+75,706 USD – Ride the Trend! How to Navigate the Waves of Yen Strength & Risk-Off Sentiment

+75,706 USD – Ride the Trend! How to Navigate the Waves of Yen Strength & Risk-Off Sentiment

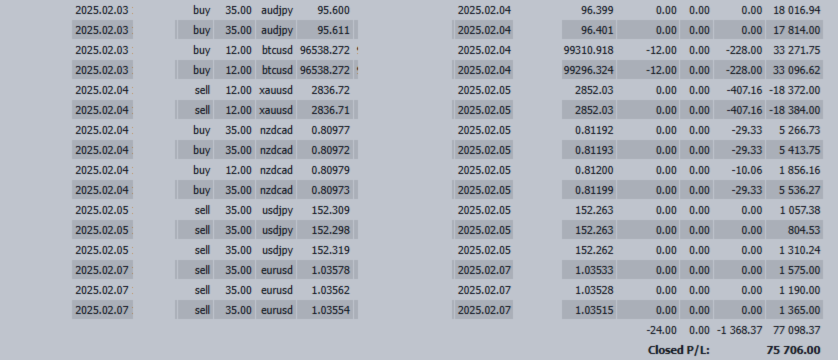

✅ Weekly Trading Results (Feb 3 - Feb 7)

💰 Profit: +75,706 USD

🎯 Key Strategies:

- USD/JPY & EUR/JPY short trades on yen strength → Unsuccessful!

- Short-term Bitcoin (BTC/USD) trades → Successful!

- Gold (XAU/USD) dip buying → Failed… missed the rebound

📌 Market Overview This Week

🌎 Market shaken by Trump tariffs & Japan-US summit

💴 Speculation of additional BOJ rate hikes accelerated yen appreciation

📉 Gold gained as a safe-haven asset, but timing issues led to missed profits

📈 Bitcoin trades secured solid gains

🔍 Forex Strategy for the Week of February 10

📌 1. USD/JPY

📉 Bias: Sell on Rallies (Yen Strength Expected)

🔎 Key Points:

- Feb 12 U.S. January CPI Report is Crucial

- Higher CPI → Fed rate cuts pushed back → USD bullish

- Lower CPI → Trump pressures Fed for cuts → USD bearish

- BOJ rate hike speculation strengthens yen buying pressure

- Sell at 152.50-153.00, target 148.00-149.00

📌 2. EUR/USD

📉 Bias: Bearish (ECB Dovish Stance)

🔎 Key Points:

- Weak GDP data from France, Germany, and Eurozone → ECB rate cut speculation

- Eurozone Industrial Production data in focus

- Sell at 1.08-1.0850, target 1.07-1.0650

📌 3. GBP/JPY

📉 Bias: Weak Momentum (BOE Dovish Policy)

🔎 Key Points:

- BOE unanimously cutting rates → GBP under selling pressure

- Weak UK GDP & Industrial Production could push GBP lower

- Sell at 195.00-195.50, target 192.00-191.50

📌 4. CAD/JPY

⚖️ Bias: Neutral (High Uncertainty)

🔎 Key Points:

- Trump's tariffs postponed to March → Stabilized price action

- BOC may signal additional rate cuts at the March meeting

- Strategy: Stay on the sidelines until clearer direction emerges

📌 5. AUD/JPY

📉 Bias: Bearish (RBA Rate Cut Expectations)

🔎 Key Points:

- RBA meeting on Feb 17-18 could signal rate cuts

- Risk-off sentiment from US-China trade tensions remains

- Sell at 95.50-96.00, target 94.00-93.50

📌 6. ZAR/JPY

📉 Bias: Continued Downtrend

🔎 Key Points:

- Uncertainty over Trump’s South Africa policies → ZAR selling continues

- Strategy: Stay on the sidelines until clearer trend emerges

📅 Key Events for February 10 Week

📌 Feb 10 (Mon) – Australia Westpac Consumer Confidence

📌 Feb 11 (Tue) – NAB Business Confidence (Australia)

📌 Feb 12 (Wed) – U.S. January CPI Report (Main Market Focus 🔥)

📌 Feb 13 (Thu) – Eurozone Industrial Production, NZ Government Financial Statement

📌 Feb 17-18 (Mon-Tue) – RBA Policy Decision

📌 Japan-US Summit: Key Takeaways & Market Impact

📝 Trump-Ishiba Meeting Highlights

- U.S. demands Japan reduce its trade surplus → Potential FX market impact

- Toyota & Isuzu U.S. investments → Factor supporting yen depreciation

- Nippon Steel & U.S. Steel investment plans → Strengthening economic ties

📉 Impact on Forex Market

- Agreement that FX policies will be handled by finance ministers

- However, Trump’s statements could still trigger yen appreciation

📌 Final Thoughts: Trading & Health – A Strategic Approach

Just as in trading, health requires a well-planned strategy to maintain focus and longevity in the market. A strong heart is key for traders managing stress and long hours.

✅ Heart-Friendly Foods for Traders:

🥬 Leafy Greens (Kale, Spinach, Romaine Lettuce) – Help maintain blood vessel elasticity & stabilize blood pressure.

🥦 Cruciferous Vegetables (Broccoli, Cauliflower, Brussels Sprouts) – High in Vitamin K & folate to enhance circulation.

🧄 Onions & Garlic – Improve blood circulation & lower blood pressure.

🥕 Beets & Carrots – Promote blood flow & provide antioxidant protection.

🥑 Nuts, Avocado, Olive Oil – Healthy fats reduce heart strain & regulate cholesterol.

📌 Trading & Health: Both Require a Consistent Strategy

Just like reading market trends, maintaining a healthy lifestyle requires strategic planning. Start small – "This week, I'll focus on eating more vegetables" – and gradually build habits for long-term success.

📢 Let’s approach next week with clear judgment and strategic trades! 🔥💹