AUD, NZD, CAD

Data Review

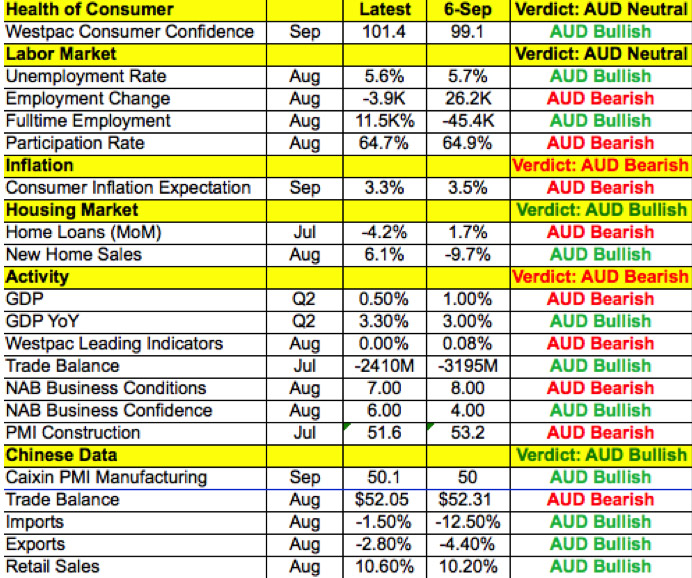

Australia

· Caixin China Manufacturing PMI 50.1 vs. 50.1 Expected

New Zealand

· NZD Trade Balance -1265m vs. -735m Expected

· NZD Balance (YTD) -3131m vs. -2675m Expected

Canada

· OPEC Announces First Production in 8 Years

· CAD GDP (MoM) 0.5% vs. 0.3% Expected

Data Preview

Australia

· RBA Rate Decision – No changes expected

· PMI Manufacturing- Likely to be weaker after strong AUD

· PMI Services and Retail Sales- Will have to see from PMI manufacturing

· Trade Balance- Likely to be weaker after strong AUD

New Zealand

· No Data

Canada

· International Merchandise Trade- Potential for downside surprise given sharp drop in IVEY

· Employment Report and IVEY PMI- IVEY released after CAD employment so best traded reactively

Key Levels

· Support AUD .7500 NZD .7200 CAD 1.3000

· Resistance AUD .7700 NZD .7400 CAD 1.3300

Commodity currencies will be in play next week with the Reserve Bank of Australia’s monetary policy announcement and Canada’s employment report scheduled for release. On Friday we learned that Canadian GDP growth accelerated more than expected in the month of July. The improvement was driven largely by trade activity because retail sales declined. This report should have no impact on next week’s trade and labor market data. Canada reported strong job growth in August with a particularly healthy increase in full time work so we would not be surprised by some payback in September. Canada’s employment and IVEY PMI report are not scheduled for release until Friday which means that oil will continue to have a significant impact on the currency. While OPEC’s decision to cut production is a significant one, some investors expressed skepticism about the actual execution and the subsequent effect the deal would have on the supply. The issue at hand is that output levels have not been strictly defined for OPEC countries. Even when the levels are defined, the effectiveness of OPEC comes into question. The lack of detail has many investors worried that the deal could break down between now and November. So while we are bullish the Canadian dollar, we prefer selling USD/CAD at the top of its range rather than the bottom.

The Reserve Bank of Australia has a lot to think about when they meet on Tuesday. The last time they convened they expressed confidence in the trend of growth and labour market. Their neutral bias was a breath of fresh air compared to the dovish sentiment expressed by the Reserve Bank of New Zealand and the Bank of England. The country’s PMI manufacturing report will be released ahead of the meeting and the outcome could shape monetary policy expectations. While the RBA is not expected to change interest rates, adjustments to their outlook could have a meaningful impact on the currency. Taking a look at the table below, there was no consistent improvement or deterioration in the economy since the last meeting. There are also no major economic reports scheduled for release from New Zealand. The Treasury is expected to publish its monthly economic indicators but the impact on NZD should be limited.

http://siellafx.com