✅ Yen Pauses as Tokyo Reopens — USD/JPY Heavy Near ¥154, Reversal Selling Dominates

✅ Yen Pauses as Tokyo Reopens — USD/JPY Heavy Near ¥154, Reversal Selling Dominates

💹 USD/JPY: Verbal Intervention Triggers Yen Rebound; Dips to ¥153 Handle Temporarily

Following the three-day weekend, Tokyo markets reopened to see USD/JPY retreat from ¥154.48 to the low ¥153s.

Despite the ongoing yen weakness trend, the pair met heavy resistance above ¥154,

prompting profit-taking and short-term corrective selling amid overbought signals.

Finance Minister Katayama commented:

“We are observing one-sided and rapid moves.”

“We are watching the market with a strong sense of urgency.”

These remarks prompted yen buying and temporary unwinding of carry trades by short-term players.

Conversely, Prime Minister Takaichi’s comments were interpreted as yen-negative:

“Inflation has not yet sustainably reached the BOJ’s target.”

“We expect the BOJ to continue appropriate monetary policy.”

Markets took this as validation of continued easing, supporting renewed yen selling.

📍 Net Result: A tug-of-war between verbal intervention-driven yen buying and policy-driven yen selling,

keeping USD/JPY volatile but anchored within ¥153–154.

🏦 Policy & Key Remarks Summary

| Speaker | Comment | Market Impact |

|---|---|---|

| FM Katayama | “Rapid one-sided moves; strong vigilance.” | Triggered yen rebound, profit-taking |

| PM Takaichi | “Inflation goal unmet; BOJ should act appropriately.” | Easing bias reaffirmed, yen selling support |

| ECB Officials | Lagarde, Lane, Nagel speeches | Policy continuity confirmed |

| Fed & BOE Officials | Bowman (Fed Vice Chair), Breeden (BOE Deputy Gov.) scheduled | May steer dollar sentiment later in NY session |

🌍 Overseas Developments: Quiet Trade; Adjustments Prevail

-

U.S.: With major economic data delayed due to the government shutdown, markets are left without direction, dominated by position adjustments.

-

Europe: Multiple ECB speeches reinforce the idea of an “economic stabilization phase,” reflecting confidence in reaching inflation goals.

-

U.K.: Sterling softened as the Financial Times reported Finance Minister Reeves is considering tax hikes — GBP/USD slid from 1.3130 → 1.3107.

📊 Tonight’s Key Events

| Region | Indicator/Event | Focus | Importance |

|---|---|---|---|

| 🇫🇷 France | Sept Fiscal Balance | Widening deficit could weigh on EUR | ★★ |

| 🇧🇷 Brazil | Sept Industrial Output | Emerging-market sentiment indicator | ★★ |

| 🇪🇺 Eurozone | ECB officials’ speeches | Policy stance reaffirmation | ★★★ |

| 🇺🇸 U.S. | Data releases delayed (gov. shutdown) | Data vacuum, limited drivers | ★ |

💱 London Session Overview

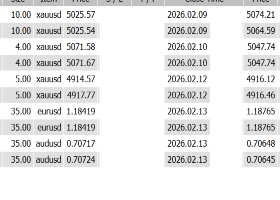

| Pair | Latest | Comment |

|---|---|---|

| USD/JPY | 154.10 | Heavy near highs, correction-driven moves |

| EUR/USD | 1.1518 | Dollar strength, euro dips to fresh lows |

| EUR/JPY | 177.49 | Cross-yen softening with risk trimming |

| GBP/USD | 1.3107 | Weighed by U.K. tax headlines |

| GBP/JPY | 201.20 | Capped by yen rebound, losing momentum |

✅ Summary: Yen Buying Pauses but Weak Bias Persists

The reopening of Tokyo prompted temporary yen buying,

but the underlying yen-weak narrative remains intact.

-

Katayama’s comments amount to verbal intervention, not action.

-

The Takaichi administration’s pro-easing stance continues to underwrite yen weakness.

🔍 Key Watchpoints Ahead

1️⃣ Whether ¥154 resistance continues to cap upside momentum

2️⃣ Duration of the U.S. government shutdown and impact on data releases

3️⃣ If U.K. tax hike speculation extends to broader European currency weakness

📈 Outlook:

Short-term corrections aside, the yen carry structure remains intact.

Until the BOJ shifts tone or U.S. yields retreat,

the yen’s relief rallies are likely to be temporary within a broader weakening trend.