+54,958 USD 🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing

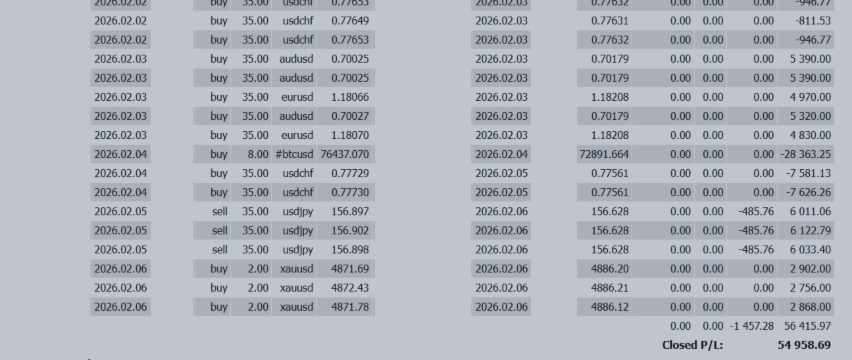

+54,958 USD

🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing

— Early February, “taking only what the market offered amid rough seas” —

✅ Weekly Trading Summary (Feb 2–Feb 6)

📊 Weekly P/L: +54,958 USD

Overall market conditions were volatile, but this was a week where clear separation between markets to trade and markets to avoid worked effectively.

-

GOLD: Consistently functioned as the main battlefield

-

FX (AUD/USD, EUR/USD, USD/JPY): Stable contributors to profits

-

BTC, USD/CHF: Acted as noise factors, detracting from performance

As a result, despite the high-volatility environment, profits were secured steadily.

The strategy of focusing on “FX + GOLD” will remain intact.

🧭 Market Environment Recap (Week of Feb 2)

This week’s market was driven by the simultaneous interaction of three forces:

-

Japanese political events

-

Repricing of U.S. dollar credibility

-

Sharp moves in commodity markets

Rather than clear direction, the market was dominated by price swings first — a “shaking” market.

🇯🇵 Japanese Yen: Politically Driven Weakness as the Foundation

-

Ahead of the Lower House election (Feb 8), expectations of a ruling coalition advantage expanded

-

Remarks by Prime Minister Takaichi were interpreted as tolerance for yen weakness, prompting overseas investors to add yen shorts

-

USD/JPY shifted its range higher into the late-156s to 157 area

-

Cross-yen pairs generally remained resilient

However, beneath the surface:

-

Memories of intervention and rate checks around 159 in January

-

Messages from the U.S. side that excessive dollar strength / yen weakness is undesirable

These factors remain active, creating an asymmetric structure where the higher prices go, the more unstable conditions become.

🇺🇸 U.S. Dollar: Peak Distrust Has Passed, but Confidence Is Not Absolute

With Warsh nominated as the next Fed Chair:

-

Excessive concerns over central bank independence eased

-

The assumption of “unconditional, one-way dollar selling” was revised

This has shifted the dollar into an environment where intermittent buying is more likely.

That said, uncertainty around U.S. employment and inflation data persists, preventing conviction strong enough to turn dollar strength into a full trend.

🪙 Gold & Silver: Sharp Sell-Off Signals “Excess Risk Cleansing”

Gold and silver dropped sharply from record-high territory due to:

-

Unwinding of leveraged positions

-

A reset of the assumption that “safe assets are always bought unconditionally”

This briefly triggered yen buying and dollar selling in FX.

However, Japan’s political yen-selling pressure limited its durability.

👉 Commodity volatility ultimately remained a short-term trigger, not a lasting driver.

🔮 Market Blueprint for Next Week (Feb 9–)

— A week where “results → interpretation → reallocation” accelerate rapidly —

Next week is likely to be defined less by the size of events and more by the speed of interpretation.

Key feature:

-

👉 Markets may produce an early, seemingly conclusive move at the start of the week

-

👉 That move could be easily overturned by U.S. data later on

In other words:

-

Don’t over-believe the initial move

-

Don’t be late in reassessing

That balance is critical.

🟢 Scenario A: Outcome Viewed as “Within Expectations”

Market reaction

-

Political events pass smoothly

-

Yen selling continues but with limited momentum

-

USD/JPY holds elevated levels but struggles to extend higher

Market psychology

-

“Not bad, but no new reason to buy more”

-

Yen shorts remain, but new entries slow

Price behavior

-

Gradual holding at higher levels

-

Shallow pullbacks

-

Range becomes fixed at a high altitude

👉 More a position-maintenance market than a trend.

🟡 Scenario B: Gap Between Expectations and Reality Is Noted

Market reaction

-

Early-week yen selling stalls quickly

-

Profit-taking and hedging drive yen buying

-

Large swings, but no clear direction

Market psychology

-

“Perhaps this was over-priced”

-

Focus shifts from politics to U.S. data

Price behavior

-

Strong in the morning, reversals in Europe/U.S.

-

Long wicks both up and down

-

High volatility, but no follow-through

👉 The most difficult trading environment.

🔴 Scenario C: Market Feels “Something Is Off” (Tail Risk)

Market reaction

-

Risk-off dominates from the start of the week

-

Yen short covering accelerates

-

Stocks, FX, and commodities may move simultaneously

Market psychology

-

“The premise has broken”

-

Reducing positions becomes the top priority

Price behavior

-

Speed that defies explanation

-

Pullbacks fail to work

-

Prices fall even without headlines

👉 Position adjustment, not fundamentals, takes control.

🧠 The Core of Next Week (Most Important Point)

Next week is about:

Not “what the result was,” but “how the market interpreted it.”

The same outcome can lead to completely opposite price action depending on whether it is processed optimistically or skeptically.

🛠 Practical Trading Mindset

-

Don’t chase the initial move early in the week

-

Target the second move after direction is tested

-

Assume positions will be trimmed around U.S. data releases

👉 Next week, reaction speed matters more than direction.

📜 Afterword

What “winter exercise habits” teach us about trading longevity

This week felt like one where results were decided less by price action itself, and more by how calmly one engaged with the market.

Interestingly, recent insights from fitness and psychology translate almost directly into trading.

⛄ Winter Is About “Systems,” Not Willpower

Experts note that winter is actually the easiest season to build habits, because:

-

Schedules are more stable

-

External noise is reduced

-

There’s less pressure to force results

Markets are the same.

When flashy trends are absent, those who can wait calmly and follow rules are strongest.

🔥 Consistency Beats Intensity

In fitness:

-

“Just 5 minutes”

-

“Light is fine today”

These ideas create continuity.

In trading:

-

Don’t trade full size all the time

-

Don’t blame yourself for no-trade days

-

Treat the decision not to trade as a success

Low-pressure discipline leads to long-term stability.

🧠 Don’t Fight Your Energy

Experts emphasize not fighting your own energy.

On tired or unfocused days, forcing trades only increases mistakes.

If today doesn’t feel right, doing nothing can be the best risk management.

🌱 Habits Change Self-Evaluation

People who maintain winter exercise habits don’t label missed days as failures.

In trading:

-

No trade ≠ loss

-

No entry ≠ escape

The moment you think that way, psychology distorts.

Those who endure are kind to themselves, strict with their rules.

✨ Final Thought: Winter Builds the Foundation

Winter isn’t about chasing spectacular profits.

It’s about strengthening:

-

The ability to wait

-

The ability to reset

-

The ability to stay unshaken

Habits built in winter become weapons when spring volatility arrives.

Next week as well—

Not with willpower, but with systems.

Calmly. Steadily.

Let’s keep facing the market that way.