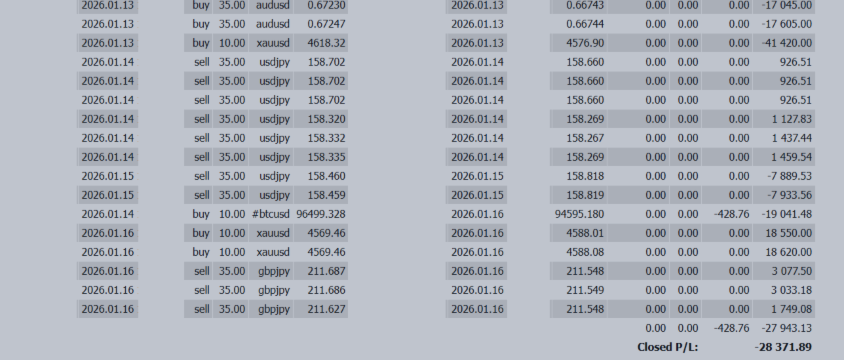

-28,371 USD The Yen Under Dual Control of “Politics and the U.S.” – Late January Marks the Entrance to a Trend Market

The Yen Under Dual Control of “Politics and the U.S.” – Late January Marks the Entrance to a Trend Market

✅ Trade Summary (Jan 12 – Jan 16)

📊 Weekly P/L: -28,371 USD

📉 Market Overview

This week was a market where “the direction was right, but the entry points were extremely difficult.”

The view toward yen strength was correct, but the rebounds were unusually powerful, making it a structure where the longer positions were held, the more exhausting and risky they became.

The current market has fully shifted into an “extremely nervous phase”:

-

Trends appear but struggle to continue

-

Counter-moves are fast and violent

-

Intervention risks, political remarks, and overseas headlines are always overhead

GOLD and BTC continue to attract attention as capital havens, but at the same time their volatility is also approaching extreme levels.

From here on, the strategy shifts to:

-

Fewer entries

-

Extremely tight stops

-

A “take-and-run” mindset

This is no longer a market to “predict and hit”, but a market to “defend while extracting profits.”

📊 Reconstructing the Recent Market (Jan 12 – Jan 16)

This period was not driven by economic indicators, but entirely by:

“Japanese politics × the U.S. stance.”

The essence of the market can be summarized in one straight line:

Japan leans toward fiscal expansion

→ Government bond selling

→ Declining confidence in the yen

→ Accelerated yen selling

What sealed this was speculation over Prime Minister Takaichi calling an early dissolution and general election.

USD/JPY temporarily climbed into the mid-159s, and the market began to see 160 yen as the next “political level.”

Then the brakes appeared:

-

Finance Minister Katayama

-

Vice Finance Minister Mimura

-

U.S. Treasury Secretary Bessent

All signaled concern over excessive yen weakness.

This clarified the structure:

-

The yen can weaken, but not in a straight line

-

Political pushback will always appear at higher levels

🌍 The Euro Downgraded to a “Geopolitical Risk Currency”

EUR/USD fell to 1.1593, and the cause was neither inflation nor growth.

It was:

Military and trade risk stemming from U.S.–EU tensions triggered by the Greenland issue.

As a result, the euro shifted from:

Stable currency

→ Currency carrying geopolitical risk

🔮 Market Themes Going Forward: Only Three

Despite appearances, the market is actually simple:

-

Japanese politics

-

The U.S. stance on FX

-

Central bank event week

Nothing else truly matters.

💱 USD/JPY Strategy View

Expected range: 157.00 – 162.00

▶ Core Structure

The yen is structurally weak.

Even if intervention occurs, the market sees it as only “buying time.”

If a general election is formally announced:

Fiscal expansion

→ Fiscal deterioration concerns

→ Entrenched yen selling

will likely restart.

▶ Maximum Risk

The only force that can create real yen strength is the United States.

If the following occur simultaneously:

-

U.S. Treasury warnings on yen weakness

-

Supreme Court rulings on Trump-era tariffs

-

FX correction pressure

USD/JPY could reverse several yen in an instant.

▶ Price Behavior

Downside: slow, shallow pullbacks

Upside: fast, but politically capped

Meaning:

-

Do not chase rallies

-

Dips get bought easily

A very unpleasant market structure.

💶 EUR/USD

Expected range: 1.1300 – 1.1700

As long as U.S.–EU tensions persist, rallies are likely to be sold.

Weak PMI data on Jan 23 could re-trigger downside pressure.

🇳🇿 NZD

Key event: Jan 23 CPI

A crucial indicator for defining the policy stance of the new RBNZ leadership.

🗓 Key Dates (by impact)

Jan 19 (Mon)

-

Prime Minister Takaichi press conference

-

China GDP (U.S. market closed)

Jan 22 (Thu)

-

ECB minutes

-

Final U.S. GDP

-

PCE

Jan 23 (Fri)

-

BOJ meeting

-

Governor Ueda press conference

-

Japan CPI

-

EU/US PMI flash

🧠 Final Summary

This market is no longer:

-

Technical

-

Fundamental

It is purely a “political-structure market.”

-

USD: the main actor

-

JPY: a political-risk currency

-

EUR: a geopolitical-risk currency

-

GOLD: safe haven

-

BTC: speculative capital sink

Winning now is less about prediction accuracy and more about:

“Whether you can endure without breaking.”

Not about “hitting,” but about “surviving.”

📜 Afterword

“Just as exercise stabilizes the mind, rules stabilize anxiety.”

Thank you for reading this week’s FX report.

Recent academic reviews show that exercise can be as effective as psychotherapy in improving depressive symptoms.

Not only medication or counseling, but movement itself helps regulate the brain and nervous system.

The same applies to financial anxiety and trading stress.

🧠 Anxiety is born not from “overthinking,” but from “not acting.”

Psychology shows that depression and anxiety are strongly linked to reduced activity levels.

The less we act, the more our thoughts turn inward and amplify fear.

The same is true in trading:

-

Vague rules

-

Stopped verification

-

No review process

This “thinking without acting” state magnifies anxiety beyond reality.

📊 Trading also needs its form of “exercise.”

If exercise resets the nervous system, then:

-

Backtesting

-

Journaling

-

Lot adjustment

-

Rule checks

are mental exercises that stabilize the mind.

Not so much to win,

but to prevent anxiety from accumulating.

☕ Don’t seek perfection, seek sustainability.

Research emphasizes that what matters is not perfection, but what can be continued.

The same is true in trading.

A rule you can follow calmly is far more powerful than a perfect strategy.

Financial anxiety comes less from money itself,

and more from the loss of control.

That is why even small actions that restore control

become the greatest source of reassurance.

Just as exercise stabilizes the mind,

rules stabilize the trader’s mind.

Next week as well,

don’t rush for wins.

Reduce anxiety one action at a time,

and face the market quietly and steadily.