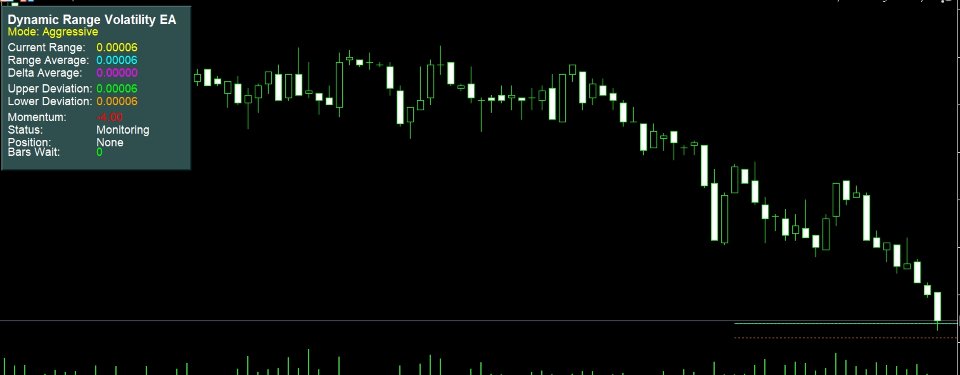

Dynamic Range Volatility EA

- Эксперты

- AL MOOSAWI ABDULLAH JAFFER BAQER

- Версия: 1.0

- Активации: 5

Dynamic Range Volatility EA

This Expert Advisor is provided in its raw, unoptimized form. It is created for you to adjust, fine-tune, and optimize according to your preferred trading instruments, timeframes, and risk tolerance.

The Dynamic Range Volatility EA is built on a dynamic grid trading approach that adapts to changing market conditions. Instead of fixed step sizes, it calculates the trading range dynamically by measuring recent price volatility. This means grid spacing widens during high volatility and narrows during quieter market periods.

How it works:

-

Volatility Measurement – The EA measures recent market range using Average True Range (ATR) and other volatility-based logic.

-

Dynamic Grid Placement – Orders are placed at adaptive intervals above and below the current price, with spacing determined by current volatility.

-

Position Management – Each grid order is managed independently with an optional take-profit target. No fixed stop loss is applied by default, allowing the system to capture oscillations within the calculated volatility range.

-

Risk Controls – Includes configurable lot sizing, maximum order limits, and volatility filters to suit your preferred balance between frequency and exposure.

Customization Options:

-

Adjustable grid step multiplier

-

Take-profit per position

-

Maximum open trades

-

Volatility threshold for entry

-

Lot size and money management

This EA is designed for traders who value flexibility. It can be used across different symbols and timeframes, but optimal results come from carefully tuning the parameters for each specific market environment.