+25,278 USD “A Week Where Yen Selling and Distrust in the Dollar Collide — The Market Shifts from ‘Direction’ to a ‘War

+25,278 USD

“A Week Where Yen Selling and Distrust in the Dollar Collide — The Market Shifts from ‘Direction’ to a ‘War of Endurance’”

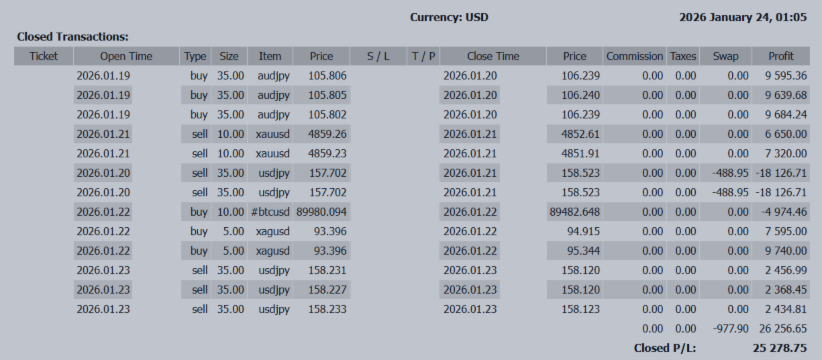

✅ Trading Results (Jan 19 – Jan 23)

📊 Weekly Total: +25,278 USD

📌 Market Overview

This week was not about building a trend.

It was a battle of attrition, where risk factors existed simultaneously for each major currency.

For the yen:

→ Japan’s fiscal concerns and election mode made it vulnerable to selling.

For the dollar:

→ U.S. political risk and declining confidence made it difficult to buy.

With both risks present at the same time,

the market structure became one where traders could not commit fully to either side.

🧭 The True Nature of the Market (1/19–1/23)

① The World Distrusted the U.S., and Japan Was Questioned on Fiscal Sustainability

In Europe, the Greenland issue reignited doubts about U.S. political stability, becoming a catalyst for dollar selling.

At the same time in Japan,

the dissolution election and tax-cut competition entrenched fears over fiscal sustainability,

firmly establishing yen selling pressure.

→ As a result:

Both the dollar and the yen became “currencies with credibility concerns.”

② USD/JPY: “Bought When It Falls, Questioned When It Rises”

-

Dollar selling from Europe pushed USD/JPY into the 157 area.

-

But Japan’s fiscal concerns quickly brought back yen selling.

-

The pair ultimately stagnated around 158.

Later in the week, with equity markets stabilizing,

the market shifted into a position-unwinding phase.

③ The Euro Was Bought as the “Least Bad Currency”

EUR/USD fell to the 1.157 area,

but rebounded sharply toward the high 1.17s as distrust in the U.S. intensified.

This was not because “Europe is strong,”

but because “the U.S. is questionable.”

The euro was chosen by default.

④ The Market’s Behavior Has Changed

-

Drops are followed by sharp rebounds

-

Rallies are met with sudden selloffs

-

Stop-hunting is frequent

Intervention fears and rate-check speculation constantly linger,

pushing the market into a full-fledged “distrust-driven environment.”

🛢 (Venezuela Issue: Market Interpretation)

The market is not pricing in a major war scenario.

Instead, it sees:

“Regime change → Sanction easing → Increased oil production”

Therefore, the risk of sustained crude oil spikes is not heavily priced in.

🔮 Core Theme for Next Week (Week of Jan 26)

Conclusion:

Both the yen and the dollar suffer from weak credibility.

Neither can be fully trusted.

→ This structure naturally favors a range-bound market.

| Force | Content |

|---|---|

| Yen selling pressure | Japan’s fiscal risk, election mode |

| Dollar selling pressure | U.S. political risk, FRB leadership uncertainty |

| Result | No clear breakout either way |

| USD/JPY range | 157 – 161 expected |

Base Structure

-

Downside: Limited because yen selling remains

-

Upside: Limited due to distrust in the U.S. and government warnings

→ A “move-and-return” market is the main scenario.

The biggest risk is any headline on the next Fed Chair.

This is not about interest rates, but about confidence shock.

EUR/USD: 1.1550 – 1.1950

The structure favors dollar selling,

making the euro difficult to push lower.

Again, it’s not “euro strength,”

but “dollar credibility erosion.”

🗓 Next Week’s “Minefield”

Most critical:

-

FOMC and Powell’s press conference

-

Headlines on the next Fed Chair

Japan-side:

-

Official campaign start for Lower House election

-

40-year JGB auction

-

BOJ minutes

🎯 Final Summary

This is not a market where you look for the “strongest currency.”

It is a market where you choose the “least problematic one.”

And above all:

This is not a market for predicting trends.

It is a market that tests your resistance to headlines.

Rather than hunting breakouts,

the priority is building a structure that survives sudden shocks.

📜 Afterword|“Those Who Control Sleep Become Stronger Against Market Noise”

Thank you for reading this week’s FX report.

Recent studies show that even small disruptions in sleep quality can significantly reduce:

-

Concentration

-

Judgment

-

Emotional control

Even something as simple as your partner’s snoring,

can become a hidden risk factor in trading.

😴 Sleep Deprivation Is the Strongest Counter-Trend Trigger

From a psychological perspective, lack of sleep causes:

-

More impulsive decisions

-

Distorted risk perception

-

Lower tolerance for losses

In other words,

just being sleep-deprived dramatically increases the chance of entering trades you normally wouldn’t.

📉 Market Noise and Sleep Noise Are Strikingly Similar

For snoring, common solutions include:

-

Earplugs

-

White noise

-

Environmental adjustments

-

Sleeping separately

These are exactly the same principles as trading discipline:

-

Stop watching too much news

-

Reduce position size

-

Step away from the market

All are methods of noise reduction.

🧠 Anxiety Can Be Reduced Through Environment

Many people think:

“I must strengthen my mental discipline.”

But in reality,

improving your environment is far more effective than trying to toughen your mind.

Good sleep conditions

Quiet time

Stable daily rhythm

These are hidden weapons that directly improve trading accuracy.

☕ Conclusion: Good Sleep Is the Best Trading Tool

Before technicals or fundamentals,

optimize your own condition.

When sleep is balanced:

-

Thoughts become calm

-

Decisions become clear

-

Market waves no longer feel overwhelming

Next week, before reading charts,

start by adjusting the noise in your body and mind,

and quietly wait for opportunity.