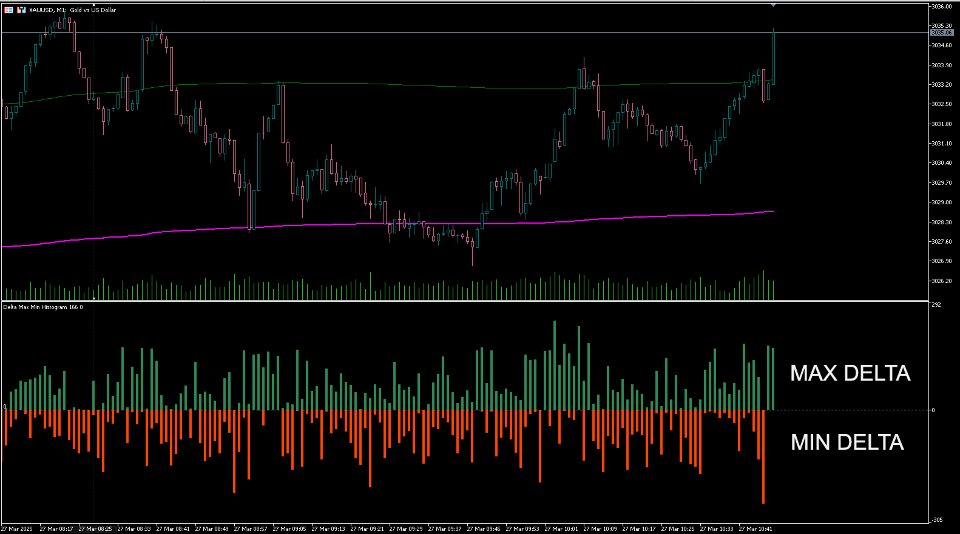

Max Min Delta Indicator

- 지표

- TitanScalper

- 버전: 2.0

- 활성화: 5

Gain Deeper Insights into Market Volume Imbalance with Delta Analysis

What is the Max Min Delta Indicator?

The Max Min Delta Indicator is a powerful market volume analysis tool that visually represents maximum and minimum delta values using a histogram. It helps traders identify market strength, weakness, absorption, and aggressive buying/selling activity with precision.

Key Features

Histogram Visualization: Displays Max Delta (Green) and Min Delta (Red) as bars, helping you quickly assess order flow and volume imbalances.

Buy/Sell Pressure Analysis: Easily detect when buyers or sellers are dominating based on delta extremes.

Perfect for Scalpers & Day Traders: Helps confirm breakouts, reversals, and absorption zones at key support/resistance levels.

Works with Any Market: Compatible with Forex, Commodities (XAUUSD, Oil), Indices, and Cryptos on MetaTrader 5.

Lightweight & Fast: Optimized for performance, ensuring smooth operation even on lower-end systems.

How It Works

Max Delta (Green Histogram) shows the maximum positive delta within each candle, indicating aggressive buying pressure.

Min Delta (Red Histogram) shows the minimum negative delta, highlighting strong selling activity.

The zero line acts as a neutral reference, making it easy to compare bullish vs bearish dominance.

Who Should Use This Indicator?

Scalpers & Day Traders: Identify entry/exit points based on volume imbalances.

Order Flow Traders: Analyze absorption and aggressive trading patterns.

Smart Money Traders (SMC & Wyckoff): Validate BOS/CHOCH and liquidity shifts.

Technical Specifications

Platform: MetaTrader 5 Timeframes: All supported timeframes Markets: Forex, Commodities, Indices, Cryptocurrencies Performance: Lightweight and optimized for all system types

Usage Applications

This indicator provides professional delta analysis for understanding market microstructure and volume imbalances. The histogram format allows traders to quickly identify periods of aggressive buying or selling activity and validate trading decisions with order flow analysis.

Perfect for traders focusing on volume-based analysis, breakout confirmations, and identifying absorption zones where institutional activity may be occurring.