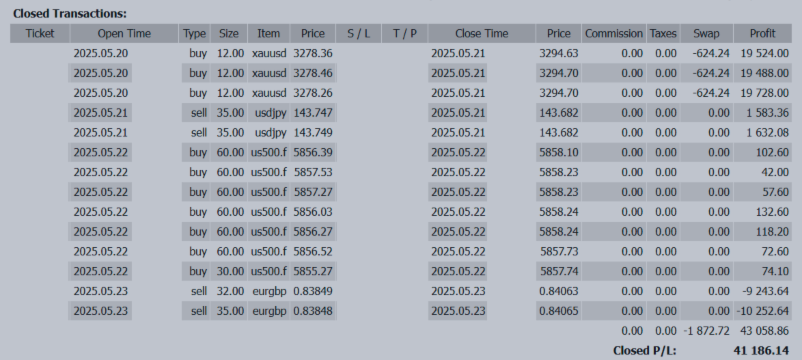

+41,186 USD Yen Strength Driven by Domestic Bond Auctions and U.S. Fiscal Risk

✅ [FX Market Review]

Yen Strength Driven by Domestic Bond Auctions and U.S. Fiscal Risk

Key Theme for the Week of May 26: “Auctions × Data”

📆 Period: May 19 (Mon) – May 24 (Sat)

💹 Weekly Realized P/L: +41,186 USD

🔍 Market Recap

Gold prices rose steadily, supported by a solid dollar-selling trend, and we were able to ride the wave with good timing.

However, by the weekend, market sentiment shifted dramatically. Former President Trump warned of a potential 50% tariff on EU goods, triggering broad selling in risk assets. U.S. equities, the euro, and the dollar all dropped sharply, resulting in a surge in volatility.

With the June 1 activation deadline approaching, trade negotiations are entering a critical stage. The week ahead will demand caution as geopolitical and policy events intersect.

📈 Currency Outlook | Week of May 26, 2025

◼️ USD/JPY

Markets will refocus on U.S. long-term yields, but a key event will be the Japanese 40-year bond auction on May 28, which may strengthen yen-buying pressure.

Additionally, concerns over the U.S. structural fiscal deficit and renewed talk of tax cuts are weighing on the dollar, creating a natural bias toward "yen buying + dollar selling."

Key U.S. releases include the FOMC minutes and core PCE. Depending on outcomes, a break below 143.00 is possible.

◼️ EUR/USD

Germany’s recent economic indicators have been soft, and expectations for an ECB rate cut this summer are gaining traction again.

However, as long as the dollar remains weak, the euro will remain relatively supported. Inflation data and the unemployment rate from May 27 onward will be key drivers.

Caution persists on euro-led gains, but the euro remains resilient in a dollar-driven market.

◼️ GBP/JPY

Persistent inflation is delaying expectations for a BOE rate cut, and progress in UK-EU trade relations is also supportive of the pound.

While PMI components were somewhat weak, the pound is likely to hold firm. A narrow range around the upper 160s to low 162s may dominate short-term movement.

◼️ CAD/JPY

Inflation data came in slightly stronger, but focus is now on Q1 GDP data (due May 30). If the result disappoints, BOC rate cut expectations could resurface.

Additionally, yen strength stemming from Japan’s long-term bond auction may affect all yen crosses, making CAD/JPY a potentially volatile pair in the near term.

◼️ AUD/JPY

Markets have mostly priced in three rate cuts by the RBA this year, which limits AUD upside.

However, if the May 28 CPI indicates accelerating inflation, expectations for a hawkish adjustment may reignite.

Local data (retail sales, housing) will also attract attention. Watch for short-term technical rebounds.

🧭 Summary

-

USD/JPY is likely to stay heavy due to Japan’s bond auction and ongoing U.S. fiscal concerns. Yen strength may intensify.

-

EUR and GBP will diverge depending on economic data. Euro faces pressure from ECB cut expectations, while the pound remains firm on strong inflation.

-

CAD and AUD are poised for large swings depending on upcoming economic indicators and central bank policy signals.