DS Moving Average Gradient

- 지표

- Richard Segrue

- 버전: 1.2

- 업데이트됨: 26 9월 2025

- 활성화: 5

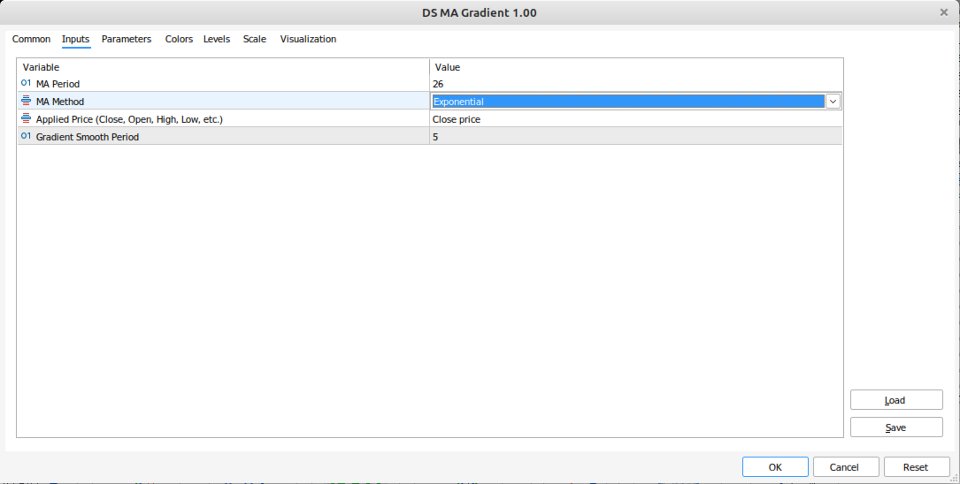

The DS Moving Average Gradient indicator is a technical analysis tool that displays the gradient of a selected moving average in a separate subwindow. Users can select from four moving average types: Simple (SMA), Exponential (EMA), Smoothed (SMMA), and Linear Weighted (LWMA). Additionally, the indicator offers the option to apply simple moving average smoothing to the calculated gradient or display the raw, unsmoothed gradient values.

This indicator quantifies the rate of change (slope) of the underlying moving average, delivering enhanced analytical capabilities that extend beyond traditional moving average interpretations. By measuring momentum dynamics rather than just price direction, the gradient provides traders with more nuanced market insights for improved decision-making and timing precision.

Key Value:

Trend Strength Detection - While a moving average shows trend direction, the gradient reveals how strong or weak that trend is. A steep positive gradient indicates accelerating upward momentum, while a flattening gradient suggests the trend is losing steam even before price reverses.

Early Warning System - The gradient often changes direction before the moving average itself crosses key levels or before price breaks trend lines. This gives traders earlier signals for potential trend changes or momentum shifts.

Momentum Confirmation - It helps confirm whether a breakout or trend continuation has genuine momentum behind it. A strong gradient supports the validity of a move, while a weak gradient might suggest a false breakout.

Entry and Exit Timing - Traders can use gradient peaks and troughs to time entries and exits more precisely. For example, entering on gradient acceleration rather than waiting for traditional crossover signals.

Filtering Signals - It helps filter out weak or sideways market conditions where traditional moving average crossovers might generate false signals. A flat or oscillating gradient suggests choppy, non-trending conditions.

The gradient essentially transforms a lagging indicator (moving average) into something more responsive to momentum changes, making it particularly useful for trend-following strategies and momentum-based trading approaches.