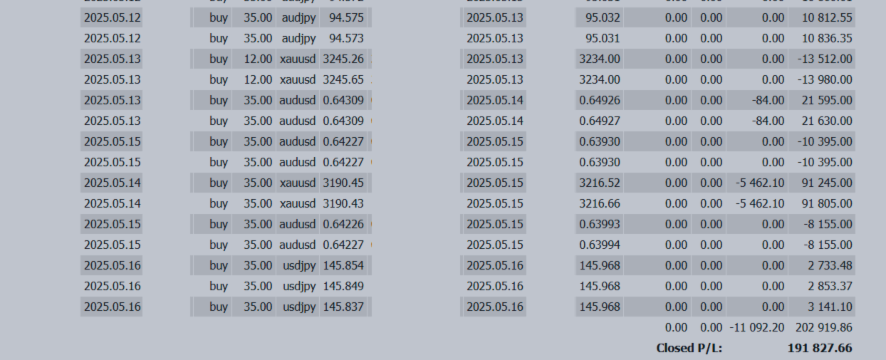

+191,827 USD Achieved! RBA Rate Cut & U.S.-Japan Trade Talks Hold the Key!

📈 Weekly Performance Report | May 12–16, 2025

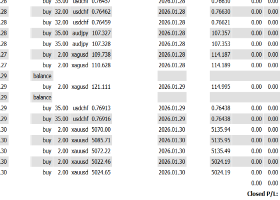

💰 Total Profit: +191,827 USD!

Markets turned risk-on following news of U.S.-China tariff easing, with the Australian dollar reacting particularly strongly. But the real game begins now—RBA rate cuts and U.S.-Japan negotiations are key.

📰 Market Overview

■ USD/JPY

Surged to 148.65 on tariff easing news but dropped sharply to the 145 range amid speculation over “yen depreciation correction” in U.S.-Japan talks. Short-term movements remain volatile.

■ EUR/USD

Lacked clear direction, moving in line with USD trends. Rebounded to 1.1266 but faced heavy resistance.

■ GBP/JPY & CAD/JPY

Briefly hit new YTD highs on risk-on sentiment but lost momentum alongside USD/JPY’s pullback.

■ AUD/JPY

Supported by U.S.-China talks and domestic political stability. Hit a new YTD high on May 13, but gains paused with USD/JPY's decline.

■ ZAR/JPY

Despite power outage and inflation concerns, remained firm. Support came from SARB and finance ministry policy adjustments.

📌 Key Focus for the Week Ahead | May 19, 2025

🔹 USD/JPY

- Focus on U.S.-Japan trade talks & currency correction debate

- Agricultural tariff discussions may introduce market risks

- Watch PMI flash data on May 22

🔹 EUR/USD

- Eurozone PMI & IFO may drive ECB rate cut speculation

- Lacks strong direction; likely to react to economic data

🔹 GBP/JPY

- Key data: May 21 CPI, May 22 PMI flash, weekend retail sales

- BOE rate cut expectations could shift depending on inflation

🔹 CAD/JPY

- G7 finance minister meeting headlines may trigger yen buying

- Watch Canadian CPI and retail sales for BOC guidance

🔹 AUD/JPY

- Focus on RBA rate decision on May 20

- Progress in U.S.-China trade may support external demand and interest rate outlook

🔹 ZAR/JPY

- May 21 South Africa summit may reignite land reform issues

- CPI, retail sales, and political developments to watch

📊 Summary & Strategy

- USD/JPY: High volatility due to political risks; headline sensitivity remains high

- EUR & GBP: More movement expected if data surprises

- AUD: Watch for market reaction post-RBA rate cut

- ZAR: Complex due to mixed political and data-related factors

✅ Key Takeaways:

📉 USD/JPY: Sharp drop (−365 pips) – Yen strength from U.S.-Japan negotiations

📈 AUD/JPY: Rise (+102 pips) – Boosted by tariff deal and political calm

⚖️ EUR/USD & ZAR/JPY: Slight gains with limited direction

🔄 GBP/JPY & CAD/JPY: Brief rally but faded with USD/JPY's pullback

Going forward, monitoring FX negotiations and policy rate decisions will be essential for strategy adjustments.