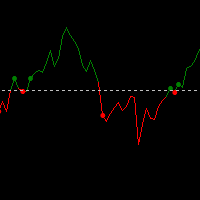

Open Close Cross Alerts

- Indicatori

- Francis Soddo Wetaka

- Versione: 2.0

This trading strategy is built around Open-Close Crossovers, a method of analyzing price movement based on the relationship between a bar's open and close prices. The system is designed to identify potential entry and exit points when these values cross over each other.

Setup and Customization

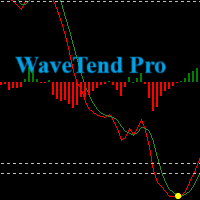

The strategy's performance can be customized by adjusting the resolution. A higher resolution, typically 3-4 times that of the chart, may be used to identify crossover signals earlier. However, this can also increase the frequency of signals, and careful testing is recommended.

The strategy allows you to choose between using raw open and close price data or incorporating a variety of Moving Average (MA) types for filtering signals. An optional trailing stop-loss feature is available for risk management.

Important Notes

-

Risk Management: Positions are entered automatically based on the crossover logic. When using the trailing stop-loss, it is critical to carefully backtest different values. Tighter settings may help mitigate potential losses but could also limit potential gains, while looser settings may increase drawdown.

-

Disclaimer: This strategy is a tool for technical analysis and does not guarantee profitable outcomes. All trading involves risk, and past performance is not indicative of future results. It is essential to conduct thorough backtesting and use proper risk management before and during live trading.

очень хорошо